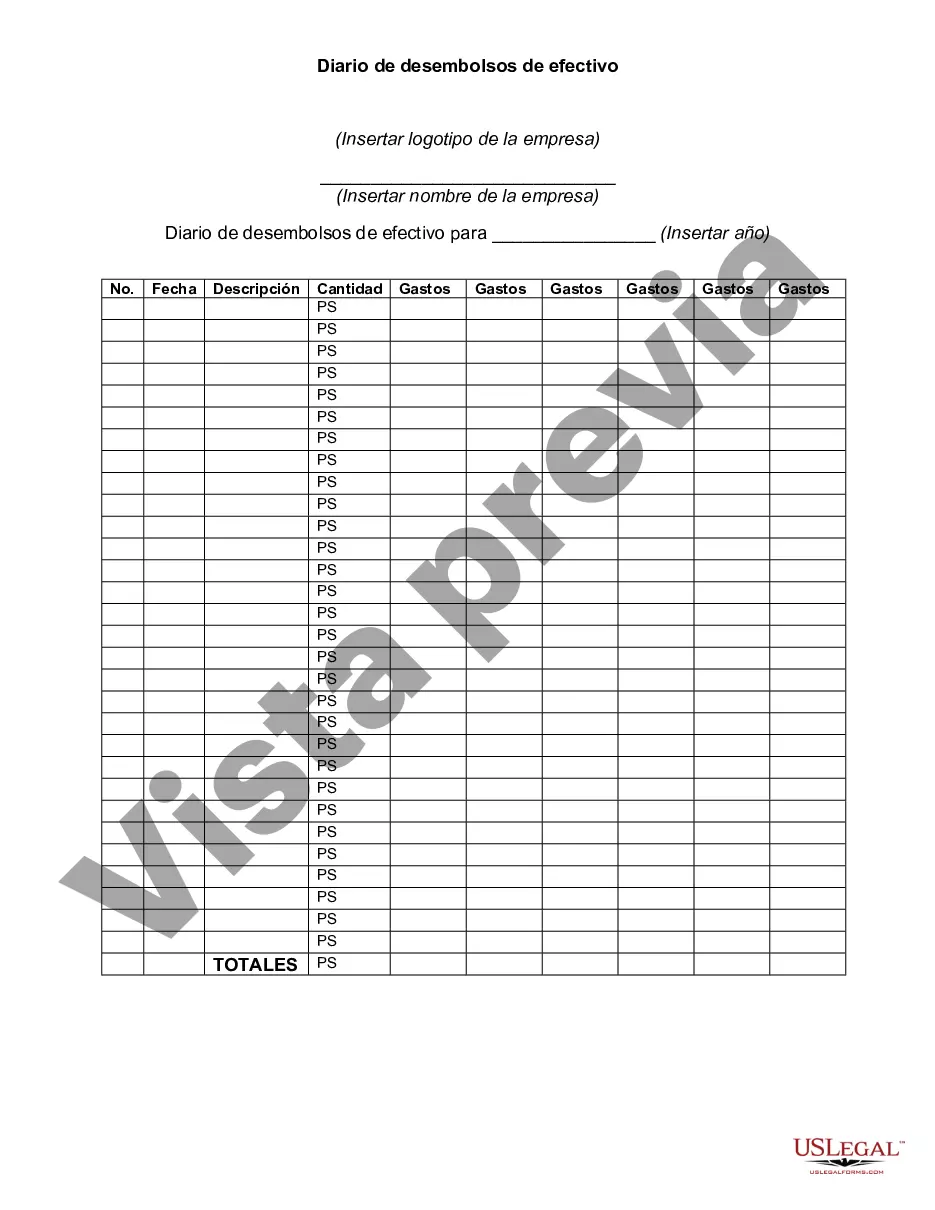

A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

Oakland Michigan Check Disbursements Journal is a financial document that records all check payments made by the entity or organization based in Oakland, Michigan. This journal plays a crucial role in keeping track of outgoing checks, ensuring accurate financial record-keeping, and facilitating easy reconciliation. The Oakland Michigan Check Disbursements Journal provides a detailed account of the payee information, corresponding check numbers, check dates, payment purposes, and respective amounts disbursed. It serves as a comprehensive register to document all expenses, such as payments to vendors, suppliers, employees, utility bills, rent, loan repayments, and more. Organizations in Oakland, Michigan may maintain different types of Check Disbursements Journals to cater to their specific needs. These variations can include: 1. General Disbursements Journal: This records all regular and routine check payments made by the organization. It encompasses a wide range of expenses, including operational costs, purchasing inventory, and daily administrative expenses. 2. Payroll Disbursements Journal: Specifically designed for payroll-related transactions, this journal focuses on recording employee salaries, wages, deductions, bonuses, and tax withholding disbursed by the organization. 3. Vendor Disbursements Journal: This journal is dedicated to documenting payments made to various vendors and suppliers. It helps monitor accounts payable, ensuring timely payments and maintaining healthy business relationships. 4. Expense Disbursements Journal: Used to track and categorize different types of expenses incurred by the organization, such as utility bills, rent, transportation costs, office supplies, advertising expenses, and more. It provides an overview of overall expenditure for analysis and budgeting purposes. 5. Project-specific Disbursements Journal: In cases where an organization undertakes multiple projects or grants, a separate disbursements journal may be created to track the expenditures associated with each project. This helps ensure accurate project accounting and budget management. Maintaining a well-organized Oakland Michigan Check Disbursements Journal is crucial for maintaining financial transparency, adhering to accounting principles, and assisting with auditing and financial analysis. It provides an essential source of information for bookkeeping, tax filing, and budget planning. By accurately recording all check disbursements, organizations in Oakland, Michigan can effectively manage their finances, make informed business decisions, and ensure compliance with legal and regulatory requirements.Oakland Michigan Check Disbursements Journal is a financial document that records all check payments made by the entity or organization based in Oakland, Michigan. This journal plays a crucial role in keeping track of outgoing checks, ensuring accurate financial record-keeping, and facilitating easy reconciliation. The Oakland Michigan Check Disbursements Journal provides a detailed account of the payee information, corresponding check numbers, check dates, payment purposes, and respective amounts disbursed. It serves as a comprehensive register to document all expenses, such as payments to vendors, suppliers, employees, utility bills, rent, loan repayments, and more. Organizations in Oakland, Michigan may maintain different types of Check Disbursements Journals to cater to their specific needs. These variations can include: 1. General Disbursements Journal: This records all regular and routine check payments made by the organization. It encompasses a wide range of expenses, including operational costs, purchasing inventory, and daily administrative expenses. 2. Payroll Disbursements Journal: Specifically designed for payroll-related transactions, this journal focuses on recording employee salaries, wages, deductions, bonuses, and tax withholding disbursed by the organization. 3. Vendor Disbursements Journal: This journal is dedicated to documenting payments made to various vendors and suppliers. It helps monitor accounts payable, ensuring timely payments and maintaining healthy business relationships. 4. Expense Disbursements Journal: Used to track and categorize different types of expenses incurred by the organization, such as utility bills, rent, transportation costs, office supplies, advertising expenses, and more. It provides an overview of overall expenditure for analysis and budgeting purposes. 5. Project-specific Disbursements Journal: In cases where an organization undertakes multiple projects or grants, a separate disbursements journal may be created to track the expenditures associated with each project. This helps ensure accurate project accounting and budget management. Maintaining a well-organized Oakland Michigan Check Disbursements Journal is crucial for maintaining financial transparency, adhering to accounting principles, and assisting with auditing and financial analysis. It provides an essential source of information for bookkeeping, tax filing, and budget planning. By accurately recording all check disbursements, organizations in Oakland, Michigan can effectively manage their finances, make informed business decisions, and ensure compliance with legal and regulatory requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.