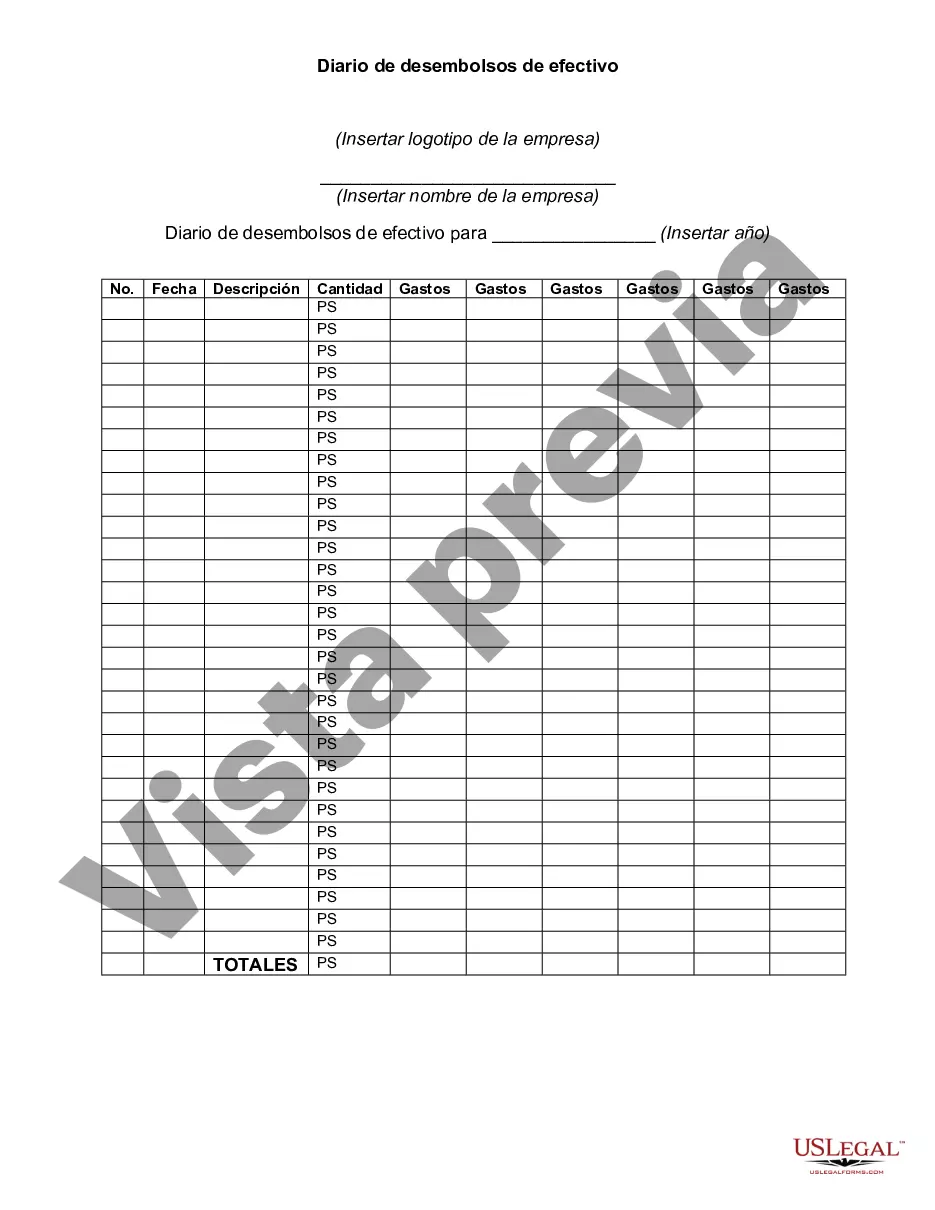

A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

Suffolk New York Check Disbursements Journal is a financial record that provides a comprehensive overview of all check disbursements made by organizations and businesses located in Suffolk County, New York. It serves as a fundamental tool for tracking outgoing payments, managing expenses, and maintaining accurate financial records. This journal contains essential information related to each check disbursement, such as the check number, its corresponding date, payee's name, purpose of payment, and the amount disbursed. It serves as a crucial document for bookkeeping purposes and helps to ensure transparency and accountability in financial transactions. There are various types of Suffolk New York Check Disbursements Journal, depending on the nature of the organization or entity using it. Some of these types include: 1. Small Business Check Disbursements Journal: This type of journal caters to small businesses operating in Suffolk County, New York. It focuses on recording disbursements related to operational expenses, vendor payments, utility bills, and other day-to-day expenditures. 2. Government Agency Check Disbursements Journal: Government entities in Suffolk County maintain their journals to keep detailed records of their expenses. These journals are specific to each agency, such as the transportation department, health department, education department, etc. They meticulously record disbursements related to salaries, contracts, infrastructure development, and other government expenditures. 3. Non-Profit Organization Check Disbursements Journal: Non-profit organizations in Suffolk County have their own unique check disbursements journal. It primarily captures disbursements related to grants, donations, program expenses, fundraising events, and administrative costs. These journals play a pivotal role in ensuring financial transparency and accountability, essential for maintaining the non-profit status. 4. Educational Institution Check Disbursements Journal: Schools and colleges in Suffolk County maintain specialized check disbursements journals to track payments related to student tuition fees, employee salaries, educational supplies, facility maintenance, and other educational expenses. These journals assist in efficient financial management and auditing processes. Using the Suffolk New York Check Disbursements Journal allows organizations to maintain an organized system of financial records, track expenditures diligently, calculate budgets, and ensure proper documentation for auditing purposes. It serves as a critical tool for financial decision-making, analyzing spending patterns, and identifying potential areas for cost-saving or improvement within an organization.Suffolk New York Check Disbursements Journal is a financial record that provides a comprehensive overview of all check disbursements made by organizations and businesses located in Suffolk County, New York. It serves as a fundamental tool for tracking outgoing payments, managing expenses, and maintaining accurate financial records. This journal contains essential information related to each check disbursement, such as the check number, its corresponding date, payee's name, purpose of payment, and the amount disbursed. It serves as a crucial document for bookkeeping purposes and helps to ensure transparency and accountability in financial transactions. There are various types of Suffolk New York Check Disbursements Journal, depending on the nature of the organization or entity using it. Some of these types include: 1. Small Business Check Disbursements Journal: This type of journal caters to small businesses operating in Suffolk County, New York. It focuses on recording disbursements related to operational expenses, vendor payments, utility bills, and other day-to-day expenditures. 2. Government Agency Check Disbursements Journal: Government entities in Suffolk County maintain their journals to keep detailed records of their expenses. These journals are specific to each agency, such as the transportation department, health department, education department, etc. They meticulously record disbursements related to salaries, contracts, infrastructure development, and other government expenditures. 3. Non-Profit Organization Check Disbursements Journal: Non-profit organizations in Suffolk County have their own unique check disbursements journal. It primarily captures disbursements related to grants, donations, program expenses, fundraising events, and administrative costs. These journals play a pivotal role in ensuring financial transparency and accountability, essential for maintaining the non-profit status. 4. Educational Institution Check Disbursements Journal: Schools and colleges in Suffolk County maintain specialized check disbursements journals to track payments related to student tuition fees, employee salaries, educational supplies, facility maintenance, and other educational expenses. These journals assist in efficient financial management and auditing processes. Using the Suffolk New York Check Disbursements Journal allows organizations to maintain an organized system of financial records, track expenditures diligently, calculate budgets, and ensure proper documentation for auditing purposes. It serves as a critical tool for financial decision-making, analyzing spending patterns, and identifying potential areas for cost-saving or improvement within an organization.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.