A public offering is an invitation to participate in a debt or equity offering that extends to the public. In the US, a public offering must comply with an extensive set of securities law and associated SEC rules. Moreover, additional laws governing a public offering exist at the state level. In contrast to a public offering, a more limited offering or an investment opportunity is known as a private placement. Like the public offering, a private placement is ordinarily regulated by securities law, but some exceptions are made for the accredited investor. In the equity markets, when a company goes public, the first public offering of stock is known as an initial public offering, or IPO. Following the initial public offering, a company's stock is publicly traded, generally on a stock exchange. The IPO is certainly the most glamorous and closely followed type of public offering.

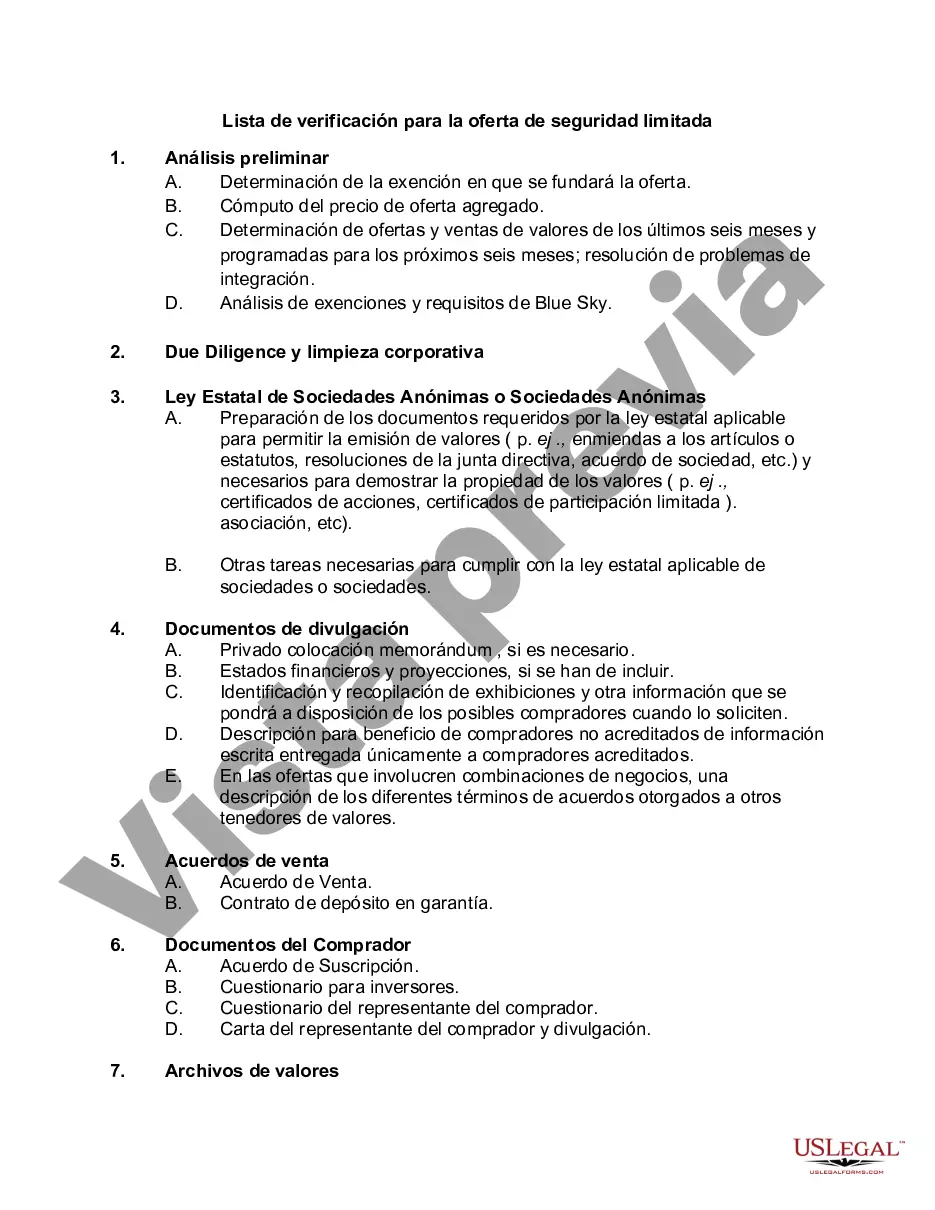

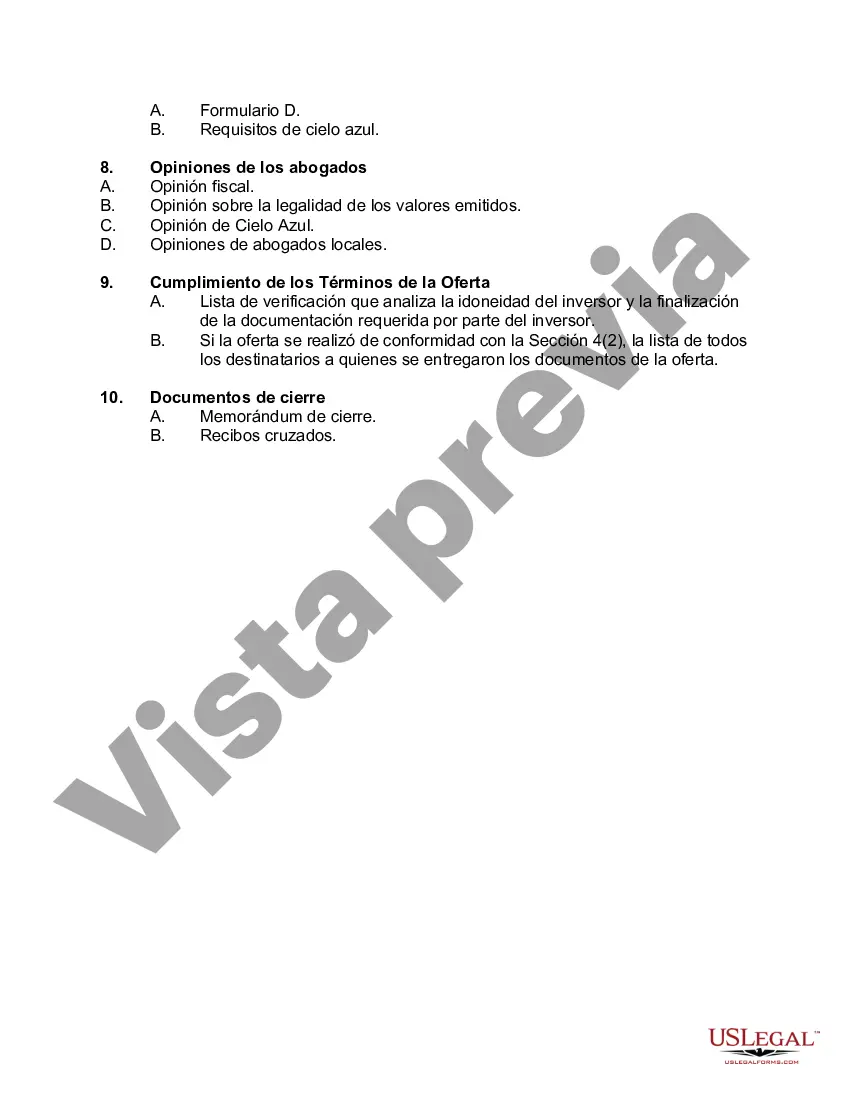

Contra Costa County is a region located in California, known for its picturesque landscapes and vibrant communities. If you are interested in raising capital through a limited security offering in Contra Costa County, it is crucial to understand and follow the official Contra Costa California Checklist for Limited Security Offering. The Contra Costa California Checklist for Limited Security Offering is a comprehensive guideline that outlines the necessary steps and requirements for carrying out a limited security offering within the county. Adhering to this checklist ensures compliance with local laws and regulations while providing transparency and protection for both investors and issuers. Some key steps within the Contra Costa California Checklist for Limited Security Offering may include: 1. Preparation of Offering Documents: Issuers must create offering documents that provide detailed information about the security being offered, the investment terms, financial projections, and any potential risks or conflicts of interest. These documents should be in compliance with the Securities and Exchange Commission (SEC) regulations and state filing requirements. 2. Filing with the California Department of Business Oversight (DBO): Before initiating any offering, issuers must submit the required documents to the DBO and obtain the necessary permits and approvals. This filing typically includes the offering documents, financial statements, and other relevant disclosures. 3. Verification of Investor Accreditation: Issuers should ensure that potential investors meet the accredited investor criteria defined under SEC regulations. This process involves verifying the income, net worth, or professional credentials of individual investors or entities. 4. Complying with Securities Laws: Issuers must comply with federal and state securities laws, such as the Securities Act of 1933 and the California Corporate Securities Law. This includes providing all necessary disclosures, adhering to anti-fraud provisions, and registering the offering if required. 5. Submission of Form D: In certain cases, issuers may need to file Form D with the SEC and provide notice of the limited security offering. The Form D filing helps ensure compliance with federal regulations and allows for exemptions from certain registration requirements. Different types of Contra Costa California Checklists for Limited Security Offering may exist based on factors like the nature of the security being offered (equity, debt, or convertible notes), the type of investor being targeted (accredited or non-accredited), and the total value of the offering (smaller or larger-scale offerings). By carefully following the Contra Costa California Checklist for Limited Security Offering, issuers can navigate the complexities of securities regulations and facilitate a transparent and lawful capital raising process. It is recommended to consult with legal professionals specializing in securities law to ensure full compliance and protect the interests of both issuers and investors.Contra Costa County is a region located in California, known for its picturesque landscapes and vibrant communities. If you are interested in raising capital through a limited security offering in Contra Costa County, it is crucial to understand and follow the official Contra Costa California Checklist for Limited Security Offering. The Contra Costa California Checklist for Limited Security Offering is a comprehensive guideline that outlines the necessary steps and requirements for carrying out a limited security offering within the county. Adhering to this checklist ensures compliance with local laws and regulations while providing transparency and protection for both investors and issuers. Some key steps within the Contra Costa California Checklist for Limited Security Offering may include: 1. Preparation of Offering Documents: Issuers must create offering documents that provide detailed information about the security being offered, the investment terms, financial projections, and any potential risks or conflicts of interest. These documents should be in compliance with the Securities and Exchange Commission (SEC) regulations and state filing requirements. 2. Filing with the California Department of Business Oversight (DBO): Before initiating any offering, issuers must submit the required documents to the DBO and obtain the necessary permits and approvals. This filing typically includes the offering documents, financial statements, and other relevant disclosures. 3. Verification of Investor Accreditation: Issuers should ensure that potential investors meet the accredited investor criteria defined under SEC regulations. This process involves verifying the income, net worth, or professional credentials of individual investors or entities. 4. Complying with Securities Laws: Issuers must comply with federal and state securities laws, such as the Securities Act of 1933 and the California Corporate Securities Law. This includes providing all necessary disclosures, adhering to anti-fraud provisions, and registering the offering if required. 5. Submission of Form D: In certain cases, issuers may need to file Form D with the SEC and provide notice of the limited security offering. The Form D filing helps ensure compliance with federal regulations and allows for exemptions from certain registration requirements. Different types of Contra Costa California Checklists for Limited Security Offering may exist based on factors like the nature of the security being offered (equity, debt, or convertible notes), the type of investor being targeted (accredited or non-accredited), and the total value of the offering (smaller or larger-scale offerings). By carefully following the Contra Costa California Checklist for Limited Security Offering, issuers can navigate the complexities of securities regulations and facilitate a transparent and lawful capital raising process. It is recommended to consult with legal professionals specializing in securities law to ensure full compliance and protect the interests of both issuers and investors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.