A public offering is an invitation to participate in a debt or equity offering that extends to the public. In the US, a public offering must comply with an extensive set of securities law and associated SEC rules. Moreover, additional laws governing a public offering exist at the state level. In contrast to a public offering, a more limited offering or an investment opportunity is known as a private placement. Like the public offering, a private placement is ordinarily regulated by securities law, but some exceptions are made for the accredited investor. In the equity markets, when a company goes public, the first public offering of stock is known as an initial public offering, or IPO. Following the initial public offering, a company's stock is publicly traded, generally on a stock exchange. The IPO is certainly the most glamorous and closely followed type of public offering.

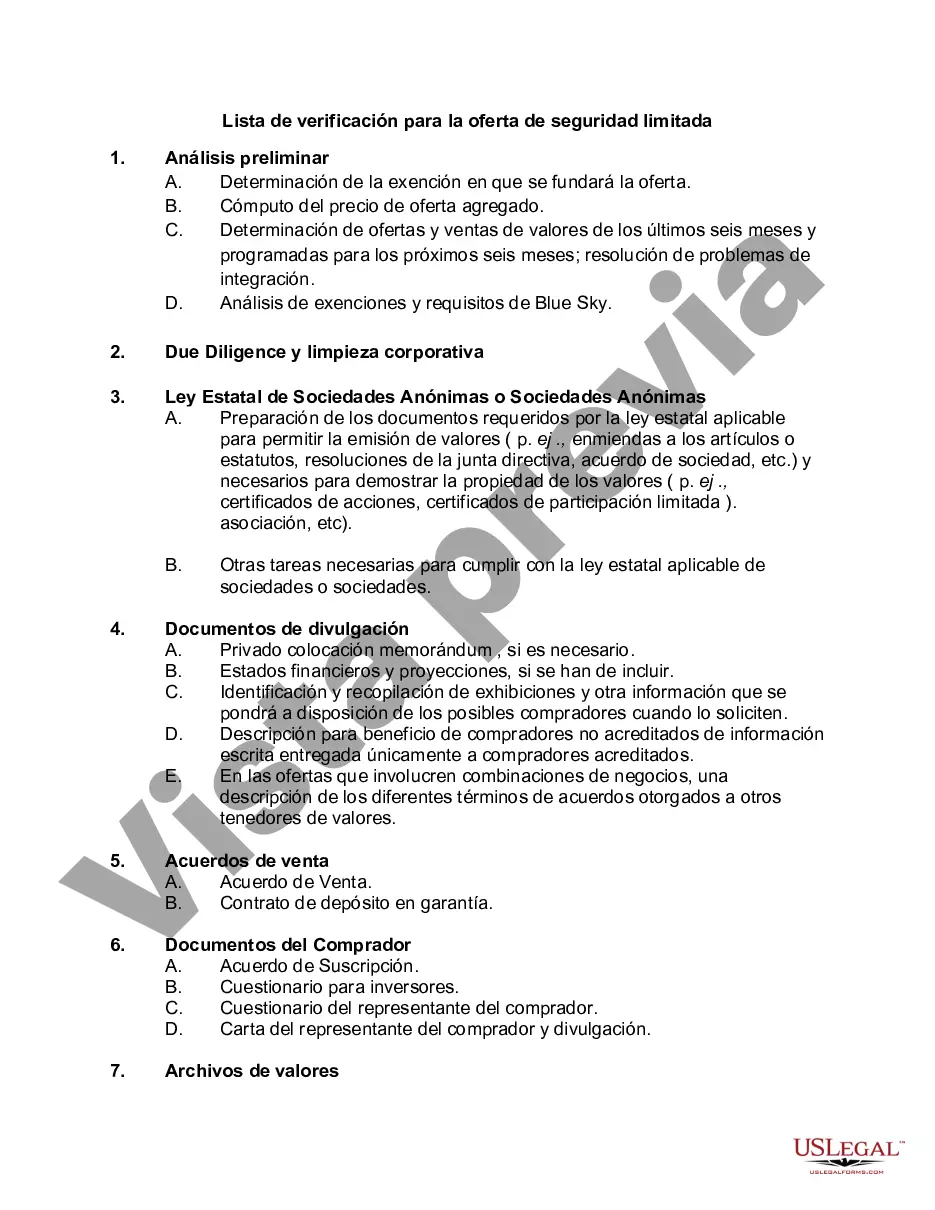

Cuyahoga County in Ohio, USA, has certain guidelines known as the Cuyahoga Ohio Checklist for Limited Security Offering that individuals and businesses must adhere to when issuing limited securities. Limited securities refer to investment opportunities that are offered to a limited number of individuals or entities. These guidelines aim to ensure investor protection and transparency in such offerings. The Cuyahoga Ohio Checklist for Limited Security Offering covers various aspects that issuers need to fulfill before conducting a limited security offering. These include: 1. Disclosure Requirements: Issuers must provide comprehensive and accurate information about the investment opportunity, including financial statements, potential risks, business operations, and any conflicts of interest. 2. Registration Process: Issuers are required to register the offering and provide necessary documentation to the relevant regulatory authorities in Cuyahoga County. 3. Compliance with State and Federal Laws: The offering must comply with all state and federal securities laws, including the Securities Act of 1933 and the Ohio Securities Act. 4. Investor Qualification: The checklist may include criteria for prospective investors, such as minimum net worth or income requirements, to ensure that the offering is limited to qualified individuals. 5. Investor Education: Issuers may be required to provide educational resources or disclosures to help investors understand the risks and potential returns associated with the limited securities. 6. Escrow Requirements: The checklist may outline requirements for holding investor funds in escrow until certain conditions are met or the offering is completed. 7. Reporting Obligations: Issuers may have ongoing reporting obligations after the offering is completed, including regular updates on the financial performance of the investment. It's worth noting that different types of limited security offerings may have their own specific checklists within Cuyahoga County. For example, there might be separate checklists for limited security offerings in real estate, technology startups, or energy projects. These checklists may have additional requirements or considerations specific to each industry or investment type. Adhering to the Cuyahoga Ohio Checklist for Limited Security Offering is vital for businesses and individuals seeking to conduct limited security offerings in Cuyahoga County. By complying with these regulations, issuers can maintain transparency, protect investors, and ensure that their offerings are conducted legally and ethically.Cuyahoga County in Ohio, USA, has certain guidelines known as the Cuyahoga Ohio Checklist for Limited Security Offering that individuals and businesses must adhere to when issuing limited securities. Limited securities refer to investment opportunities that are offered to a limited number of individuals or entities. These guidelines aim to ensure investor protection and transparency in such offerings. The Cuyahoga Ohio Checklist for Limited Security Offering covers various aspects that issuers need to fulfill before conducting a limited security offering. These include: 1. Disclosure Requirements: Issuers must provide comprehensive and accurate information about the investment opportunity, including financial statements, potential risks, business operations, and any conflicts of interest. 2. Registration Process: Issuers are required to register the offering and provide necessary documentation to the relevant regulatory authorities in Cuyahoga County. 3. Compliance with State and Federal Laws: The offering must comply with all state and federal securities laws, including the Securities Act of 1933 and the Ohio Securities Act. 4. Investor Qualification: The checklist may include criteria for prospective investors, such as minimum net worth or income requirements, to ensure that the offering is limited to qualified individuals. 5. Investor Education: Issuers may be required to provide educational resources or disclosures to help investors understand the risks and potential returns associated with the limited securities. 6. Escrow Requirements: The checklist may outline requirements for holding investor funds in escrow until certain conditions are met or the offering is completed. 7. Reporting Obligations: Issuers may have ongoing reporting obligations after the offering is completed, including regular updates on the financial performance of the investment. It's worth noting that different types of limited security offerings may have their own specific checklists within Cuyahoga County. For example, there might be separate checklists for limited security offerings in real estate, technology startups, or energy projects. These checklists may have additional requirements or considerations specific to each industry or investment type. Adhering to the Cuyahoga Ohio Checklist for Limited Security Offering is vital for businesses and individuals seeking to conduct limited security offerings in Cuyahoga County. By complying with these regulations, issuers can maintain transparency, protect investors, and ensure that their offerings are conducted legally and ethically.

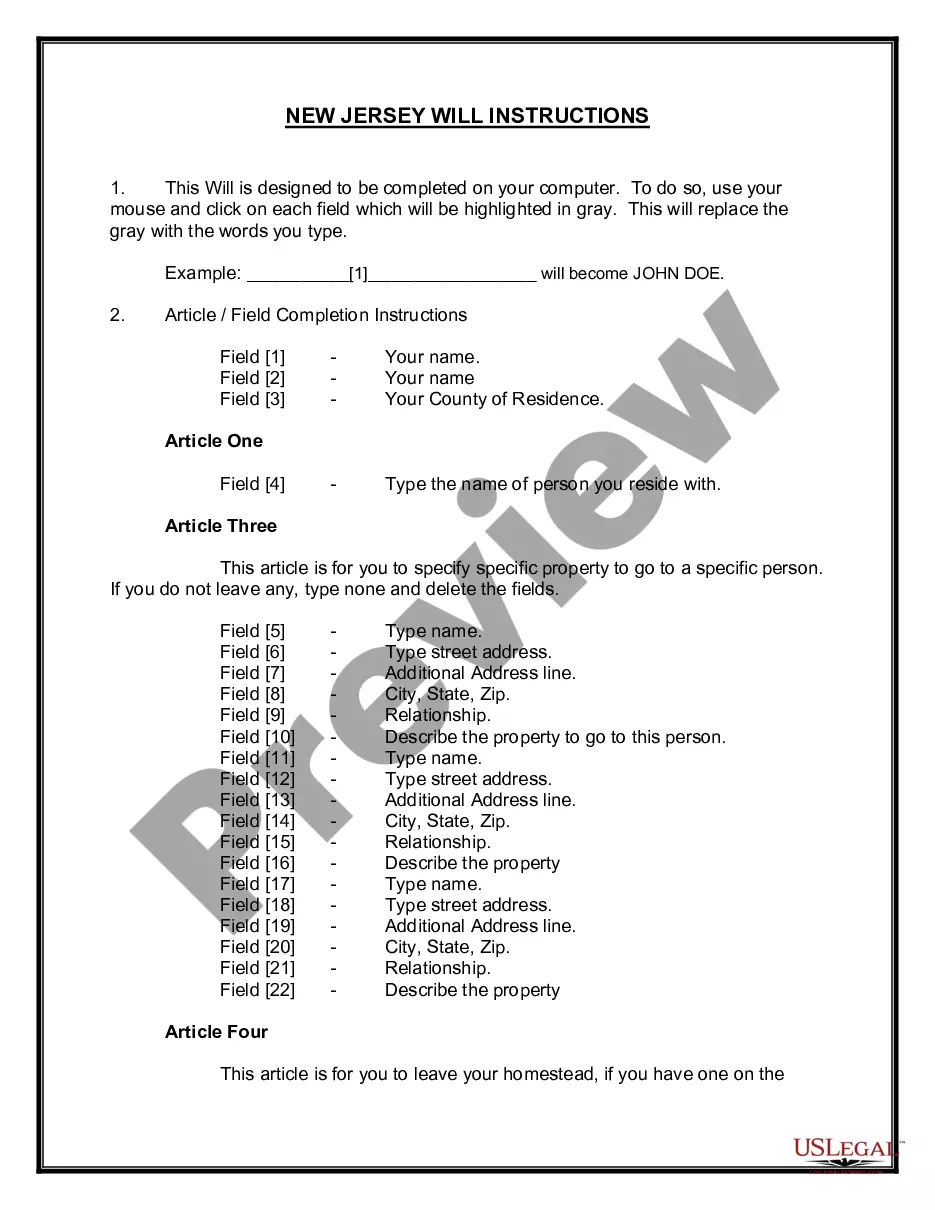

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.