A public offering is an invitation to participate in a debt or equity offering that extends to the public. In the US, a public offering must comply with an extensive set of securities law and associated SEC rules. Moreover, additional laws governing a public offering exist at the state level. In contrast to a public offering, a more limited offering or an investment opportunity is known as a private placement. Like the public offering, a private placement is ordinarily regulated by securities law, but some exceptions are made for the accredited investor. In the equity markets, when a company goes public, the first public offering of stock is known as an initial public offering, or IPO. Following the initial public offering, a company's stock is publicly traded, generally on a stock exchange. The IPO is certainly the most glamorous and closely followed type of public offering.

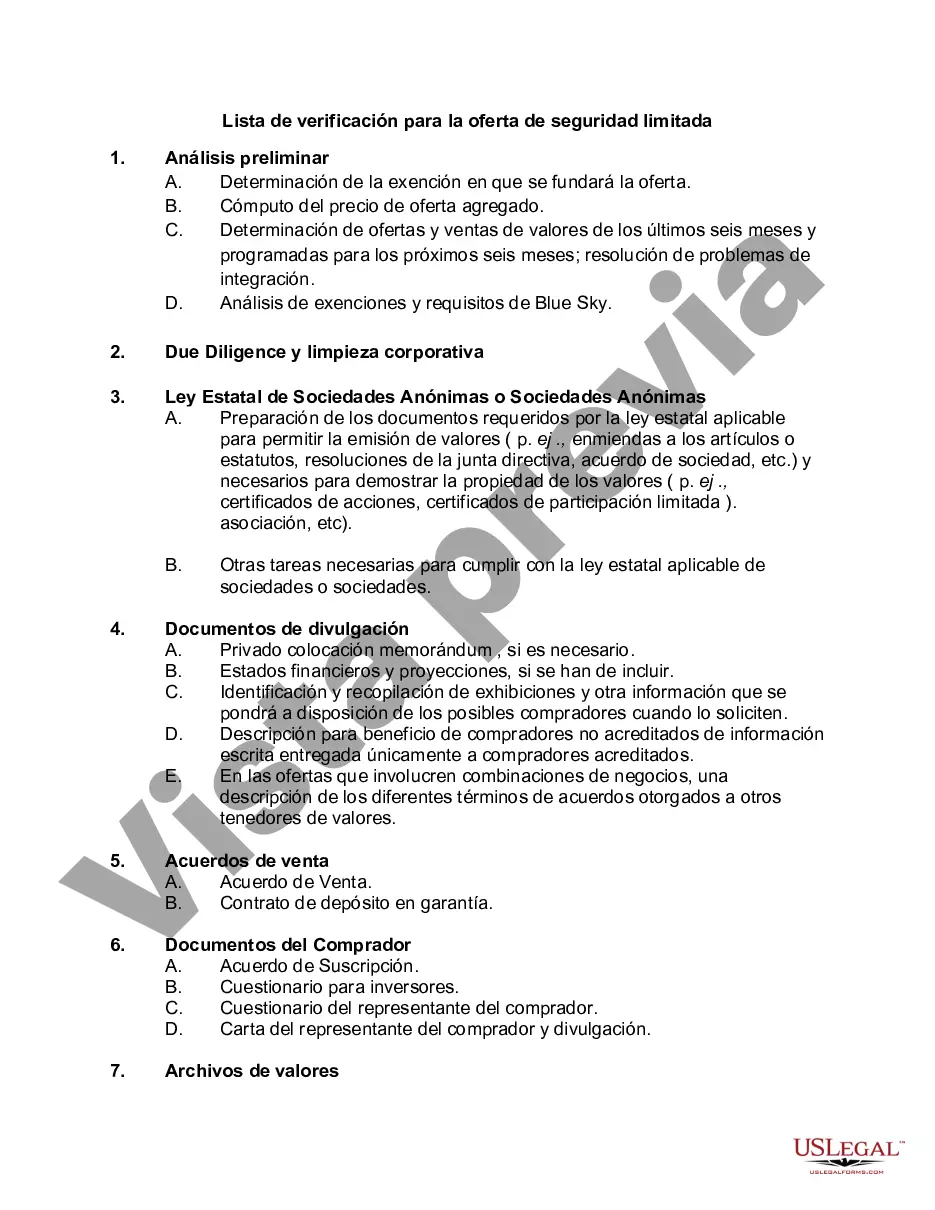

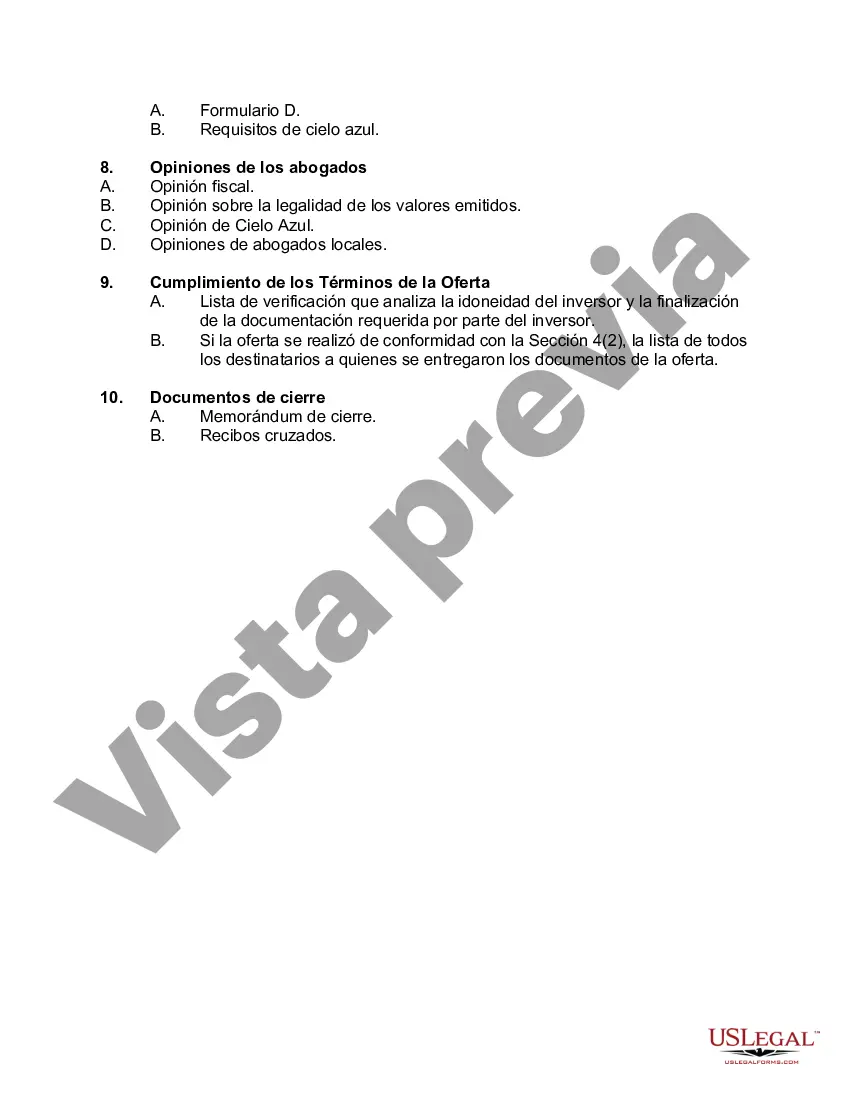

Fulton Georgia Checklist for Limited Security Offering: A Comprehensive Guide Introduction to Fulton Georgia's Limited Security Offering: Fulton County, located in the state of Georgia, has established a definitive checklist to guide businesses and entrepreneurs who wish to initiate a Limited Security Offering (LSO). An LSO is a type of financial investment opportunity that allows businesses to raise capital by selling securities to a limited number of accredited investors. Compliance with the Fulton Georgia Checklist for Limited Security Offering is crucial to ensure legal and regulatory compliance, investor protection, and smooth execution of the offering. 1. Legal Framework: Understanding the Regulations and Requirements — Fulton Georgia Securities Act: Familiarize yourself with the provisions of the Fulton Georgia Securities Act, which governs the offering and sale of securities within the county. — Compliance with SEC Regulations: Ensure compliance with the relevant federal securities laws, particularly the Securities and Exchange Commission (SEC) regulations, including exemptions under Regulation D. — Accredited Investor Verification: Verify the accreditation of investors to ensure compliance with the requirements set forth by the SEC and Fulton Georgia. 2. Disclosure Documents and Investor Protection: — Offering Memorandum: Prepare a comprehensive offering memorandum that discloses all the necessary information about the business, including its operations, financials, risks, and future prospects. — Audited Financial Statements: Obtain independently audited financial statements to provide credibility and transparency to potential investors. — Investor Questionnaire: A standardized questionnaire should be prepared to collect relevant information from investors, ensuring suitability and appropriateness of the investment. 3. Investor Relations and Communications: — Ongoing Disclosure Obligations: Establish procedures and protocols to provide regular updates, financial reports, and other relevant information to investors, ensuring transparency and accountability. — Anti-Fraud Measures: Implement proper measures to prevent fraudulent activities, including strict internal controls, regular audits, and compliance monitoring. 4. Escrow and Fund Management: — Escrow Account: Establish an escrow account with a reputable financial institution to handle investor contributions and ensure regulations concerning the use of funds are followed. — Fund Management: Employ qualified professionals or external fund managers to handle the investment funds, ensuring adherence to proper investment practices and regulations. 5. Legal Compliance and Documentation: — Legal Counsel: Seek guidance from experienced legal professionals specializing in securities law to ensure compliance with all relevant regulations and to review offering documents. — Offering Notice Filing: File the necessary notice with the appropriate regulatory authorities within Fulton Georgia before initiating the LSO. Record keepingng and Reporting: Maintain accurate and up-to-date records of all transactions, filings, and communications related to the LSO. Different Types of Fulton Georgia Checklist for Limited Security Offering: 1. Equity Limited Security Offering Checklist: Specifically designed for businesses planning to issue equity securities, such as common stock, preferred stock, or membership interests. 2. Debt Limited Security Offering Checklist: Tailored for businesses intending to offer debt securities, including corporate bonds, promissory notes, or convertible debt instruments. 3. Real Estate Limited Security Offering Checklist: Focused on companies engaged in real estate development or investment, offering securities tied to real estate assets. Summary: The Fulton Georgia Checklist for Limited Security Offering serves as a valuable and comprehensive resource for businesses and entrepreneurs seeking to engage in an LSO. Adhering to the checklist ensures compliance with legal and regulatory requirements, protects investor interests, and facilitates a successful offering. By understanding the legal framework, maintaining transparency with investors, managing funds appropriately, and fulfilling documentation and reporting obligations, businesses can confidently navigate the process of a limited security offering within Fulton County, Georgia.Fulton Georgia Checklist for Limited Security Offering: A Comprehensive Guide Introduction to Fulton Georgia's Limited Security Offering: Fulton County, located in the state of Georgia, has established a definitive checklist to guide businesses and entrepreneurs who wish to initiate a Limited Security Offering (LSO). An LSO is a type of financial investment opportunity that allows businesses to raise capital by selling securities to a limited number of accredited investors. Compliance with the Fulton Georgia Checklist for Limited Security Offering is crucial to ensure legal and regulatory compliance, investor protection, and smooth execution of the offering. 1. Legal Framework: Understanding the Regulations and Requirements — Fulton Georgia Securities Act: Familiarize yourself with the provisions of the Fulton Georgia Securities Act, which governs the offering and sale of securities within the county. — Compliance with SEC Regulations: Ensure compliance with the relevant federal securities laws, particularly the Securities and Exchange Commission (SEC) regulations, including exemptions under Regulation D. — Accredited Investor Verification: Verify the accreditation of investors to ensure compliance with the requirements set forth by the SEC and Fulton Georgia. 2. Disclosure Documents and Investor Protection: — Offering Memorandum: Prepare a comprehensive offering memorandum that discloses all the necessary information about the business, including its operations, financials, risks, and future prospects. — Audited Financial Statements: Obtain independently audited financial statements to provide credibility and transparency to potential investors. — Investor Questionnaire: A standardized questionnaire should be prepared to collect relevant information from investors, ensuring suitability and appropriateness of the investment. 3. Investor Relations and Communications: — Ongoing Disclosure Obligations: Establish procedures and protocols to provide regular updates, financial reports, and other relevant information to investors, ensuring transparency and accountability. — Anti-Fraud Measures: Implement proper measures to prevent fraudulent activities, including strict internal controls, regular audits, and compliance monitoring. 4. Escrow and Fund Management: — Escrow Account: Establish an escrow account with a reputable financial institution to handle investor contributions and ensure regulations concerning the use of funds are followed. — Fund Management: Employ qualified professionals or external fund managers to handle the investment funds, ensuring adherence to proper investment practices and regulations. 5. Legal Compliance and Documentation: — Legal Counsel: Seek guidance from experienced legal professionals specializing in securities law to ensure compliance with all relevant regulations and to review offering documents. — Offering Notice Filing: File the necessary notice with the appropriate regulatory authorities within Fulton Georgia before initiating the LSO. Record keepingng and Reporting: Maintain accurate and up-to-date records of all transactions, filings, and communications related to the LSO. Different Types of Fulton Georgia Checklist for Limited Security Offering: 1. Equity Limited Security Offering Checklist: Specifically designed for businesses planning to issue equity securities, such as common stock, preferred stock, or membership interests. 2. Debt Limited Security Offering Checklist: Tailored for businesses intending to offer debt securities, including corporate bonds, promissory notes, or convertible debt instruments. 3. Real Estate Limited Security Offering Checklist: Focused on companies engaged in real estate development or investment, offering securities tied to real estate assets. Summary: The Fulton Georgia Checklist for Limited Security Offering serves as a valuable and comprehensive resource for businesses and entrepreneurs seeking to engage in an LSO. Adhering to the checklist ensures compliance with legal and regulatory requirements, protects investor interests, and facilitates a successful offering. By understanding the legal framework, maintaining transparency with investors, managing funds appropriately, and fulfilling documentation and reporting obligations, businesses can confidently navigate the process of a limited security offering within Fulton County, Georgia.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.