A public offering is an invitation to participate in a debt or equity offering that extends to the public. In the US, a public offering must comply with an extensive set of securities law and associated SEC rules. Moreover, additional laws governing a public offering exist at the state level. In contrast to a public offering, a more limited offering or an investment opportunity is known as a private placement. Like the public offering, a private placement is ordinarily regulated by securities law, but some exceptions are made for the accredited investor. In the equity markets, when a company goes public, the first public offering of stock is known as an initial public offering, or IPO. Following the initial public offering, a company's stock is publicly traded, generally on a stock exchange. The IPO is certainly the most glamorous and closely followed type of public offering.

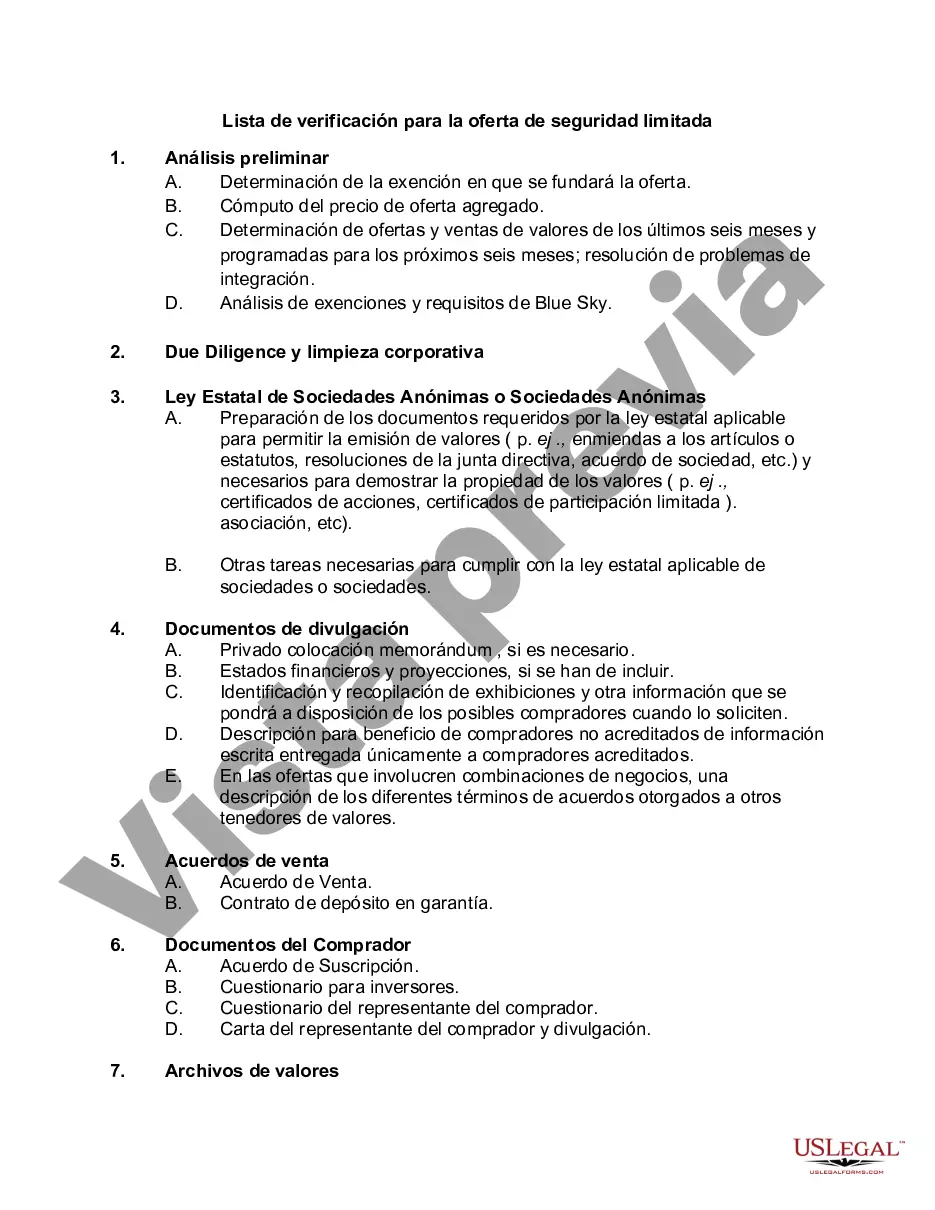

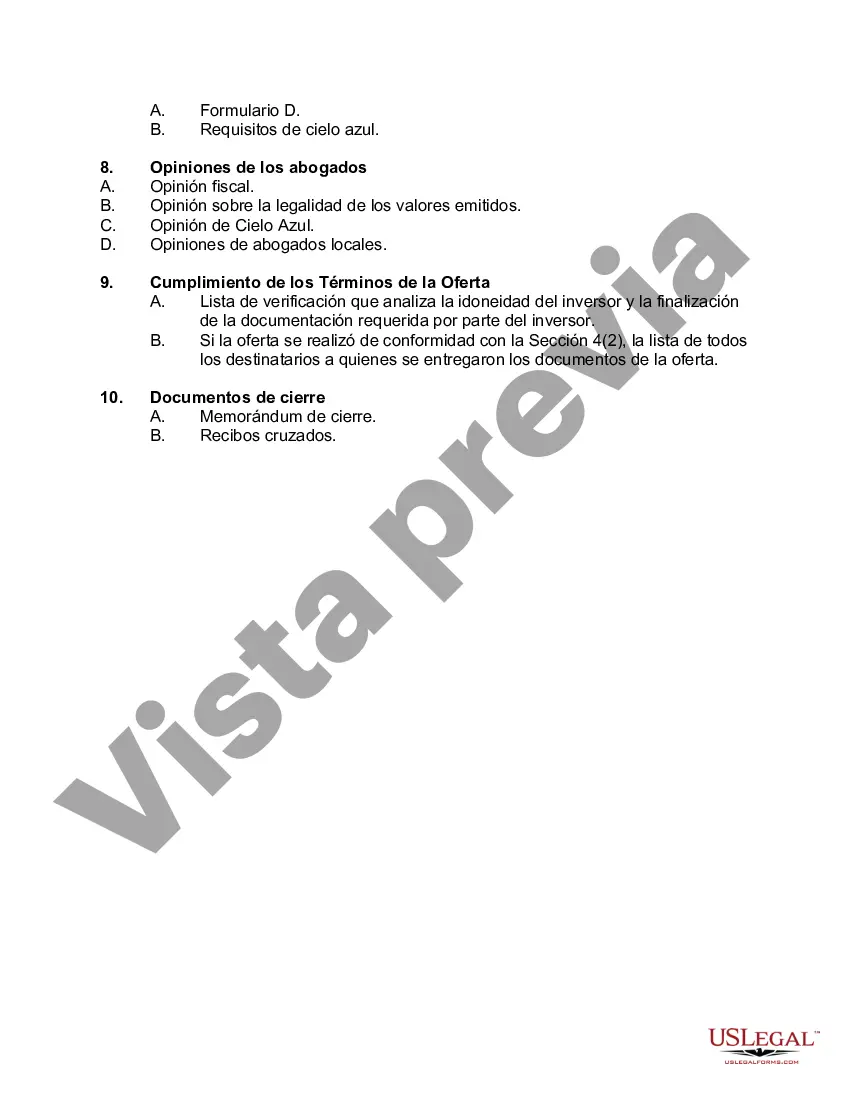

Title: Exploring the Maricopa, Arizona Checklist for Limited Security Offering: A Comprehensive Guide Introduction: The Maricopa, Arizona Checklist for Limited Security Offering is an essential framework designed to ensure compliance, transparency, and investor protection in the realm of securities offerings. This detailed description will shed light on the key aspects, requirements, and different types of checklists that exist within the Maricopa, Arizona jurisdiction. 1. Overview of the Maricopa, Arizona Checklist for Limited Security Offering: The checklist serves as a procedural guide, providing issuers and stakeholders with a structured approach to execute limited security offerings within Maricopa, Arizona. It aims to strike a balance between enabling businesses to raise capital and safeguarding the interests of investors. 2. Key Requirements in the Checklist: — Proper documentation: Issuers are required to submit accurate and comprehensive information concerning their offering, such as the business plan, financial statements, and risk disclosure. — Systematic disclosure: The checklist outlines the essential details that issuers must provide, including the nature of the investment, intended use of funds, terms of the offering, and potential risks associated. — Verification of accredited investors: Ensuring that investors meet specific requirements to be accredited is crucial to maintain compliance within the Maricopa, Arizona jurisdiction. — Filing requirements: Issuers should follow the stipulated filing procedures, which include submitting notices, reports, and any other necessary documents to the appropriate regulatory bodies. 3. Types of Maricopa, Arizona Checklist for Limited Security Offering: a. Equity Offering Checklist: Regulating the issuance and sale of equity securities, this checklist focuses on detailing requirements specific to equity-based limited security offerings. b. Debt Offering Checklist: Addressing the issuance and sale of debt securities, this checklist caters to businesses raising capital by offering debt instruments, such as bonds or promissory notes. c. Hybrid Offering Checklist: For offerings involving a combination of equity and debt securities, this checklist ensures compliance when issuing hybrid instruments, such as convertible notes. 4. Benefits of Complying with the Checklist: — Increased investor confidence: Fulfilling the requirements outlined in the checklist enhances transparency and builds trust among potential investors. — Legal compliance: Adhering to the Maricopa, Arizona Checklist for Limited Security Offering helps issuers avoid legal repercussions, penalties, and potential conflicts arising from non-compliance. — Access to capital: Demonstrating compliance can attract more potential investors, opening doors to additional sources of capital for businesses. — Enhanced investor protection: The checklist ensures that investors receive complete and accurate information, shielding them from fraud and misleading practices. Conclusion: Understanding the Maricopa, Arizona Checklist for Limited Security Offering is crucial for businesses intending to raise capital through a limited security offering. Adhering to the requirements outlined in the checklist promotes compliance, transparency, and investor protection, ultimately fostering a sustainable and trustworthy capital market ecosystem within Maricopa, Arizona.Title: Exploring the Maricopa, Arizona Checklist for Limited Security Offering: A Comprehensive Guide Introduction: The Maricopa, Arizona Checklist for Limited Security Offering is an essential framework designed to ensure compliance, transparency, and investor protection in the realm of securities offerings. This detailed description will shed light on the key aspects, requirements, and different types of checklists that exist within the Maricopa, Arizona jurisdiction. 1. Overview of the Maricopa, Arizona Checklist for Limited Security Offering: The checklist serves as a procedural guide, providing issuers and stakeholders with a structured approach to execute limited security offerings within Maricopa, Arizona. It aims to strike a balance between enabling businesses to raise capital and safeguarding the interests of investors. 2. Key Requirements in the Checklist: — Proper documentation: Issuers are required to submit accurate and comprehensive information concerning their offering, such as the business plan, financial statements, and risk disclosure. — Systematic disclosure: The checklist outlines the essential details that issuers must provide, including the nature of the investment, intended use of funds, terms of the offering, and potential risks associated. — Verification of accredited investors: Ensuring that investors meet specific requirements to be accredited is crucial to maintain compliance within the Maricopa, Arizona jurisdiction. — Filing requirements: Issuers should follow the stipulated filing procedures, which include submitting notices, reports, and any other necessary documents to the appropriate regulatory bodies. 3. Types of Maricopa, Arizona Checklist for Limited Security Offering: a. Equity Offering Checklist: Regulating the issuance and sale of equity securities, this checklist focuses on detailing requirements specific to equity-based limited security offerings. b. Debt Offering Checklist: Addressing the issuance and sale of debt securities, this checklist caters to businesses raising capital by offering debt instruments, such as bonds or promissory notes. c. Hybrid Offering Checklist: For offerings involving a combination of equity and debt securities, this checklist ensures compliance when issuing hybrid instruments, such as convertible notes. 4. Benefits of Complying with the Checklist: — Increased investor confidence: Fulfilling the requirements outlined in the checklist enhances transparency and builds trust among potential investors. — Legal compliance: Adhering to the Maricopa, Arizona Checklist for Limited Security Offering helps issuers avoid legal repercussions, penalties, and potential conflicts arising from non-compliance. — Access to capital: Demonstrating compliance can attract more potential investors, opening doors to additional sources of capital for businesses. — Enhanced investor protection: The checklist ensures that investors receive complete and accurate information, shielding them from fraud and misleading practices. Conclusion: Understanding the Maricopa, Arizona Checklist for Limited Security Offering is crucial for businesses intending to raise capital through a limited security offering. Adhering to the requirements outlined in the checklist promotes compliance, transparency, and investor protection, ultimately fostering a sustainable and trustworthy capital market ecosystem within Maricopa, Arizona.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.