A public offering is an invitation to participate in a debt or equity offering that extends to the public. In the US, a public offering must comply with an extensive set of securities law and associated SEC rules. Moreover, additional laws governing a public offering exist at the state level. In contrast to a public offering, a more limited offering or an investment opportunity is known as a private placement. Like the public offering, a private placement is ordinarily regulated by securities law, but some exceptions are made for the accredited investor. In the equity markets, when a company goes public, the first public offering of stock is known as an initial public offering, or IPO. Following the initial public offering, a company's stock is publicly traded, generally on a stock exchange. The IPO is certainly the most glamorous and closely followed type of public offering.

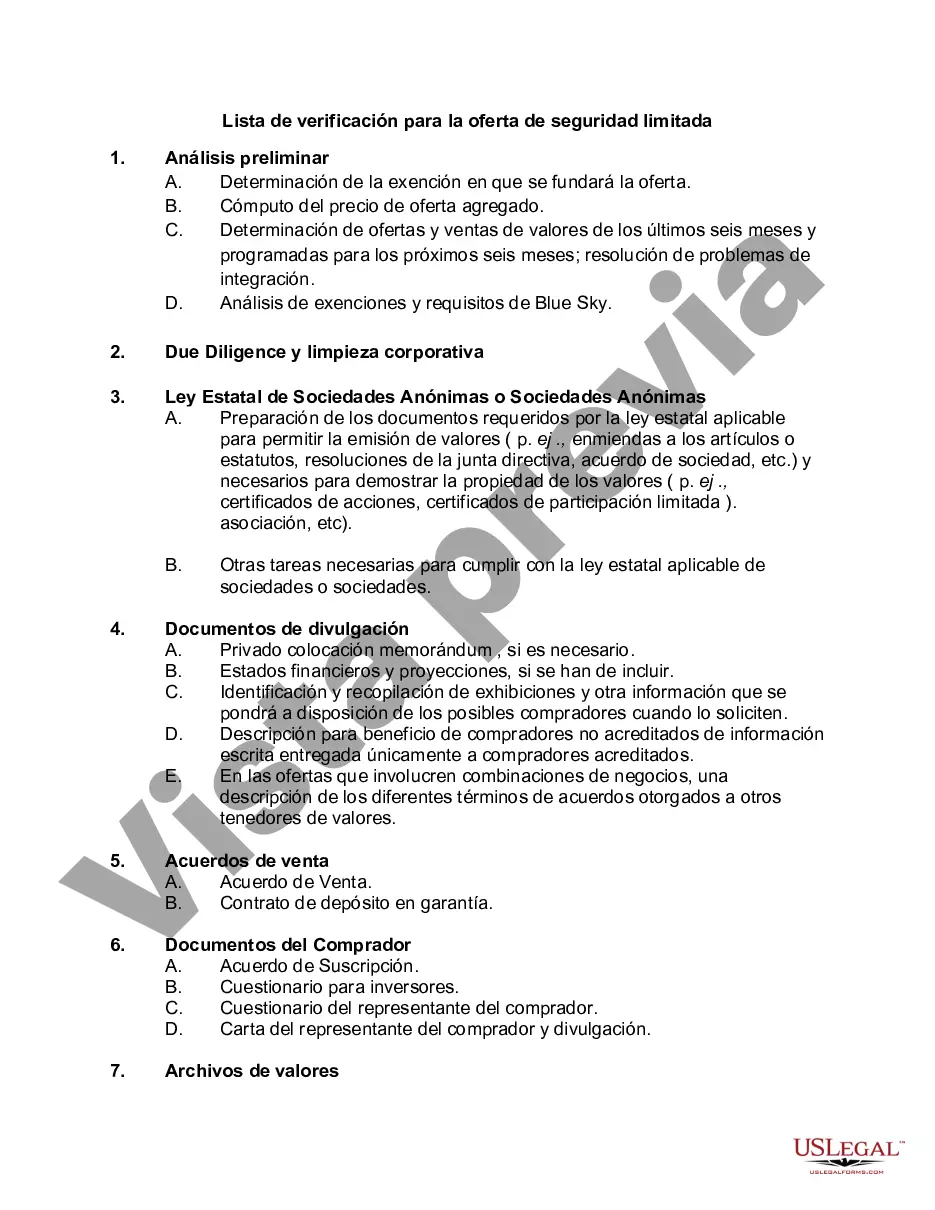

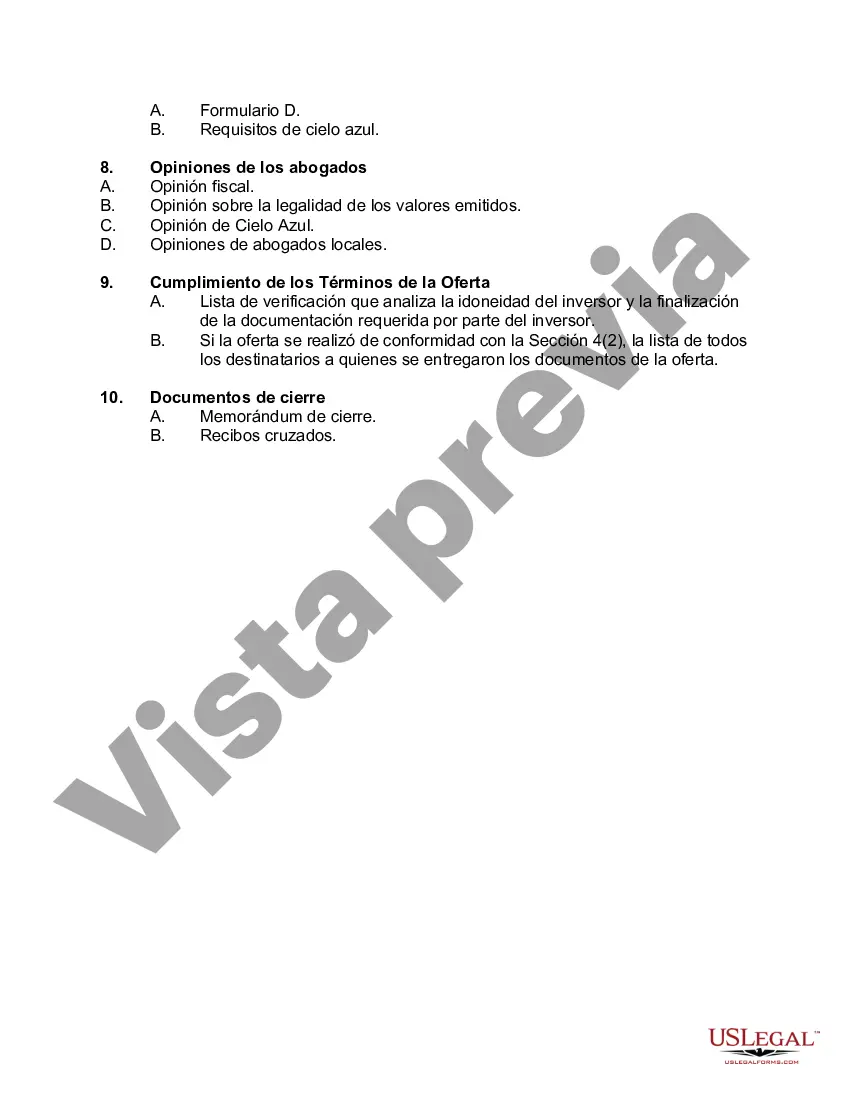

Nassau New York Checklist for Limited Security Offering: A Comprehensive Guide to Compliance Introduction: The Nassau New York Checklist for Limited Security Offering is an essential tool for businesses looking to conduct a limited security offering within the jurisdiction of Nassau County, New York. This checklist ensures that companies comply with the regulations and guidelines established by the local authorities, providing a smooth and legally sound process for fundraising. Key Keywords: 1. Nassau New York 2. Limited Security Offering 3. Checklist 4. Compliance 5. Regulations 6. Guidelines 7. Authorities 8. Fundraising Types of Nassau New York Checklist for Limited Security Offering: 1. Basic Requirements: This section entails the fundamental prerequisites that need to be fulfilled before conducting a limited security offering in Nassau County. It covers factors such as company structure, legal entity formation, and verification of eligibility. 2. Registration and Filing: This category highlights the necessary paperwork and documentation that must be completed to register a limited security offering with the appropriate authorities in Nassau County. It outlines the submission deadlines and essential information required for a successful application. 3. Disclosures and Investor Protection: In this section, the checklist emphasizes the importance of providing accurate and complete disclosures to potential investors. It details the specific types of information that must be shared, including financial statements, risk factors, and potential conflicts of interest. 4. Escrow and Use of Proceeds: This segment focuses on the requirements related to the handling of investor funds. It outlines the need for establishing an escrow account and provides guidelines on how the raised capital should be utilized. 5. Advertising and Solicitation: The checklist addresses the rules and restrictions concerning the marketing and solicitation of a limited security offering within Nassau County. It explains the permitted modes of advertising and provides guidance on compliance with anti-fraud regulations. 6. Reporting and Record-Keeping: This category highlights the ongoing responsibilities of a company after a limited security offering is concluded. It outlines the periodic reporting requirements, record-keeping obligations, and the need for maintaining transparency with investors and regulatory agencies. Conclusion: The Nassau New York Checklist for Limited Security Offering is a comprehensive resource for businesses seeking to conduct a legally compliant fundraising campaign within Nassau County, New York. By following this checklist diligently, companies can ensure that they meet all the necessary requirements, protect investors' interests, and maintain transparency throughout the process. Compliance with the guidelines outlined in the checklist is crucial for a smooth and successful limited security offering in Nassau County.Nassau New York Checklist for Limited Security Offering: A Comprehensive Guide to Compliance Introduction: The Nassau New York Checklist for Limited Security Offering is an essential tool for businesses looking to conduct a limited security offering within the jurisdiction of Nassau County, New York. This checklist ensures that companies comply with the regulations and guidelines established by the local authorities, providing a smooth and legally sound process for fundraising. Key Keywords: 1. Nassau New York 2. Limited Security Offering 3. Checklist 4. Compliance 5. Regulations 6. Guidelines 7. Authorities 8. Fundraising Types of Nassau New York Checklist for Limited Security Offering: 1. Basic Requirements: This section entails the fundamental prerequisites that need to be fulfilled before conducting a limited security offering in Nassau County. It covers factors such as company structure, legal entity formation, and verification of eligibility. 2. Registration and Filing: This category highlights the necessary paperwork and documentation that must be completed to register a limited security offering with the appropriate authorities in Nassau County. It outlines the submission deadlines and essential information required for a successful application. 3. Disclosures and Investor Protection: In this section, the checklist emphasizes the importance of providing accurate and complete disclosures to potential investors. It details the specific types of information that must be shared, including financial statements, risk factors, and potential conflicts of interest. 4. Escrow and Use of Proceeds: This segment focuses on the requirements related to the handling of investor funds. It outlines the need for establishing an escrow account and provides guidelines on how the raised capital should be utilized. 5. Advertising and Solicitation: The checklist addresses the rules and restrictions concerning the marketing and solicitation of a limited security offering within Nassau County. It explains the permitted modes of advertising and provides guidance on compliance with anti-fraud regulations. 6. Reporting and Record-Keeping: This category highlights the ongoing responsibilities of a company after a limited security offering is concluded. It outlines the periodic reporting requirements, record-keeping obligations, and the need for maintaining transparency with investors and regulatory agencies. Conclusion: The Nassau New York Checklist for Limited Security Offering is a comprehensive resource for businesses seeking to conduct a legally compliant fundraising campaign within Nassau County, New York. By following this checklist diligently, companies can ensure that they meet all the necessary requirements, protect investors' interests, and maintain transparency throughout the process. Compliance with the guidelines outlined in the checklist is crucial for a smooth and successful limited security offering in Nassau County.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.