A public offering is an invitation to participate in a debt or equity offering that extends to the public. In the US, a public offering must comply with an extensive set of securities law and associated SEC rules. Moreover, additional laws governing a public offering exist at the state level. In contrast to a public offering, a more limited offering or an investment opportunity is known as a private placement. Like the public offering, a private placement is ordinarily regulated by securities law, but some exceptions are made for the accredited investor. In the equity markets, when a company goes public, the first public offering of stock is known as an initial public offering, or IPO. Following the initial public offering, a company's stock is publicly traded, generally on a stock exchange. The IPO is certainly the most glamorous and closely followed type of public offering.

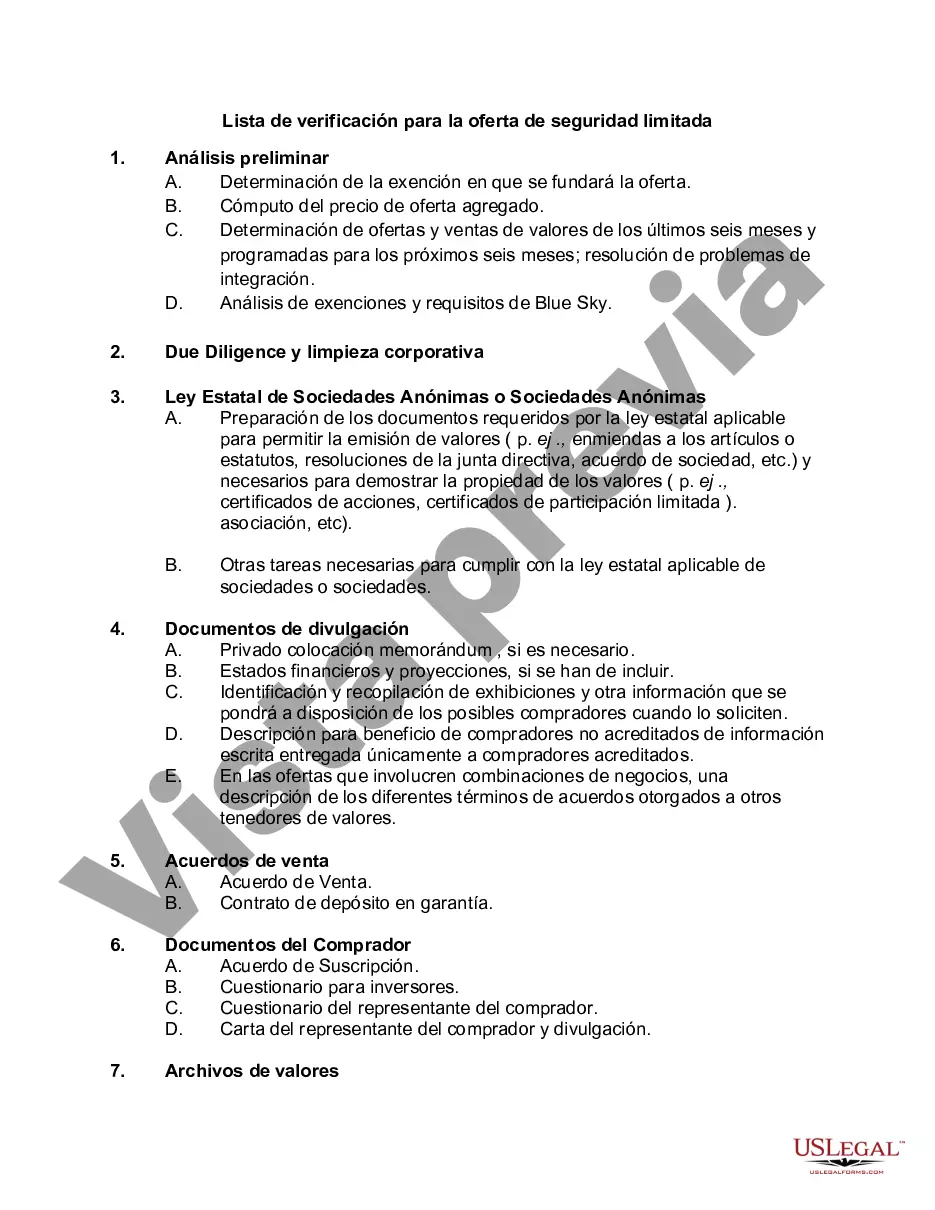

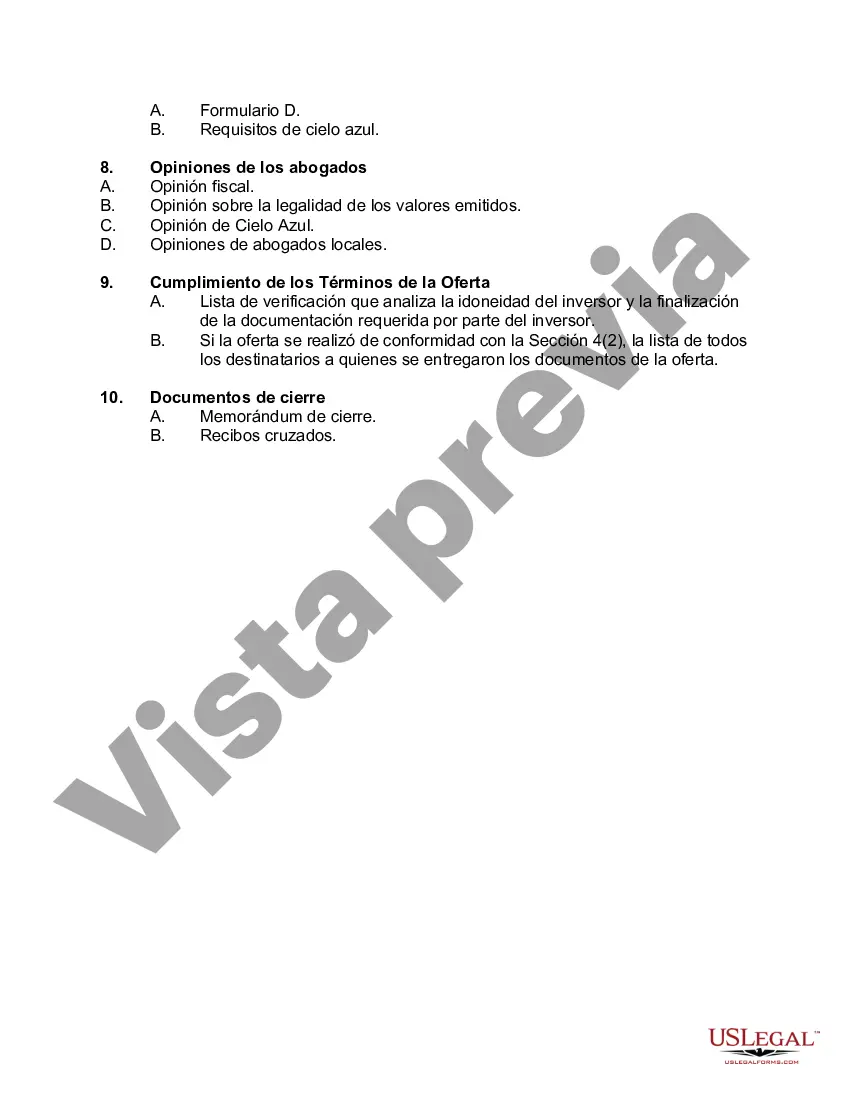

San Diego California Checklist for Limited Security Offering is an essential tool for ensuring compliance and minimizing risks while conducting a limited security offering in the region. This comprehensive checklist provides a blueprint that companies can follow to meet the legal requirements and guidelines governed by the Securities and Exchange Commission (SEC). 1. Verification of Eligibility: The checklist starts with verifying the eligibility of the offering entity and ensuring it qualifies for a limited security offering under the SEC regulations. 2. Registration Requirements: Companies need to ensure they have met all necessary registration requirements before initiating the limited security offering. This involves submitting Form D to the SEC within the specified time frame. 3. Offering Documentation: This section covers the preparation and review of offering documentation, including the drafting of a private placement memorandum (PPM) or an offering circular. Attention should be given to accurately representing the terms, risks, and information about the investment opportunity. 4. Investor Qualification Process: The checklist includes a process for determining the eligibility and accreditation status of potential investors. This involves conducting due diligence and implementing a system for obtaining necessary investor representations and warranties. 5. Disclosure Requirements: A vital aspect of any limited security offering is providing sufficient and accurate disclosure to investors. The checklist emphasizes the importance of meeting the disclosure requirements and providing material information about the offering entity, its financials, risks, and conflicts of interest. 6. Marketing and Advertising Compliance: Companies should adhere to strict guidelines when marketing and advertising their limited security offering. Understanding the marketing restrictions and ensuring compliance with applicable laws is crucial to avoid any legal repercussions. 7. Non-Disclosure Agreements: This section focuses on the importance of utilizing non-disclosure agreements (NDAs) when interacting with potential investors or other parties involved in the offering process. NDAs protect sensitive information from being disclosed without proper authorization. Different Types of San Diego California Checklist for Limited Security Offering: 1. Basic Checklist: This type of checklist covers all the fundamental elements required for a limited security offering in San Diego, California. It ensures compliance with the minimum legal obligations set by the SEC. 2. Advanced Checklist: This checklist goes beyond the basic requirements and includes additional measures that companies can voluntarily adapt to strengthen their limited security offering. It may involve more detailed due diligence, enhanced investor qualification processes, or additional contractual protections. 3. Technology-enabled Checklist: In the digital age, technology plays a vital role in streamlining the limited security offering process. This checklist focuses on leveraging technology platforms or services to facilitate various aspects, such as investor verification, documentation management, and communication with potential investors. By diligently following the San Diego California Checklist for Limited Security Offering, companies can enhance their chances of conducting a successful and legally compliant offering, allowing them to raise funds while safeguarding the interests of investors and mitigating potential risks.San Diego California Checklist for Limited Security Offering is an essential tool for ensuring compliance and minimizing risks while conducting a limited security offering in the region. This comprehensive checklist provides a blueprint that companies can follow to meet the legal requirements and guidelines governed by the Securities and Exchange Commission (SEC). 1. Verification of Eligibility: The checklist starts with verifying the eligibility of the offering entity and ensuring it qualifies for a limited security offering under the SEC regulations. 2. Registration Requirements: Companies need to ensure they have met all necessary registration requirements before initiating the limited security offering. This involves submitting Form D to the SEC within the specified time frame. 3. Offering Documentation: This section covers the preparation and review of offering documentation, including the drafting of a private placement memorandum (PPM) or an offering circular. Attention should be given to accurately representing the terms, risks, and information about the investment opportunity. 4. Investor Qualification Process: The checklist includes a process for determining the eligibility and accreditation status of potential investors. This involves conducting due diligence and implementing a system for obtaining necessary investor representations and warranties. 5. Disclosure Requirements: A vital aspect of any limited security offering is providing sufficient and accurate disclosure to investors. The checklist emphasizes the importance of meeting the disclosure requirements and providing material information about the offering entity, its financials, risks, and conflicts of interest. 6. Marketing and Advertising Compliance: Companies should adhere to strict guidelines when marketing and advertising their limited security offering. Understanding the marketing restrictions and ensuring compliance with applicable laws is crucial to avoid any legal repercussions. 7. Non-Disclosure Agreements: This section focuses on the importance of utilizing non-disclosure agreements (NDAs) when interacting with potential investors or other parties involved in the offering process. NDAs protect sensitive information from being disclosed without proper authorization. Different Types of San Diego California Checklist for Limited Security Offering: 1. Basic Checklist: This type of checklist covers all the fundamental elements required for a limited security offering in San Diego, California. It ensures compliance with the minimum legal obligations set by the SEC. 2. Advanced Checklist: This checklist goes beyond the basic requirements and includes additional measures that companies can voluntarily adapt to strengthen their limited security offering. It may involve more detailed due diligence, enhanced investor qualification processes, or additional contractual protections. 3. Technology-enabled Checklist: In the digital age, technology plays a vital role in streamlining the limited security offering process. This checklist focuses on leveraging technology platforms or services to facilitate various aspects, such as investor verification, documentation management, and communication with potential investors. By diligently following the San Diego California Checklist for Limited Security Offering, companies can enhance their chances of conducting a successful and legally compliant offering, allowing them to raise funds while safeguarding the interests of investors and mitigating potential risks.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.