A public offering is an invitation to participate in a debt or equity offering that extends to the public. In the US, a public offering must comply with an extensive set of securities law and associated SEC rules. Moreover, additional laws governing a public offering exist at the state level. In contrast to a public offering, a more limited offering or an investment opportunity is known as a private placement. Like the public offering, a private placement is ordinarily regulated by securities law, but some exceptions are made for the accredited investor. In the equity markets, when a company goes public, the first public offering of stock is known as an initial public offering, or IPO. Following the initial public offering, a company's stock is publicly traded, generally on a stock exchange. The IPO is certainly the most glamorous and closely followed type of public offering.

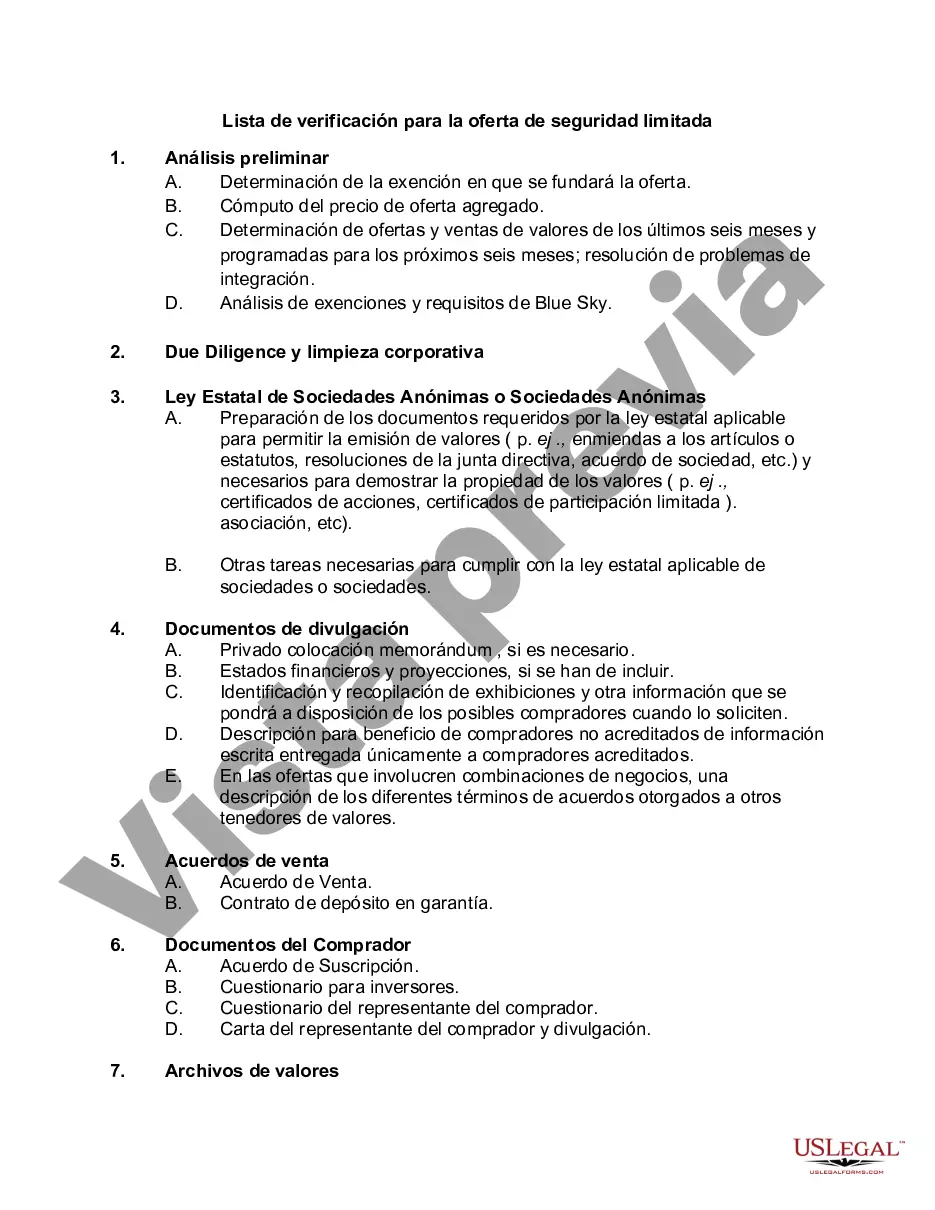

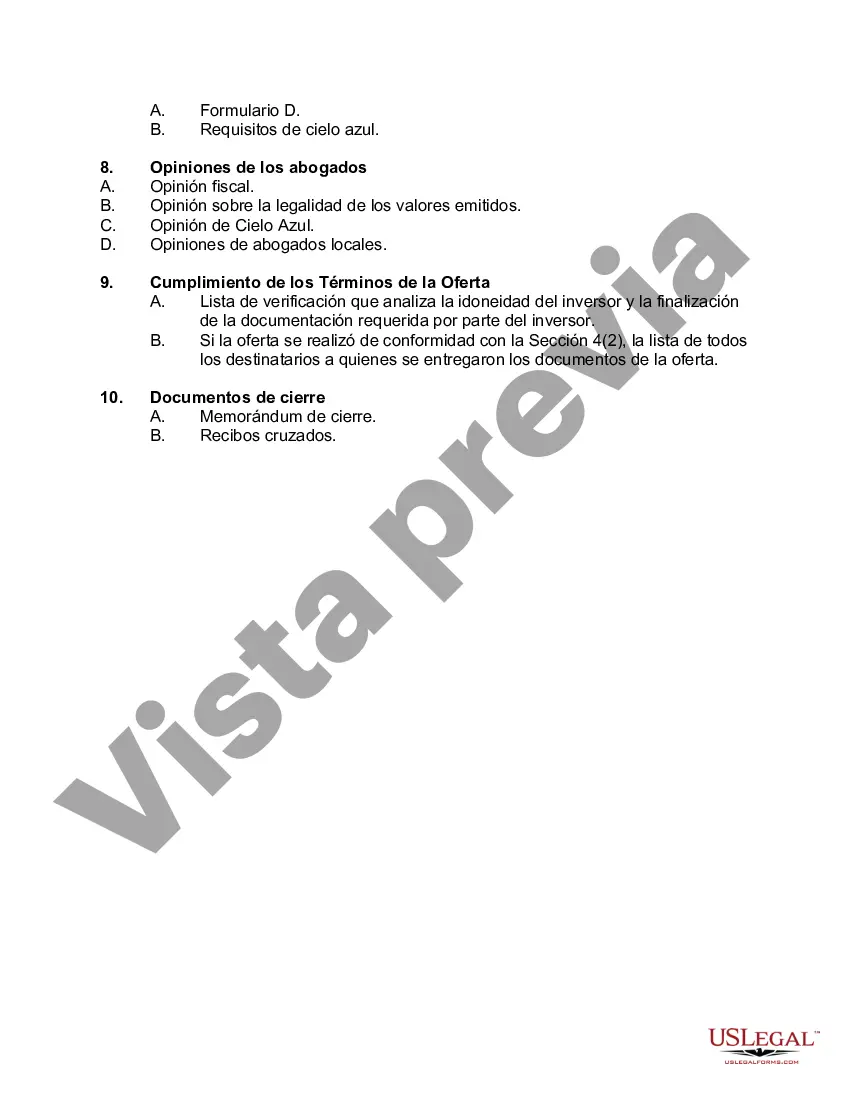

Suffolk County, located on Long Island, New York, has established a comprehensive checklist for Limited Security Offerings (Los). This checklist serves as a guideline for businesses and individuals intending to conduct Los within the county's jurisdiction. The Suffolk New York Checklist for Limited Security Offering covers various important aspects and regulatory requirements that must be adhered to during the offering process. 1. Qualification Criteria: The checklist outlines the necessary eligibility criteria that issuers must meet to conduct an LSO in Suffolk County. These criteria may include residency requirements, financial stability, and compliance with existing securities laws. 2. Offering Documentation: The checklist emphasizes the importance of preparing accurate and complete offering documentation. This includes a detailed offering memorandum, disclosure documents, and subscription agreements. These documents play a critical role in providing potential investors with comprehensive information about the offering. 3. Filing Requirements: Suffolk County requires issuers to file certain documentation and forms with relevant authorities before commencing an LSO. This usually includes submitting a notice of the offering, a consent to service of process, and any required exhibits or attachments. 4. Investor Disclosure: The checklist highlights the importance of providing potential investors with full and fair disclosure of all material information relating to the offering. This includes financial statements, business plans, risk factors, and any other information that could impact an investor's decision-making process. 5. Limitations on Advertising: Suffolk County may impose restrictions on how issuers can advertise or promote their Los. The checklist provides guidance on compliance with these limitations, ensuring that promotional activities do not fall afoul of securities laws or mislead potential investors. 6. Investor Suitability: To protect investors, the checklist emphasizes that issuers must take reasonable steps to ensure that potential investors are suitable for the LSO. This may involve conducting investor questionnaires, assessing risk tolerance, and verifying accredited investor status where applicable. While the Suffolk New York Checklist for Limited Security Offering is comprehensive, it does not differentiate between different types of Los. Rather, it serves as a general guideline applicable to all Los conducted within Suffolk County. By following this checklist, issuers can remain in compliance with Suffolk County regulations and ensure transparency, investor protection, and fair practices throughout the Limited Security Offering process.Suffolk County, located on Long Island, New York, has established a comprehensive checklist for Limited Security Offerings (Los). This checklist serves as a guideline for businesses and individuals intending to conduct Los within the county's jurisdiction. The Suffolk New York Checklist for Limited Security Offering covers various important aspects and regulatory requirements that must be adhered to during the offering process. 1. Qualification Criteria: The checklist outlines the necessary eligibility criteria that issuers must meet to conduct an LSO in Suffolk County. These criteria may include residency requirements, financial stability, and compliance with existing securities laws. 2. Offering Documentation: The checklist emphasizes the importance of preparing accurate and complete offering documentation. This includes a detailed offering memorandum, disclosure documents, and subscription agreements. These documents play a critical role in providing potential investors with comprehensive information about the offering. 3. Filing Requirements: Suffolk County requires issuers to file certain documentation and forms with relevant authorities before commencing an LSO. This usually includes submitting a notice of the offering, a consent to service of process, and any required exhibits or attachments. 4. Investor Disclosure: The checklist highlights the importance of providing potential investors with full and fair disclosure of all material information relating to the offering. This includes financial statements, business plans, risk factors, and any other information that could impact an investor's decision-making process. 5. Limitations on Advertising: Suffolk County may impose restrictions on how issuers can advertise or promote their Los. The checklist provides guidance on compliance with these limitations, ensuring that promotional activities do not fall afoul of securities laws or mislead potential investors. 6. Investor Suitability: To protect investors, the checklist emphasizes that issuers must take reasonable steps to ensure that potential investors are suitable for the LSO. This may involve conducting investor questionnaires, assessing risk tolerance, and verifying accredited investor status where applicable. While the Suffolk New York Checklist for Limited Security Offering is comprehensive, it does not differentiate between different types of Los. Rather, it serves as a general guideline applicable to all Los conducted within Suffolk County. By following this checklist, issuers can remain in compliance with Suffolk County regulations and ensure transparency, investor protection, and fair practices throughout the Limited Security Offering process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.