A private placement memorandum is a legal document that sets out the terms upon which securities are offered to potential private investors. It can refer to any kind of offering of securities to any number of private accredited investors. It lays out for the prospective client almost all the details of an investment opportunity. The principal purpose of this document is to give the company the opportunity to present all potential risks to the investor. A Private Placement Memorandum is in fact a plan for the company. It plainly identifies the nature and purpose of the company.

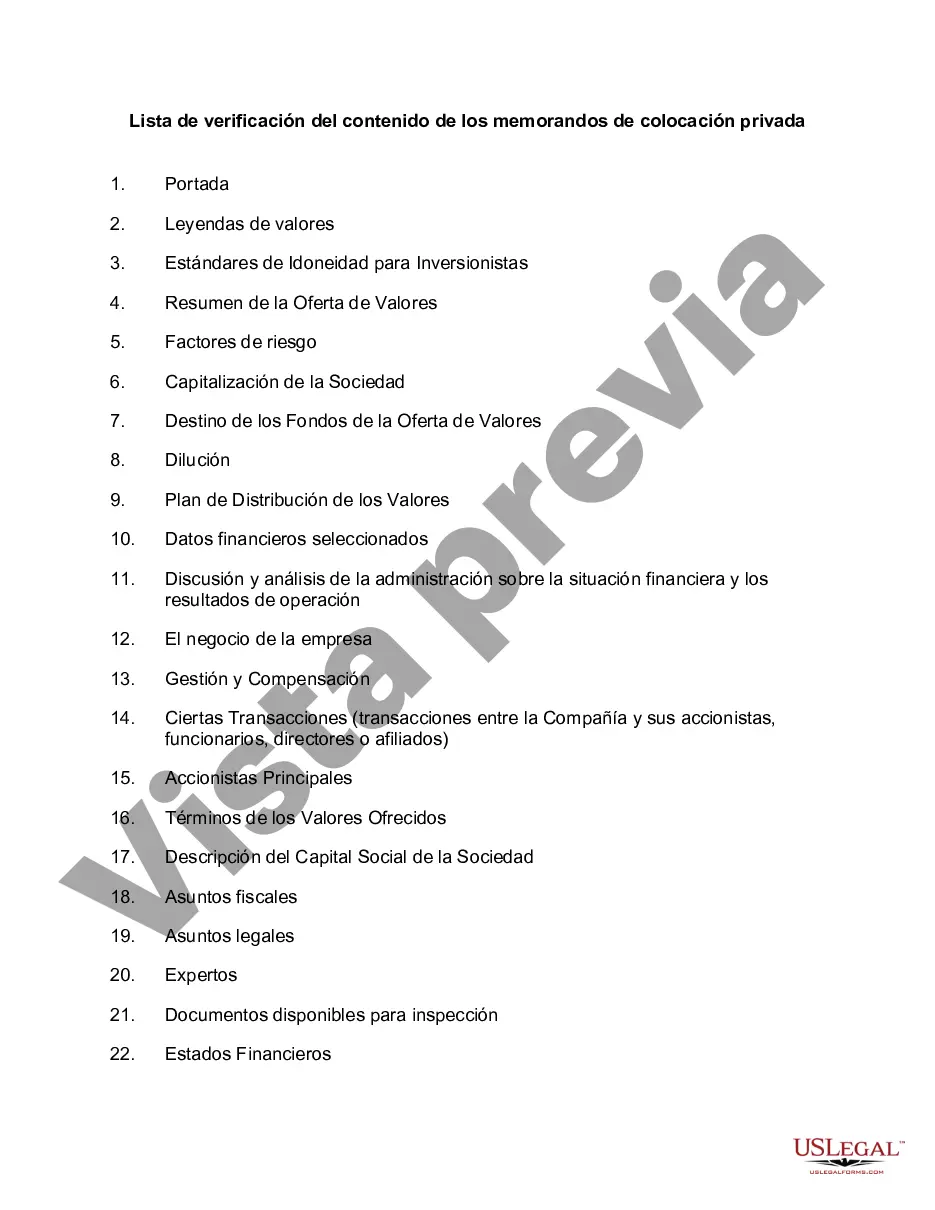

This is a simple checklist regarding matters to be included in a private placement memorandum for a securities offering intended to meet certain disclosure requirements of SEC Regulation D.

Alameda, California is a bustling city located in Alameda County, California, known for its picturesque coastal location and vibrant community. It offers a wide range of attractions, including beautiful parks, historic landmarks, and a diverse culinary scene. If you are considering a private placement memorandum (PPM) in Alameda, it's crucial to understand the checklist of contents required for this legal document. Here is a detailed description of what an Alameda California checklist for the contents of a Private Placement Memorandum typically includes: 1. Executive Summary: This section provides a concise overview of the PPM, including a summary of the offering, key financial figures, and any unique selling points. 2. Table of Contents: A comprehensive table of contents is essential for easy navigation within the document, allowing investors to review specific sections quickly. 3. Introduction: The introduction provides important background information on the company or project, outlining its mission, history, and goals. 4. Risk Factors: This section highlights the potential risks associated with investing in the project or company, such as industry-specific risks, market volatility, and regulatory hurdles. 5. Offering Summary: Here, you outline the terms and conditions of the investment opportunity, including the type of securities being offered, the offering size, the investment minimum, and any relevant subscription procedures. 6. Business Description: This section dives into the details of the company/project, including its structure, ownership, product or service offerings, target market, and competitive advantages. 7. Management Team: Investors want to know who is leading the company. This section introduces key members of the management team, including their backgrounds, roles, and expertise. Resumes or biographies may accompany this section. 8. Use of Proceeds: Outline how the funds raised through the private placement will be used. This may include expansion plans, research and development, working capital, or debt repayment. 9. Financial Statements: Including audited or reviewed financial statements is essential for investors to assess the company's financial health and performance. This typically includes the balance sheet, income statement, and cash flow statement. 10. Plan of Operation: Detail the company's short and long-term strategic plans, major milestones, and growth projections. This section should also discuss any regulatory or legal considerations. 11. Dilution: If the private placement involves multiple rounds of funding, explain how the investment could potentially dilute the ownership and voting rights of existing shareholders. 12. Subscription Agreement: Provide a detailed subscription agreement that outlines the specific terms, conditions, and mechanics of the investment process, including the financial terms, representations and warranties, transfer restrictions, and dispute resolution mechanisms. 13. Legal Considerations: Include applicable legal disclaimers, disclosures, representations, and any securities' law compliance information to ensure the document adheres to regulatory requirements. 14. Appendices: Attach supplementary documents such as contracts, patents, licenses, key customer agreements, or supporting industry research to further validate the investment opportunity. Different types of Alameda California checklists for the contents of Private Placement Memorandum may exist based on specific industries or purposes. For instance, a technology startup PPM may emphasize intellectual property rights and scalability, while a real estate development PPM may focus on property specifics, zoning regulations, and projected returns on investment. In conclusion, a comprehensive Alameda California checklist for the contents of a Private Placement Memorandum includes an executive summary, table of contents, introduction, risk factors, offering summary, business description, management team, use of proceeds, financial statements, plan of operation, dilution explanation, subscription agreement, legal considerations, and appendices. Adapting the contents to suit specific industries or investment opportunities can result in various types of checklists.Alameda, California is a bustling city located in Alameda County, California, known for its picturesque coastal location and vibrant community. It offers a wide range of attractions, including beautiful parks, historic landmarks, and a diverse culinary scene. If you are considering a private placement memorandum (PPM) in Alameda, it's crucial to understand the checklist of contents required for this legal document. Here is a detailed description of what an Alameda California checklist for the contents of a Private Placement Memorandum typically includes: 1. Executive Summary: This section provides a concise overview of the PPM, including a summary of the offering, key financial figures, and any unique selling points. 2. Table of Contents: A comprehensive table of contents is essential for easy navigation within the document, allowing investors to review specific sections quickly. 3. Introduction: The introduction provides important background information on the company or project, outlining its mission, history, and goals. 4. Risk Factors: This section highlights the potential risks associated with investing in the project or company, such as industry-specific risks, market volatility, and regulatory hurdles. 5. Offering Summary: Here, you outline the terms and conditions of the investment opportunity, including the type of securities being offered, the offering size, the investment minimum, and any relevant subscription procedures. 6. Business Description: This section dives into the details of the company/project, including its structure, ownership, product or service offerings, target market, and competitive advantages. 7. Management Team: Investors want to know who is leading the company. This section introduces key members of the management team, including their backgrounds, roles, and expertise. Resumes or biographies may accompany this section. 8. Use of Proceeds: Outline how the funds raised through the private placement will be used. This may include expansion plans, research and development, working capital, or debt repayment. 9. Financial Statements: Including audited or reviewed financial statements is essential for investors to assess the company's financial health and performance. This typically includes the balance sheet, income statement, and cash flow statement. 10. Plan of Operation: Detail the company's short and long-term strategic plans, major milestones, and growth projections. This section should also discuss any regulatory or legal considerations. 11. Dilution: If the private placement involves multiple rounds of funding, explain how the investment could potentially dilute the ownership and voting rights of existing shareholders. 12. Subscription Agreement: Provide a detailed subscription agreement that outlines the specific terms, conditions, and mechanics of the investment process, including the financial terms, representations and warranties, transfer restrictions, and dispute resolution mechanisms. 13. Legal Considerations: Include applicable legal disclaimers, disclosures, representations, and any securities' law compliance information to ensure the document adheres to regulatory requirements. 14. Appendices: Attach supplementary documents such as contracts, patents, licenses, key customer agreements, or supporting industry research to further validate the investment opportunity. Different types of Alameda California checklists for the contents of Private Placement Memorandum may exist based on specific industries or purposes. For instance, a technology startup PPM may emphasize intellectual property rights and scalability, while a real estate development PPM may focus on property specifics, zoning regulations, and projected returns on investment. In conclusion, a comprehensive Alameda California checklist for the contents of a Private Placement Memorandum includes an executive summary, table of contents, introduction, risk factors, offering summary, business description, management team, use of proceeds, financial statements, plan of operation, dilution explanation, subscription agreement, legal considerations, and appendices. Adapting the contents to suit specific industries or investment opportunities can result in various types of checklists.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.