A private placement memorandum is a legal document that sets out the terms upon which securities are offered to potential private investors. It can refer to any kind of offering of securities to any number of private accredited investors. It lays out for the prospective client almost all the details of an investment opportunity. The principal purpose of this document is to give the company the opportunity to present all potential risks to the investor. A Private Placement Memorandum is in fact a plan for the company. It plainly identifies the nature and purpose of the company.

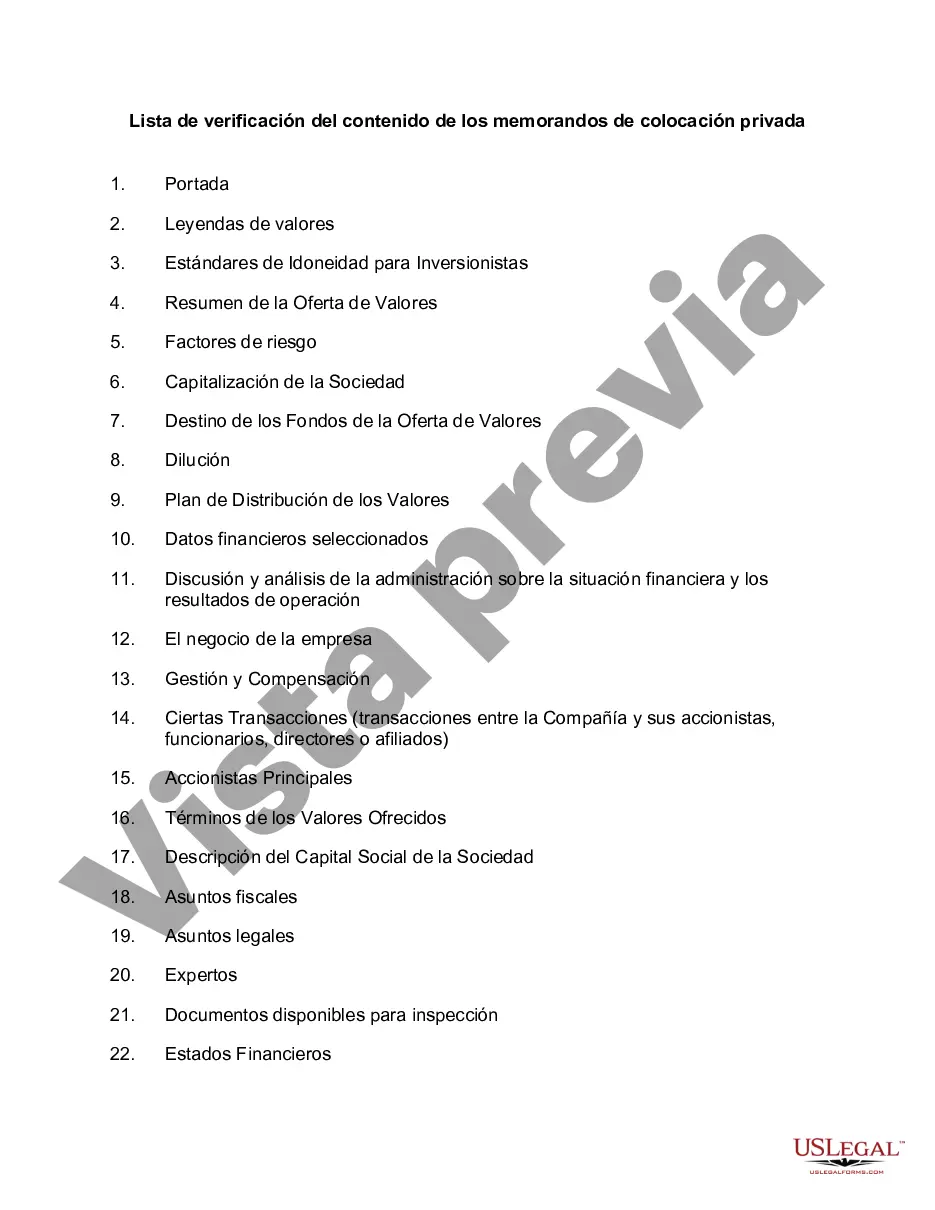

This is a simple checklist regarding matters to be included in a private placement memorandum for a securities offering intended to meet certain disclosure requirements of SEC Regulation D.

Chicago, Illinois is a vibrant city and the third-largest in the United States. Known for its world-class architecture, lively arts and cultural scene, and diverse neighborhoods, Chicago attracts millions of visitors every year. When it comes to Private Placement Memorandum (PPM) in Chicago, there are several checklists that need to be considered to ensure compliance and thoroughness. Some prominent ones include: 1. Executive Summary: This section provides a concise overview of the private placement offering, highlighting key information like the purpose and objective, investment strategy, and potential risks involved. 2. Business Description: Outlining the business's nature, industry, and competitive landscape, this section delves into the company's history, key milestones, and unique selling propositions. 3. Management Team: Highlighting the expertise and experience of the management team, this section showcases the key individuals responsible for making strategic decisions and driving the company's growth. 4. Offering Terms: Discussing the terms and conditions of the private placement, this section provides comprehensive details about the investment opportunity, including offering amount, price per share/unit, minimum investment, and any associated expenses or fees. 5. Risk Factors: Enumerating the risks investors may encounter, this section addresses market, operational, financial, and regulatory risks that could affect the company's performance and potentially impact investment returns. 6. Financial Overview: This section includes historical and projected financial statements, covering income statements, balance sheets, cash flow statements, and key financial ratios, enabling investors to evaluate the company's past and future performance. 7. Legal and Regulatory: Outlining the legal and regulatory compliance aspects, this section provides information on licenses, registrations, permits, and any ongoing litigation or regulatory constraints that may affect the company's operations. 8. Use of Proceeds: Detailing how the investment funds will be utilized, this section explains the allocation of proceeds and provides transparency regarding capital expenditure, debt repayment, working capital, research and development, and other essential areas. 9. Subscription Procedures: Covering the investment process, subscription procedures typically include instructions for potential investors to subscribe to the private placement, including required documentation, contact information, and any specific instructions. 10. Offering Document Review: This last section advises potential investors to carefully review the entire PPM, consult with relevant professionals (like attorneys and financial advisors) to ensure they understand the terms, risks, and potential rewards associated with the investment opportunity. These are some of the key components that are often included in a Chicago, Illinois checklist for the contents of a Private Placement Memorandum. Adhering to these guidelines ensures that the PPM provides comprehensive and transparent information to potential investors, mitigating risks and fostering investor confidence.Chicago, Illinois is a vibrant city and the third-largest in the United States. Known for its world-class architecture, lively arts and cultural scene, and diverse neighborhoods, Chicago attracts millions of visitors every year. When it comes to Private Placement Memorandum (PPM) in Chicago, there are several checklists that need to be considered to ensure compliance and thoroughness. Some prominent ones include: 1. Executive Summary: This section provides a concise overview of the private placement offering, highlighting key information like the purpose and objective, investment strategy, and potential risks involved. 2. Business Description: Outlining the business's nature, industry, and competitive landscape, this section delves into the company's history, key milestones, and unique selling propositions. 3. Management Team: Highlighting the expertise and experience of the management team, this section showcases the key individuals responsible for making strategic decisions and driving the company's growth. 4. Offering Terms: Discussing the terms and conditions of the private placement, this section provides comprehensive details about the investment opportunity, including offering amount, price per share/unit, minimum investment, and any associated expenses or fees. 5. Risk Factors: Enumerating the risks investors may encounter, this section addresses market, operational, financial, and regulatory risks that could affect the company's performance and potentially impact investment returns. 6. Financial Overview: This section includes historical and projected financial statements, covering income statements, balance sheets, cash flow statements, and key financial ratios, enabling investors to evaluate the company's past and future performance. 7. Legal and Regulatory: Outlining the legal and regulatory compliance aspects, this section provides information on licenses, registrations, permits, and any ongoing litigation or regulatory constraints that may affect the company's operations. 8. Use of Proceeds: Detailing how the investment funds will be utilized, this section explains the allocation of proceeds and provides transparency regarding capital expenditure, debt repayment, working capital, research and development, and other essential areas. 9. Subscription Procedures: Covering the investment process, subscription procedures typically include instructions for potential investors to subscribe to the private placement, including required documentation, contact information, and any specific instructions. 10. Offering Document Review: This last section advises potential investors to carefully review the entire PPM, consult with relevant professionals (like attorneys and financial advisors) to ensure they understand the terms, risks, and potential rewards associated with the investment opportunity. These are some of the key components that are often included in a Chicago, Illinois checklist for the contents of a Private Placement Memorandum. Adhering to these guidelines ensures that the PPM provides comprehensive and transparent information to potential investors, mitigating risks and fostering investor confidence.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.