A private placement memorandum is a legal document that sets out the terms upon which securities are offered to potential private investors. It can refer to any kind of offering of securities to any number of private accredited investors. It lays out for the prospective client almost all the details of an investment opportunity. The principal purpose of this document is to give the company the opportunity to present all potential risks to the investor. A Private Placement Memorandum is in fact a plan for the company. It plainly identifies the nature and purpose of the company.

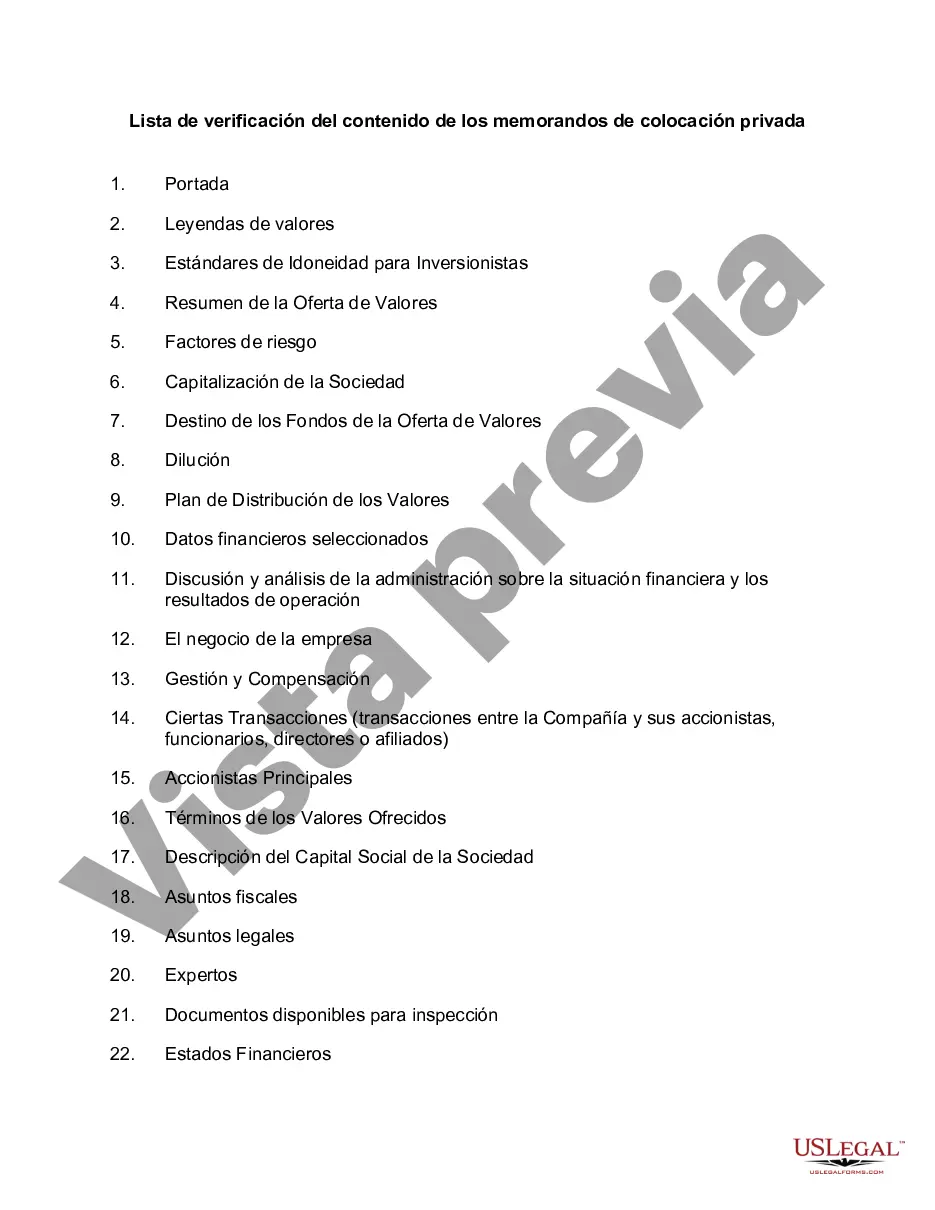

This is a simple checklist regarding matters to be included in a private placement memorandum for a securities offering intended to meet certain disclosure requirements of SEC Regulation D.

The Cuyahoga Ohio Checklist for Contents of Private Placement Memorandum acts as a comprehensive guide for individuals and organizations looking to issue a private placement memorandum (PPM) within the Cuyahoga County, Ohio region. This checklist ensures that all necessary information and legal requirements are included in the PPM, safeguarding the interests of both issuers and potential investors. Key areas covered by the Cuyahoga Ohio Checklist for Contents of Private Placement Memorandum include: 1. Introduction: This section introduces the PPM, providing details on the issuer, their business model, and the purpose of the private placement offering. 2. Executive Summary: A concise overview of the offering, highlighting the key investment highlights and risks associated with the investment opportunity. 3. Description of Securities: A thorough description of the securities being offered, including details on the nature, type, and terms of the securities. 4. Risk Factors: A comprehensive disclosure of all potential risks involved in the investment opportunity, ensuring that potential investors are aware of the associated risks before making any investment decisions. 5. Management Team and Advisors: Detailed information on the key personnel and advisors involved in the offering, including their qualifications, experience, and roles within the company. 6. Use of Proceeds: A breakdown of how the funds generated from the private placement will be used within the company, ensuring transparency and accountability. 7. Financial Information: Comprehensive financial statements, including balance sheets, income statements, and cash flow statements, providing potential investors with a clear understanding of the financial health and prospects of the issuer. 8. Legal and Regulatory Matters: Detailed information on any legal or regulatory aspects connected to the offering, such as compliance with securities laws, relevant permits, licenses, or registrations. 9. Subscription Agreement: An agreement outlining the terms and conditions under which investors can subscribe to the offering, including the amount of investment, payment terms, and any associated rights or restrictions. 10. Appendices and Exhibits: Supporting documentation, including any legal opinions, contracts, or other additional materials pertinent to the offering. Different Types of Cuyahoga Ohio Checklist for Contents of Private Placement Memorandum may vary based on the specific industry or legal requirements. For example, there might be a separate checklist for real estate private placements, technology startups, or healthcare companies operating within Cuyahoga County, Ohio. These industry-specific checklists would include additional sections, disclosures, or considerations relevant to the specific sector.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.