A private placement memorandum is a legal document that sets out the terms upon which securities are offered to potential private investors. It can refer to any kind of offering of securities to any number of private accredited investors. It lays out for the prospective client almost all the details of an investment opportunity. The principal purpose of this document is to give the company the opportunity to present all potential risks to the investor. A Private Placement Memorandum is in fact a plan for the company. It plainly identifies the nature and purpose of the company.

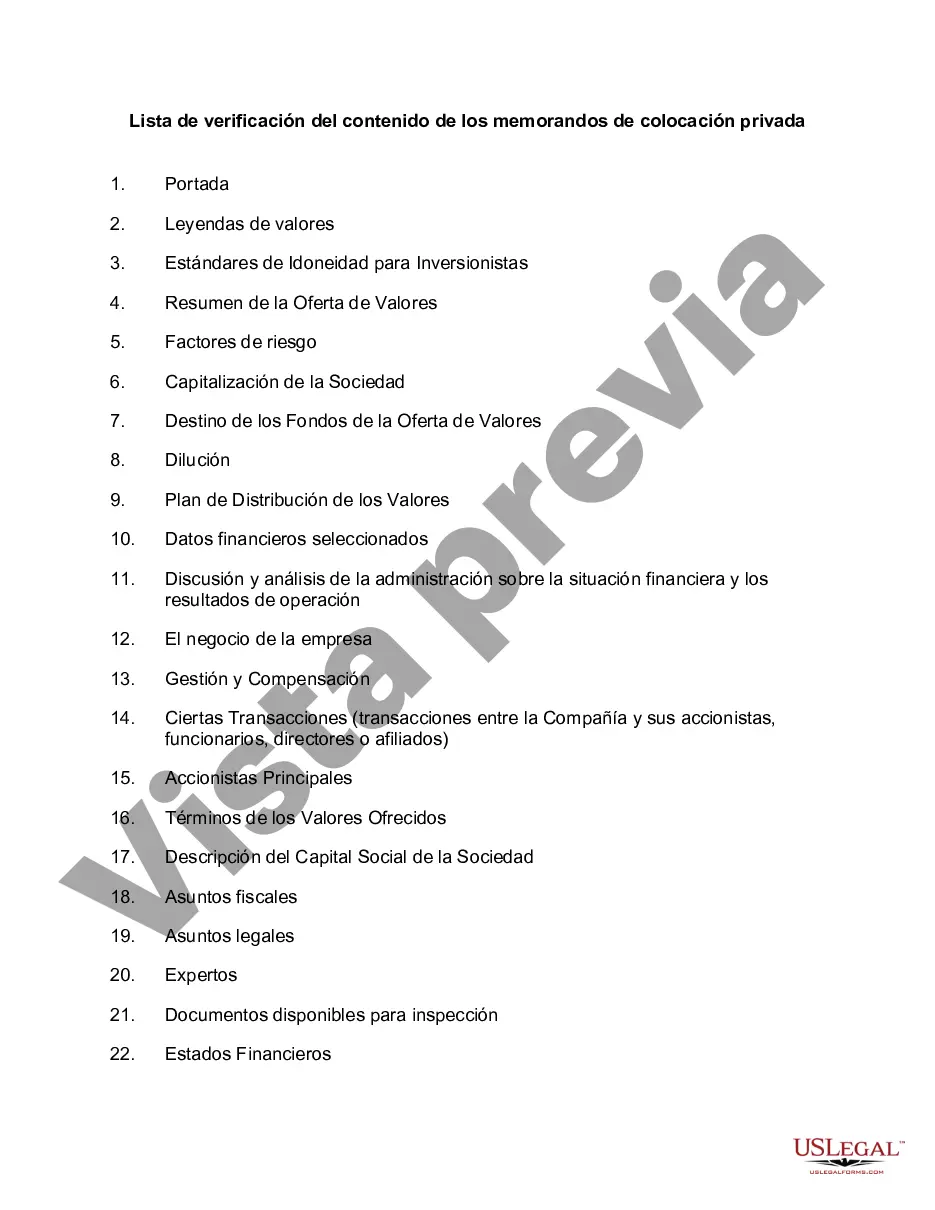

This is a simple checklist regarding matters to be included in a private placement memorandum for a securities offering intended to meet certain disclosure requirements of SEC Regulation D.

Title: Comprehensive Guide: Houston, Texas — Checklist for Contents of Private Placement Memorandum Introduction: Houston, the fourth-most populous city in the United States, offers a dynamic economic landscape and a thriving business environment. For entrepreneurs and investors seeking capital, understanding the key components of a Private Placement Memorandum (PPM) is crucial. In this article, we present a detailed checklist outlining the essential contents of a Houston, Texas-focused PPM. 1. Executive Summary: The executive summary provides an overview of the private placement opportunity, highlighting the key elements such as the purpose, structure, and potential risks and returns. 2. Company Overview: Detailed information about the company issuing the private placement, including its legal structure, background, management team, industry experience, and overall business strategy. 3. Offering Terms: This section outlines the terms of the investment opportunity, including the type and class of securities offered, investment minimums, pricing, and any applicable discounts or special provisions for Houston-based investors. 4. Market Analysis: An in-depth analysis of the Houston market, including industry trends, market size, key players, competitive landscape, and growth potential. Emphasis on Houston-centric data and market-specific opportunities enhances investor confidence. 5. Financial Projections and Performance: Detailed financial projections and historical performance, including revenue forecasts, profit margins, expenses, and cash flow analysis, specifically tailored to the Houston market. This information helps investors gauge the company's growth potential within the local context. 6. Risk Factors: A comprehensive disclosure of potential risks associated with the investment, both general and specific to Houston, including regulatory, economic, competitive, and operational risks. Highlighting Houston-specific factors provides a localized perspective to potential investors. 7. Use of Proceeds: A clear and detailed breakdown of how the invested capital will be utilized, emphasizing Houston-specific initiatives such as expansion plans, research and development, marketing campaigns, or infrastructure investment. 8. Legal Considerations: A legal section encompassing compliance with state and federal securities regulations, potential legal issues, and relevant contracts and agreements associated with the placement, customized to include Houston-specific regulations and requirements. 9. Due Diligence Materials: Including audited financial statements, legal opinions, intellectual property rights documentation, licenses, permits, patents, and any additional materials essential for investor due diligence. 10. Subscription Agreement: A document outlining the terms and conditions for investors to participate in the private placement, including subscription instructions, investment amounts, closing dates, and investor representations and warranties. Types of Houston, Texas Checklist for Contents of Private Placement Memorandum: 1. Energy Industry-Specific: A checklist tailored to Ppm for energy-focused Houston-based companies, highlighting the region's unique oil and gas sector, renewable energy opportunities, or emerging technologies. 2. Real Estate Development: A Houston-oriented PPM checklist focusing on real estate development projects, encompassing property market analysis, project timelines, local regulations, and potential risks and returns. 3. Healthcare and Biotechnology: A specialized checklist for biotech and healthcare-related Ppm, considering Houston's renowned medical center and its vibrant biotech industry, covering factors like research funding, regulatory standards, and competitive landscape specific to the healthcare sector. 4. Technology and Innovation Ventures: A checklist specifically designed for technology-driven Ppm, elaborating on Houston's growing startup ecosystem, local incubators, funding opportunities, and the city's commitment to fostering innovation. Conclusion: When crafting a private placement memorandum for Houston, Texas, it is imperative to consider the city's unique characteristics and market dynamics. By adhering to this comprehensive checklist tailored to the Houston landscape, businesses and investors can effectively capture the attention of potential stakeholders and pave the way for successful capital-raising endeavors in the vibrant city of Houston.Title: Comprehensive Guide: Houston, Texas — Checklist for Contents of Private Placement Memorandum Introduction: Houston, the fourth-most populous city in the United States, offers a dynamic economic landscape and a thriving business environment. For entrepreneurs and investors seeking capital, understanding the key components of a Private Placement Memorandum (PPM) is crucial. In this article, we present a detailed checklist outlining the essential contents of a Houston, Texas-focused PPM. 1. Executive Summary: The executive summary provides an overview of the private placement opportunity, highlighting the key elements such as the purpose, structure, and potential risks and returns. 2. Company Overview: Detailed information about the company issuing the private placement, including its legal structure, background, management team, industry experience, and overall business strategy. 3. Offering Terms: This section outlines the terms of the investment opportunity, including the type and class of securities offered, investment minimums, pricing, and any applicable discounts or special provisions for Houston-based investors. 4. Market Analysis: An in-depth analysis of the Houston market, including industry trends, market size, key players, competitive landscape, and growth potential. Emphasis on Houston-centric data and market-specific opportunities enhances investor confidence. 5. Financial Projections and Performance: Detailed financial projections and historical performance, including revenue forecasts, profit margins, expenses, and cash flow analysis, specifically tailored to the Houston market. This information helps investors gauge the company's growth potential within the local context. 6. Risk Factors: A comprehensive disclosure of potential risks associated with the investment, both general and specific to Houston, including regulatory, economic, competitive, and operational risks. Highlighting Houston-specific factors provides a localized perspective to potential investors. 7. Use of Proceeds: A clear and detailed breakdown of how the invested capital will be utilized, emphasizing Houston-specific initiatives such as expansion plans, research and development, marketing campaigns, or infrastructure investment. 8. Legal Considerations: A legal section encompassing compliance with state and federal securities regulations, potential legal issues, and relevant contracts and agreements associated with the placement, customized to include Houston-specific regulations and requirements. 9. Due Diligence Materials: Including audited financial statements, legal opinions, intellectual property rights documentation, licenses, permits, patents, and any additional materials essential for investor due diligence. 10. Subscription Agreement: A document outlining the terms and conditions for investors to participate in the private placement, including subscription instructions, investment amounts, closing dates, and investor representations and warranties. Types of Houston, Texas Checklist for Contents of Private Placement Memorandum: 1. Energy Industry-Specific: A checklist tailored to Ppm for energy-focused Houston-based companies, highlighting the region's unique oil and gas sector, renewable energy opportunities, or emerging technologies. 2. Real Estate Development: A Houston-oriented PPM checklist focusing on real estate development projects, encompassing property market analysis, project timelines, local regulations, and potential risks and returns. 3. Healthcare and Biotechnology: A specialized checklist for biotech and healthcare-related Ppm, considering Houston's renowned medical center and its vibrant biotech industry, covering factors like research funding, regulatory standards, and competitive landscape specific to the healthcare sector. 4. Technology and Innovation Ventures: A checklist specifically designed for technology-driven Ppm, elaborating on Houston's growing startup ecosystem, local incubators, funding opportunities, and the city's commitment to fostering innovation. Conclusion: When crafting a private placement memorandum for Houston, Texas, it is imperative to consider the city's unique characteristics and market dynamics. By adhering to this comprehensive checklist tailored to the Houston landscape, businesses and investors can effectively capture the attention of potential stakeholders and pave the way for successful capital-raising endeavors in the vibrant city of Houston.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.