A private placement memorandum is a legal document that sets out the terms upon which securities are offered to potential private investors. It can refer to any kind of offering of securities to any number of private accredited investors. It lays out for the prospective client almost all the details of an investment opportunity. The principal purpose of this document is to give the company the opportunity to present all potential risks to the investor. A Private Placement Memorandum is in fact a plan for the company. It plainly identifies the nature and purpose of the company.

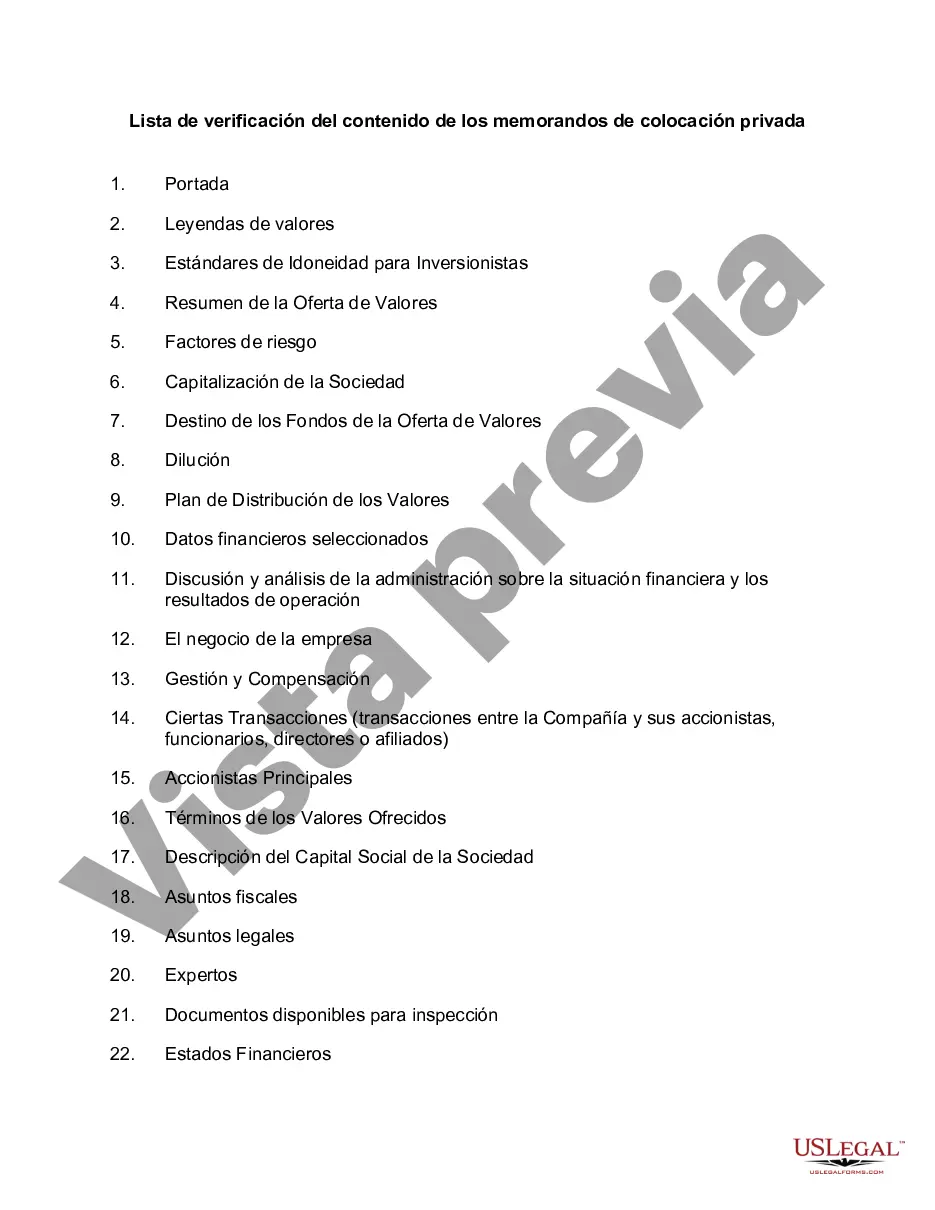

This is a simple checklist regarding matters to be included in a private placement memorandum for a securities offering intended to meet certain disclosure requirements of SEC Regulation D.

Miami-Dade County is located in the southeastern part of the state of Florida, United States. It is the most populous county in Florida and encompasses several cities, including Miami, the county seat and the largest city in the county. Miami-Dade County is renowned for its vibrant culture, stunning beaches, diverse communities, and thriving economy. The county attracts millions of tourists each year and serves as a major hub for international trade and finance. Keywords: Miami-Dade County, Florida, private placement memorandum, checklist, content. A private placement memorandum (PPM) is a legal document that presents detailed information about a private investment opportunity to potential investors. In the case of Miami-Dade County, a PPM may be required for various investment projects or ventures within the county's jurisdiction. The checklist for the contents of a private placement memorandum typically includes the following: 1. Executive Summary: This section provides an overview of the investment opportunity, including the purpose, size, and potential returns. 2. Investment Offering: Enumerates the type and amount of securities being offered, such as stocks, bonds, or units in a limited partnership. 3. Risk Factors: Outlines the potential risks associated with the investment, such as economic, regulatory, or operational risks specific to Miami-Dade County or the industry in which the project is situated. 4. Business Description: Provides detailed information about the business or project, including its history, management team, organizational structure, and competitive advantage. 5. Financial Statements: Presents audited financial statements, tax returns, and other relevant financial information to evaluate the financial health and stability of the investment opportunity. 6. Use of Proceeds: Describes how the funds raised through the private placement will be utilized, whether it is for expansion, acquisition, or working capital. 7. Market Analysis: Outlines the market size, trends, and competitive landscape, focusing on the Miami-Dade County area and its target market. 8. Legal Considerations: Discloses any legal or regulatory requirements, licenses, permits, or litigation that may impact the investment project. 9. Management Compensation: Details the compensation structure for the management team, including salaries, bonuses, and equity incentives. 10. Exit Strategy: Presents potential exit options for investors, such as an initial public offering (IPO), merger, acquisition, or sale of assets. 11. Subscription Agreement: Includes the legal documentation required to invest in the private placement, such as subscription forms, investor questionnaires, and confidentiality agreements. It is important to note that specific Miami-Dade Florida checklist requirements for contents of private placement memorandums may vary depending on the nature of the investment, the industry, and any county-specific regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.