A private placement memorandum is a legal document that sets out the terms upon which securities are offered to potential private investors. It can refer to any kind of offering of securities to any number of private accredited investors. It lays out for the prospective client almost all the details of an investment opportunity. The principal purpose of this document is to give the company the opportunity to present all potential risks to the investor. A Private Placement Memorandum is in fact a plan for the company. It plainly identifies the nature and purpose of the company.

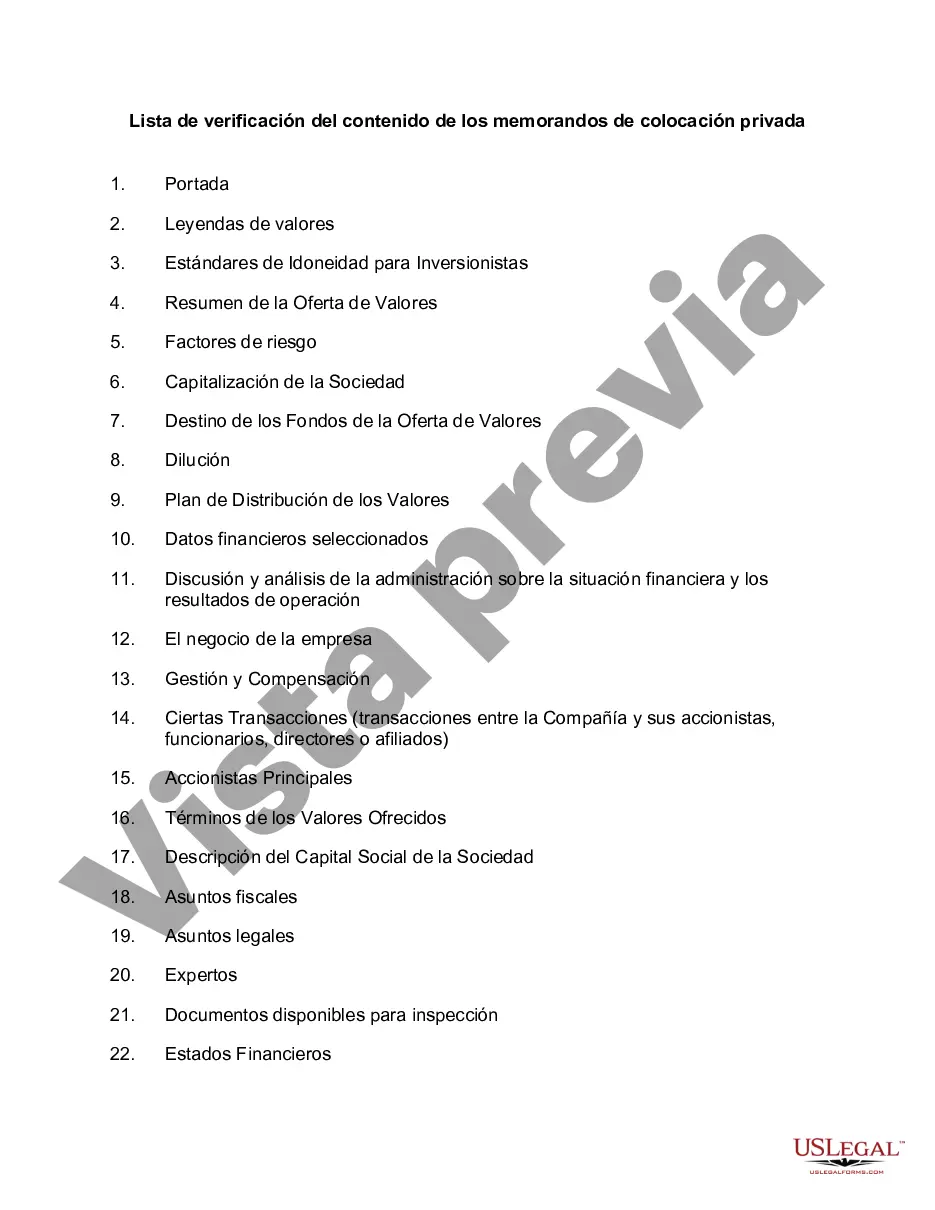

This is a simple checklist regarding matters to be included in a private placement memorandum for a securities offering intended to meet certain disclosure requirements of SEC Regulation D.

Salt Lake Utah is a vibrant city located in the western part of the United States. It is the capital of Utah and is known for its stunning natural beauty, outdoor recreation opportunities, and thriving business environment. When it comes to private placement memorandum (PPM) in Salt Lake Utah, there are several important contents that should be included. Here is a detailed checklist of the necessary components: 1. Executive Summary: Provide a concise overview of the investment opportunity, including key details of the project or business venture. 2. Offering Summary: Outline the specific terms of the investment, including the type of securities offered, the offering amount, minimum investment requirements, and any applicable use of proceeds. 3. Company Background: Present a comprehensive background of the company or project, including its history, management team, and ownership structure. 4. Risk Factors: Highlight the potential risks associated with the investment, such as market risks, regulatory risks, competition, and financial risks. This section is crucial for investors to make informed decisions. 5. Financial Information: Include detailed financial statements, including balance sheets, income statements, and cash flow statements. Provide historical financial performance and projected financials, if available. 6. Use of Proceeds: Explain how the funds raised through the private placement will be used, whether it is for business expansion, research and development, marketing efforts, or debt repayment. 7. Offering Terms: Specify the offering terms, such as the purchase price, investment minimums, subscription procedures, and any applicable warranties or guarantees. 8. Dilution: Discuss how the investment may affect existing shareholders or the ownership structure of the company. 9. Subscription Agreement: Include a subscription agreement that outlines the terms and conditions for investors to subscribe to the offering. 10. Confidentiality and Disclaimer: Clearly state the confidential nature of the document and include disclaimers regarding the accuracy of the information provided. Different types of Salt Lake Utah Checklist for Contents of Private Placement Memorandum may include variations based on the specific industry or nature of the investment opportunity. Some examples could be: 1. Real Estate PPM: A checklist that includes additional elements related to property details, market analysis, operational plans, and property valuation. 2. Technology Start-up PPM: Tailored checklist focusing on aspects such as product development, intellectual property rights, market potential, and scalability. 3. Energy Project PPM: Specific checklist addressing any regulatory requirements, project timelines, environmental impact, and revenue-generating mechanisms. 4. Healthcare Venture PPM: Customized checklist highlighting the competitive landscape, patient demographic analysis, regulatory compliance, and industry trends. In conclusion, a comprehensive private placement memorandum should cover essential components like executive summary, offering details, company background, risk factors, financial information, use of proceeds, offering terms, dilution, subscription agreement, and confidentiality disclaimers. Different sectors or industries may require additional areas of focus, resulting in varied types of Salt Lake Utah Checklist for Contents of Private Placement Memorandum.Salt Lake Utah is a vibrant city located in the western part of the United States. It is the capital of Utah and is known for its stunning natural beauty, outdoor recreation opportunities, and thriving business environment. When it comes to private placement memorandum (PPM) in Salt Lake Utah, there are several important contents that should be included. Here is a detailed checklist of the necessary components: 1. Executive Summary: Provide a concise overview of the investment opportunity, including key details of the project or business venture. 2. Offering Summary: Outline the specific terms of the investment, including the type of securities offered, the offering amount, minimum investment requirements, and any applicable use of proceeds. 3. Company Background: Present a comprehensive background of the company or project, including its history, management team, and ownership structure. 4. Risk Factors: Highlight the potential risks associated with the investment, such as market risks, regulatory risks, competition, and financial risks. This section is crucial for investors to make informed decisions. 5. Financial Information: Include detailed financial statements, including balance sheets, income statements, and cash flow statements. Provide historical financial performance and projected financials, if available. 6. Use of Proceeds: Explain how the funds raised through the private placement will be used, whether it is for business expansion, research and development, marketing efforts, or debt repayment. 7. Offering Terms: Specify the offering terms, such as the purchase price, investment minimums, subscription procedures, and any applicable warranties or guarantees. 8. Dilution: Discuss how the investment may affect existing shareholders or the ownership structure of the company. 9. Subscription Agreement: Include a subscription agreement that outlines the terms and conditions for investors to subscribe to the offering. 10. Confidentiality and Disclaimer: Clearly state the confidential nature of the document and include disclaimers regarding the accuracy of the information provided. Different types of Salt Lake Utah Checklist for Contents of Private Placement Memorandum may include variations based on the specific industry or nature of the investment opportunity. Some examples could be: 1. Real Estate PPM: A checklist that includes additional elements related to property details, market analysis, operational plans, and property valuation. 2. Technology Start-up PPM: Tailored checklist focusing on aspects such as product development, intellectual property rights, market potential, and scalability. 3. Energy Project PPM: Specific checklist addressing any regulatory requirements, project timelines, environmental impact, and revenue-generating mechanisms. 4. Healthcare Venture PPM: Customized checklist highlighting the competitive landscape, patient demographic analysis, regulatory compliance, and industry trends. In conclusion, a comprehensive private placement memorandum should cover essential components like executive summary, offering details, company background, risk factors, financial information, use of proceeds, offering terms, dilution, subscription agreement, and confidentiality disclaimers. Different sectors or industries may require additional areas of focus, resulting in varied types of Salt Lake Utah Checklist for Contents of Private Placement Memorandum.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.