A private placement memorandum is a legal document that sets out the terms upon which securities are offered to potential private investors. It can refer to any kind of offering of securities to any number of private accredited investors. It lays out for the prospective client almost all the details of an investment opportunity. The principal purpose of this document is to give the company the opportunity to present all potential risks to the investor. A Private Placement Memorandum is in fact a plan for the company. It plainly identifies the nature and purpose of the company.

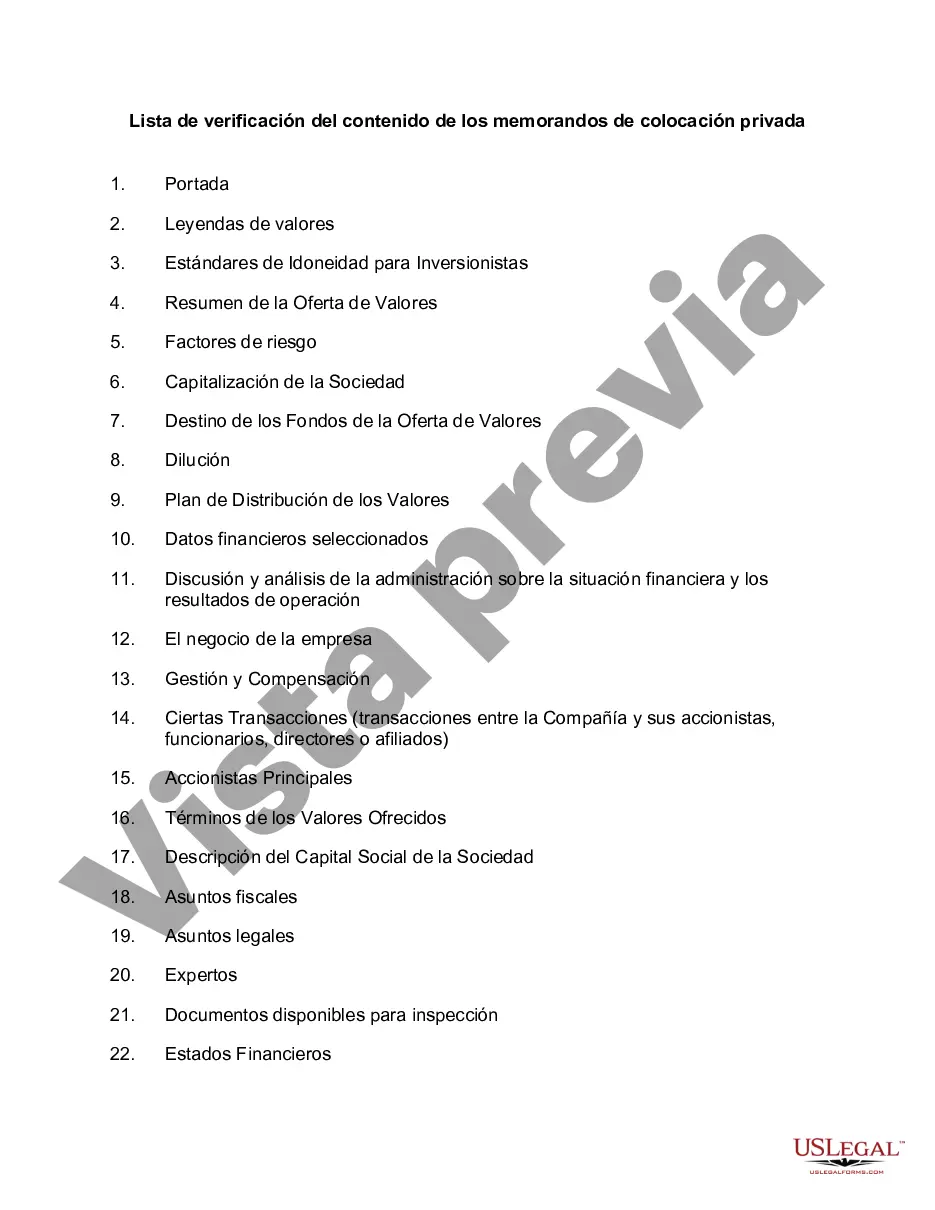

This is a simple checklist regarding matters to be included in a private placement memorandum for a securities offering intended to meet certain disclosure requirements of SEC Regulation D.

San Diego California is a vibrant city located on the Pacific coast of Southern California. Known for its idyllic weather, stunning beaches, and diverse culture, San Diego offers a plethora of attractions and activities for both residents and visitors. When it comes to the checklist for the contents of a Private Placement Memorandum (PPM) in San Diego, several key elements should be included to ensure compliance with applicable regulations and provide investors with all necessary information. Here is a detailed description of what a San Diego California Checklist for Contents of Private Placement Memorandum should include: 1. Executive Summary: This section provides an overview of the PPM, including the purpose of the investment, key features, and potential risks involved. 2. Risk Factors: A comprehensive list of risks associated with the investment opportunity in San Diego should be highlighted. These risks may include market conditions, regulatory changes, competition, and other factors specific to the San Diego area. 3. Business Description: This section outlines the nature of the business or project being funded. For example, if the investment opportunity is in a real estate development project in San Diego, details about the location, timeline, and target market should be included. 4. Management Team: Information about the key individuals involved in the project or business is crucial. This includes their experience, qualifications, and track record in similar ventures. 5. Financial Information: Detailed financial statements, including historical and projected data, should be provided. This allows potential investors to assess the financial stability and profitability of the project. 6. Use of Proceeds: A clear breakdown of how the funds raised will be utilized is necessary. Whether it is for property acquisition, construction, marketing, or other purposes, providing a transparent plan helps investors understand the intended use of their funds. 7. Legal Considerations: All legal and regulatory disclosures related to the investment should be included, ensuring compliance with securities laws and regulations in San Diego, California. 8. Offering Terms: This section outlines the terms of the investment, such as the minimum investment amount, valuation, investor rights, and any potential future fundraising rounds. 9. Investor Suitability: A checklist or questionnaire may be included to determine if potential investors meet the eligibility requirements set forth by the issuer or securities laws. 10. Subscription Agreement: The subscription agreement is a legally binding contract that documents the commitments made by investors and outlines the terms and conditions of the investment. This should be included as a separate document within the PPM. Different types of San Diego California Checklist for Contents of Private Placement Memorandum can vary based on the specific investment opportunity being presented. For instance, the checklist may differ between a real estate development project, a tech startup, or a new restaurant concept. The key is to ensure that the PPM contains all necessary information relevant to the specific industry or sector, while still adhering to the general checklist items mentioned above. By providing a comprehensive checklist for the contents of a Private Placement Memorandum, San Diego-based investment opportunities can present themselves in a transparent and organized manner, attracting potential investors who are well-informed about the project and its associated risks.San Diego California is a vibrant city located on the Pacific coast of Southern California. Known for its idyllic weather, stunning beaches, and diverse culture, San Diego offers a plethora of attractions and activities for both residents and visitors. When it comes to the checklist for the contents of a Private Placement Memorandum (PPM) in San Diego, several key elements should be included to ensure compliance with applicable regulations and provide investors with all necessary information. Here is a detailed description of what a San Diego California Checklist for Contents of Private Placement Memorandum should include: 1. Executive Summary: This section provides an overview of the PPM, including the purpose of the investment, key features, and potential risks involved. 2. Risk Factors: A comprehensive list of risks associated with the investment opportunity in San Diego should be highlighted. These risks may include market conditions, regulatory changes, competition, and other factors specific to the San Diego area. 3. Business Description: This section outlines the nature of the business or project being funded. For example, if the investment opportunity is in a real estate development project in San Diego, details about the location, timeline, and target market should be included. 4. Management Team: Information about the key individuals involved in the project or business is crucial. This includes their experience, qualifications, and track record in similar ventures. 5. Financial Information: Detailed financial statements, including historical and projected data, should be provided. This allows potential investors to assess the financial stability and profitability of the project. 6. Use of Proceeds: A clear breakdown of how the funds raised will be utilized is necessary. Whether it is for property acquisition, construction, marketing, or other purposes, providing a transparent plan helps investors understand the intended use of their funds. 7. Legal Considerations: All legal and regulatory disclosures related to the investment should be included, ensuring compliance with securities laws and regulations in San Diego, California. 8. Offering Terms: This section outlines the terms of the investment, such as the minimum investment amount, valuation, investor rights, and any potential future fundraising rounds. 9. Investor Suitability: A checklist or questionnaire may be included to determine if potential investors meet the eligibility requirements set forth by the issuer or securities laws. 10. Subscription Agreement: The subscription agreement is a legally binding contract that documents the commitments made by investors and outlines the terms and conditions of the investment. This should be included as a separate document within the PPM. Different types of San Diego California Checklist for Contents of Private Placement Memorandum can vary based on the specific investment opportunity being presented. For instance, the checklist may differ between a real estate development project, a tech startup, or a new restaurant concept. The key is to ensure that the PPM contains all necessary information relevant to the specific industry or sector, while still adhering to the general checklist items mentioned above. By providing a comprehensive checklist for the contents of a Private Placement Memorandum, San Diego-based investment opportunities can present themselves in a transparent and organized manner, attracting potential investors who are well-informed about the project and its associated risks.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.