Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.

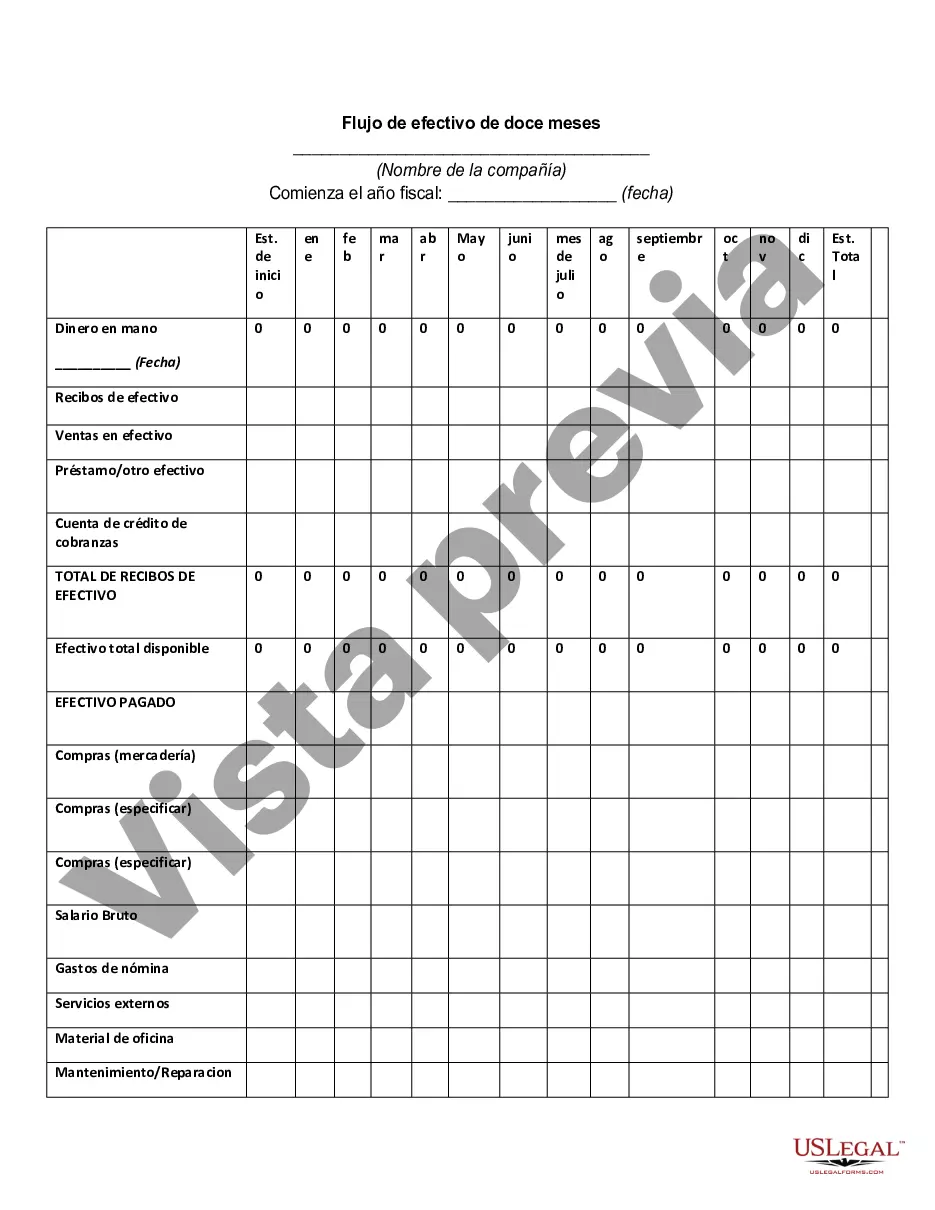

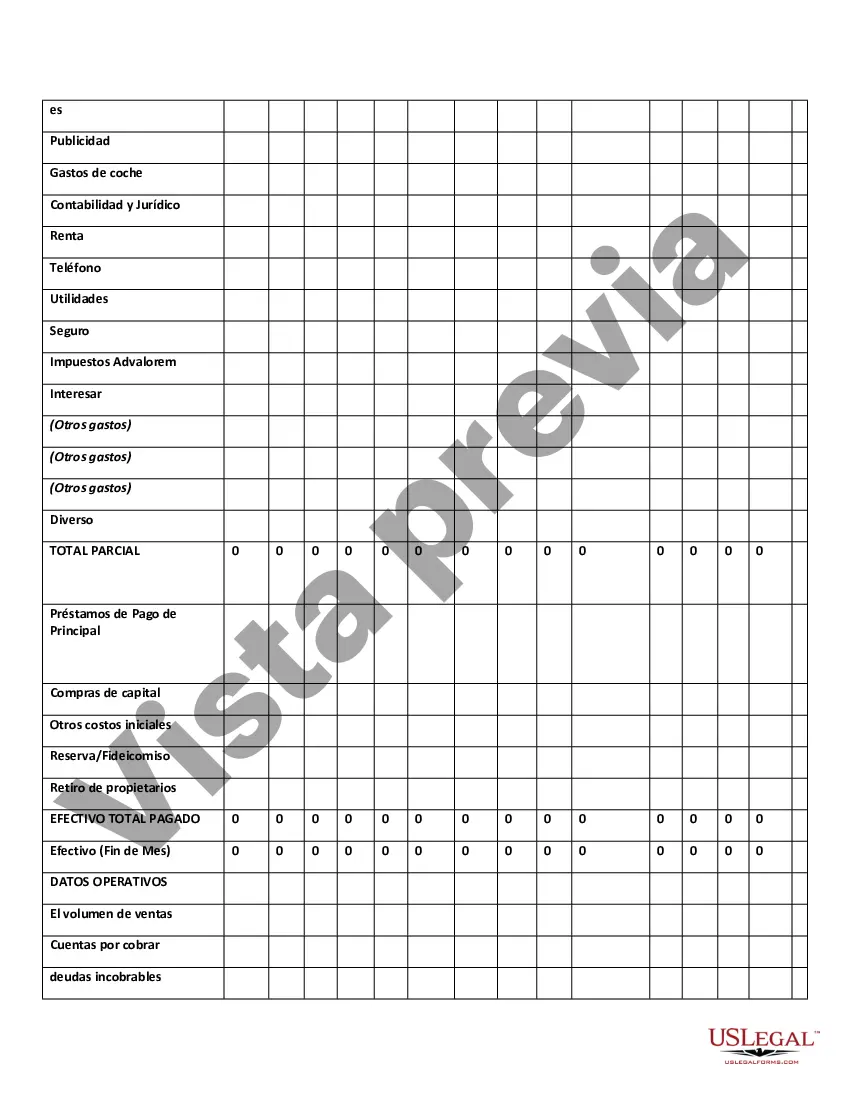

Cook Illinois Twelve-Month Cash Flow refers to a financial statement that outlines the inflows and outflows of cash over a twelve-month period for Cook Illinois Corporation. This statement provides a detailed overview of the company's cash position, showcasing how cash is generated from operations, investments, and financing activities. Keywords: Cook Illinois, Twelve-Month Cash Flow, financial statement, inflows, outflows, cash position, operations, investments, financing activities. Different types of Cook Illinois Twelve-Month Cash Flow: 1. Operating Cash Flow: This section of the statement focuses on the company's core business operations. It includes cash inflows and outflows directly related to daily business activities such as sales, production costs, salaries, and supplier payments. 2. Investing Cash Flow: This section highlights cash inflows and outflows related to the company's investments in long-term assets. It includes activities such as purchase or sale of property, plant, and equipment, acquisition or sale of investments, and lending or collecting on loans. 3. Financing Cash Flow: This section shows the cash inflows and outflows associated with the company's financing activities. These activities involve raising capital from debt or equity sources or making repayments to lenders. Examples include issuing or repurchasing stock, borrowing or repaying loans, and payment of dividends. 4. Net Cash Flow: This section calculates the net change in cash and cash equivalents over the specified twelve-month period. It takes into account the total cash inflows from operating, investing, and financing activities, and subtracts the total cash outflows to determine the overall change in cash reserves. By providing a comprehensive overview of Cook Illinois Corporation's cash flows from various sources, the Twelve-Month Cash Flow statement assists stakeholders in assessing the company's ability to generate and manage cash effectively. This document enables analysis of the liquidity, solvency, and financial health of Cook Illinois, aiding investors, lenders, and managers in making informed decisions.Cook Illinois Twelve-Month Cash Flow refers to a financial statement that outlines the inflows and outflows of cash over a twelve-month period for Cook Illinois Corporation. This statement provides a detailed overview of the company's cash position, showcasing how cash is generated from operations, investments, and financing activities. Keywords: Cook Illinois, Twelve-Month Cash Flow, financial statement, inflows, outflows, cash position, operations, investments, financing activities. Different types of Cook Illinois Twelve-Month Cash Flow: 1. Operating Cash Flow: This section of the statement focuses on the company's core business operations. It includes cash inflows and outflows directly related to daily business activities such as sales, production costs, salaries, and supplier payments. 2. Investing Cash Flow: This section highlights cash inflows and outflows related to the company's investments in long-term assets. It includes activities such as purchase or sale of property, plant, and equipment, acquisition or sale of investments, and lending or collecting on loans. 3. Financing Cash Flow: This section shows the cash inflows and outflows associated with the company's financing activities. These activities involve raising capital from debt or equity sources or making repayments to lenders. Examples include issuing or repurchasing stock, borrowing or repaying loans, and payment of dividends. 4. Net Cash Flow: This section calculates the net change in cash and cash equivalents over the specified twelve-month period. It takes into account the total cash inflows from operating, investing, and financing activities, and subtracts the total cash outflows to determine the overall change in cash reserves. By providing a comprehensive overview of Cook Illinois Corporation's cash flows from various sources, the Twelve-Month Cash Flow statement assists stakeholders in assessing the company's ability to generate and manage cash effectively. This document enables analysis of the liquidity, solvency, and financial health of Cook Illinois, aiding investors, lenders, and managers in making informed decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.