Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.

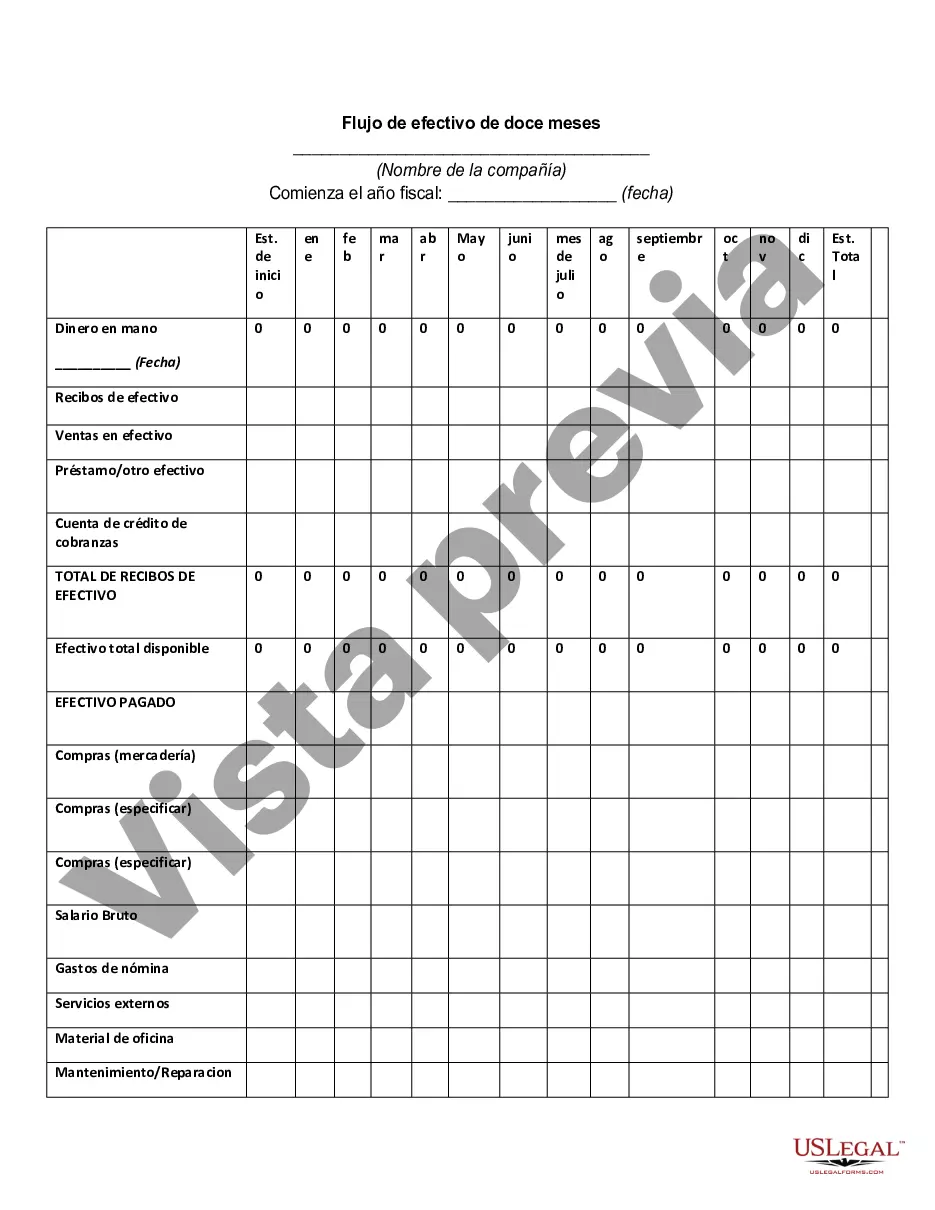

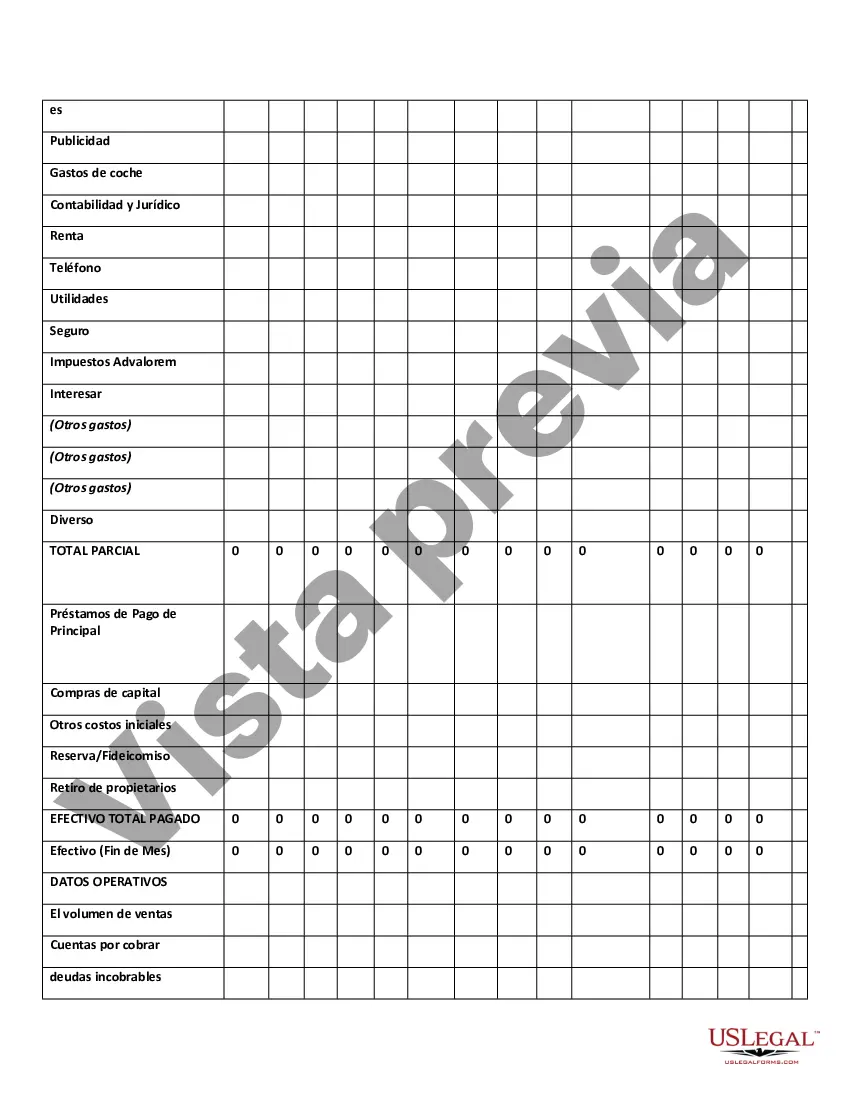

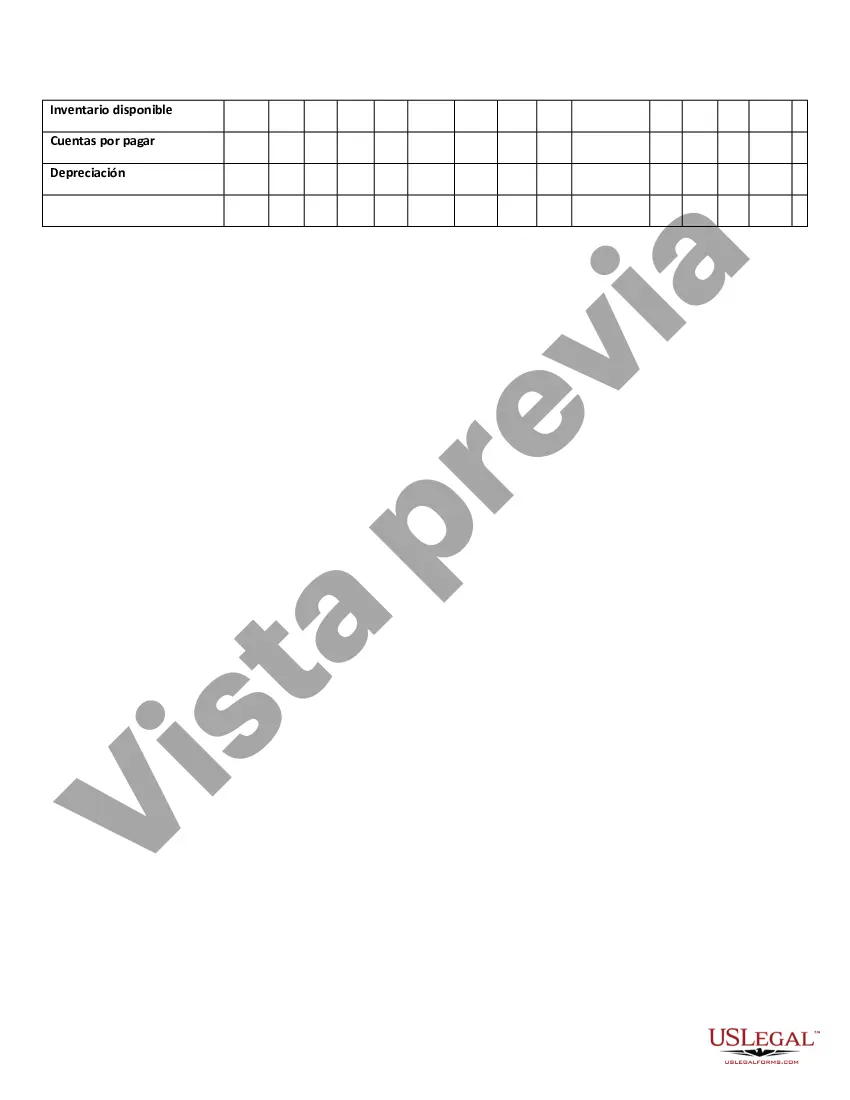

Dallas Texas Twelve-Month Cash Flow refers to a comprehensive financial report that showcases the inflows and outflows of cash over a period of twelve months in the city of Dallas, Texas. This analysis helps individuals, businesses, and organizations in Dallas to understand their cash position, plan their budgets, and make informed financial decisions. The Dallas Texas Twelve-Month Cash Flow report highlights various sources of cash inflows and cash outflows, providing a clear picture of the financial health of the city. Keywords: Dallas Texas, Twelve-Month, Cash Flow, financial report, inflows, outflows, cash position, budgets, financial decisions, sources, financial health. There are different types of Dallas Texas Twelve-Month Cash Flow reports that focus on specific sectors or entities: 1. Dallas Texas Municipal Cash Flow: This type of cash flow report focuses on the financial activities of the Dallas city government, including revenue from taxes, fees, grants, and other sources, along with expenditures on public services, infrastructure, and administrative costs. 2. Dallas Texas Business Cash Flow: This report caters to local businesses in Dallas, showcasing their cash inflows from sales, investments, loans, and other revenue streams, as well as their expenditures on operations, inventory, marketing, payroll, and other business-related expenses. 3. Dallas Texas Real Estate Cash Flow: This cash flow report specifically targets the real estate market in Dallas, providing insights on rental income, property sales, financing costs, maintenance expenses, and overall profitability for property owners, investors, and real estate developers. 4. Dallas Texas Personal Cash Flow: This type of cash flow report focuses on individual households' financial activities in Dallas, detailing their income from various sources, such as salary, investments, and side businesses, as well as their expenses on housing, transportation, education, healthcare, taxes, and other personal expenditures. By analyzing and interpreting these Dallas Texas Twelve-Month Cash Flow reports, individuals, businesses, and organizations in the city can gain a better understanding of their financial standing, identify potential areas for improvement, and devise strategies to enhance cash flow, ensure financial stability, and achieve their financial goals.Dallas Texas Twelve-Month Cash Flow refers to a comprehensive financial report that showcases the inflows and outflows of cash over a period of twelve months in the city of Dallas, Texas. This analysis helps individuals, businesses, and organizations in Dallas to understand their cash position, plan their budgets, and make informed financial decisions. The Dallas Texas Twelve-Month Cash Flow report highlights various sources of cash inflows and cash outflows, providing a clear picture of the financial health of the city. Keywords: Dallas Texas, Twelve-Month, Cash Flow, financial report, inflows, outflows, cash position, budgets, financial decisions, sources, financial health. There are different types of Dallas Texas Twelve-Month Cash Flow reports that focus on specific sectors or entities: 1. Dallas Texas Municipal Cash Flow: This type of cash flow report focuses on the financial activities of the Dallas city government, including revenue from taxes, fees, grants, and other sources, along with expenditures on public services, infrastructure, and administrative costs. 2. Dallas Texas Business Cash Flow: This report caters to local businesses in Dallas, showcasing their cash inflows from sales, investments, loans, and other revenue streams, as well as their expenditures on operations, inventory, marketing, payroll, and other business-related expenses. 3. Dallas Texas Real Estate Cash Flow: This cash flow report specifically targets the real estate market in Dallas, providing insights on rental income, property sales, financing costs, maintenance expenses, and overall profitability for property owners, investors, and real estate developers. 4. Dallas Texas Personal Cash Flow: This type of cash flow report focuses on individual households' financial activities in Dallas, detailing their income from various sources, such as salary, investments, and side businesses, as well as their expenses on housing, transportation, education, healthcare, taxes, and other personal expenditures. By analyzing and interpreting these Dallas Texas Twelve-Month Cash Flow reports, individuals, businesses, and organizations in the city can gain a better understanding of their financial standing, identify potential areas for improvement, and devise strategies to enhance cash flow, ensure financial stability, and achieve their financial goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.