Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.

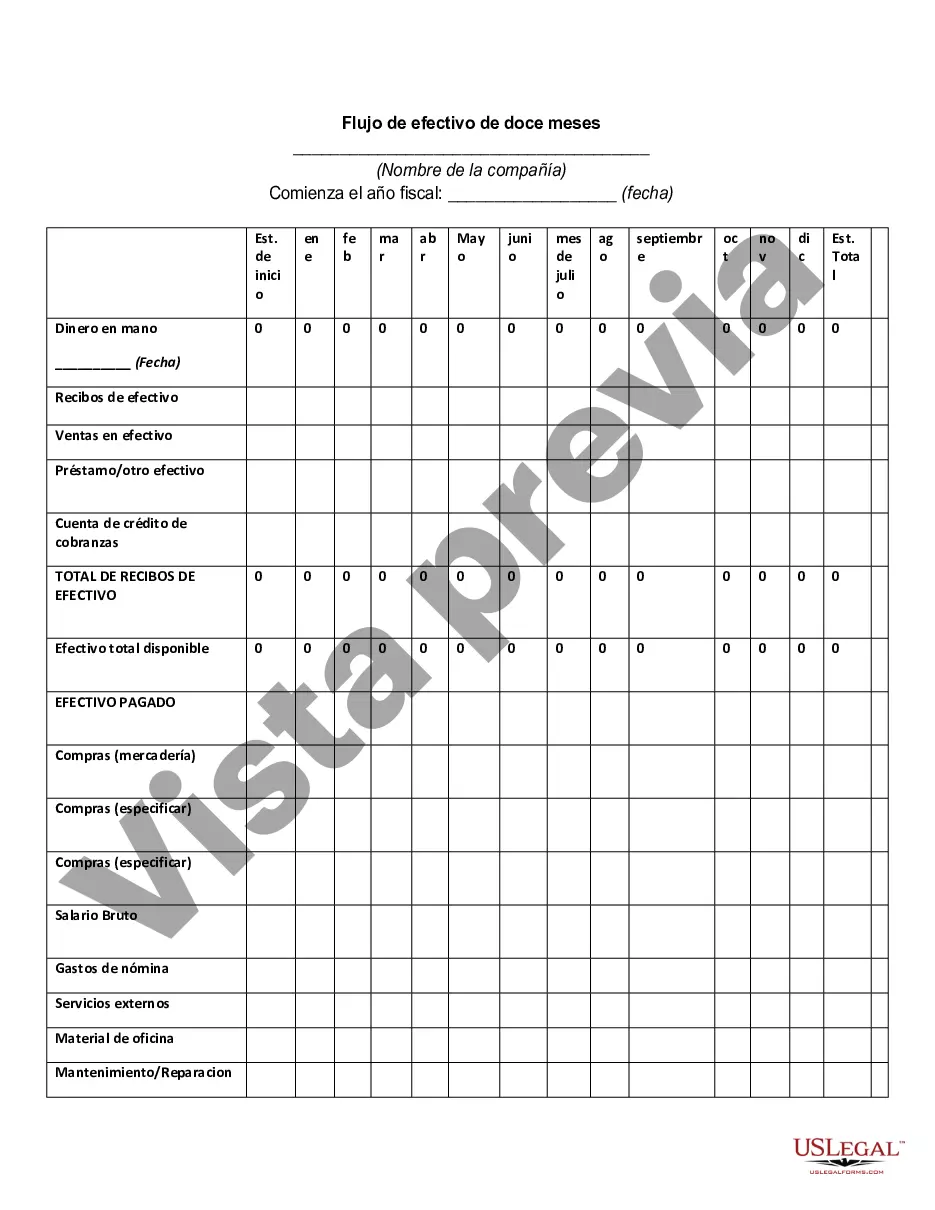

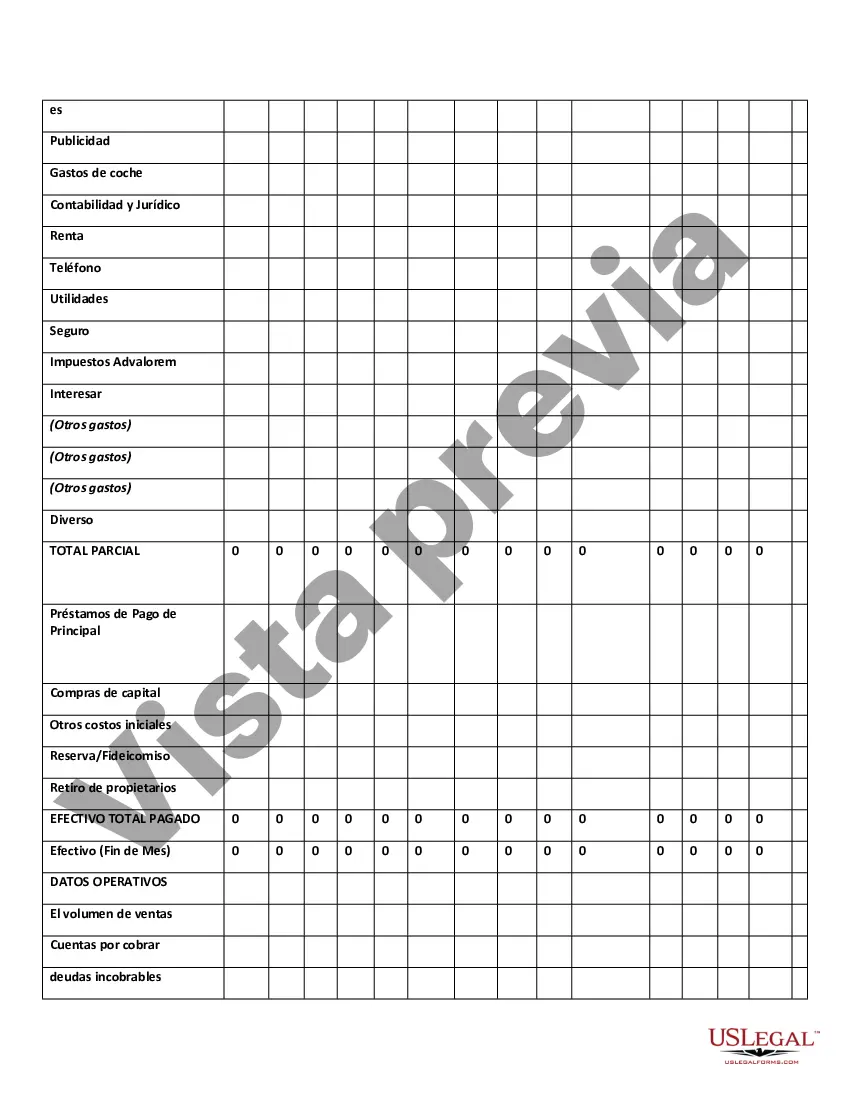

Suffolk New York Twelve-Month Cash Flow is a financial statement that depicts the inflows and outflows of cash in a specified period, typically spanning twelve months. It serves as a valuable tool for individuals, businesses, and organizations operating in Suffolk County, New York, to analyze their cash position, forecast future cash flows, and make informed financial decisions. This cash flow statement provides a comprehensive breakdown of cash sources and uses categorized into three main sections: operating activities, investing activities, and financing activities. It helps stakeholders understand the financial health of an entity by accounting for cash receipts and payments related to day-to-day operations, long-term investments, and capital structure. In Suffolk New York, there can be different types of twelve-month cash flow statements tailored to specific sectors or industries: 1. Suffolk County Small Business Twelve-Month Cash Flow: This statement is designed to assist small businesses in Suffolk County, New York, in managing their cash flows effectively. It focuses on specific cash inflows and outflows relevant to small businesses, considering their unique challenges and requirements. 2. Suffolk County Real Estate Twelve-Month Cash Flow: Aimed at real estate investors and property owners in Suffolk County, this cash flow statement provides insights into the cash flow generated by rental properties, including income, expenses, and loan payments. It helps investors assess the profitability and sustainability of their real estate investments. 3. Suffolk County Non-Profit Twelve-Month Cash Flow: Non-profit organizations in Suffolk County can utilize this cash flow statement to monitor and analyze their financial activities. It accounts for cash inflows from donations, grants, and fundraising, as well as outflows related to program expenditures, administrative costs, and debt service. 4. Suffolk County Personal Twelve-Month Cash Flow: This type of statement serves individuals residing in Suffolk County, helping them track their personal cash inflows and outflows. It highlights sources like salary, investments, and other income streams, while also considering expenses such as rent/mortgage, utilities, transportation, and leisure activities. Regardless of the specific type, Suffolk New York Twelve-Month Cash Flow statements are crucial financial tools for making informed decisions, identifying potential cash flow issues, and developing strategies to improve overall financial stability. It is recommended for individuals and businesses alike to regularly update and review their cash flow statements to effectively manage their finances and achieve their financial goals.Suffolk New York Twelve-Month Cash Flow is a financial statement that depicts the inflows and outflows of cash in a specified period, typically spanning twelve months. It serves as a valuable tool for individuals, businesses, and organizations operating in Suffolk County, New York, to analyze their cash position, forecast future cash flows, and make informed financial decisions. This cash flow statement provides a comprehensive breakdown of cash sources and uses categorized into three main sections: operating activities, investing activities, and financing activities. It helps stakeholders understand the financial health of an entity by accounting for cash receipts and payments related to day-to-day operations, long-term investments, and capital structure. In Suffolk New York, there can be different types of twelve-month cash flow statements tailored to specific sectors or industries: 1. Suffolk County Small Business Twelve-Month Cash Flow: This statement is designed to assist small businesses in Suffolk County, New York, in managing their cash flows effectively. It focuses on specific cash inflows and outflows relevant to small businesses, considering their unique challenges and requirements. 2. Suffolk County Real Estate Twelve-Month Cash Flow: Aimed at real estate investors and property owners in Suffolk County, this cash flow statement provides insights into the cash flow generated by rental properties, including income, expenses, and loan payments. It helps investors assess the profitability and sustainability of their real estate investments. 3. Suffolk County Non-Profit Twelve-Month Cash Flow: Non-profit organizations in Suffolk County can utilize this cash flow statement to monitor and analyze their financial activities. It accounts for cash inflows from donations, grants, and fundraising, as well as outflows related to program expenditures, administrative costs, and debt service. 4. Suffolk County Personal Twelve-Month Cash Flow: This type of statement serves individuals residing in Suffolk County, helping them track their personal cash inflows and outflows. It highlights sources like salary, investments, and other income streams, while also considering expenses such as rent/mortgage, utilities, transportation, and leisure activities. Regardless of the specific type, Suffolk New York Twelve-Month Cash Flow statements are crucial financial tools for making informed decisions, identifying potential cash flow issues, and developing strategies to improve overall financial stability. It is recommended for individuals and businesses alike to regularly update and review their cash flow statements to effectively manage their finances and achieve their financial goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.