Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.

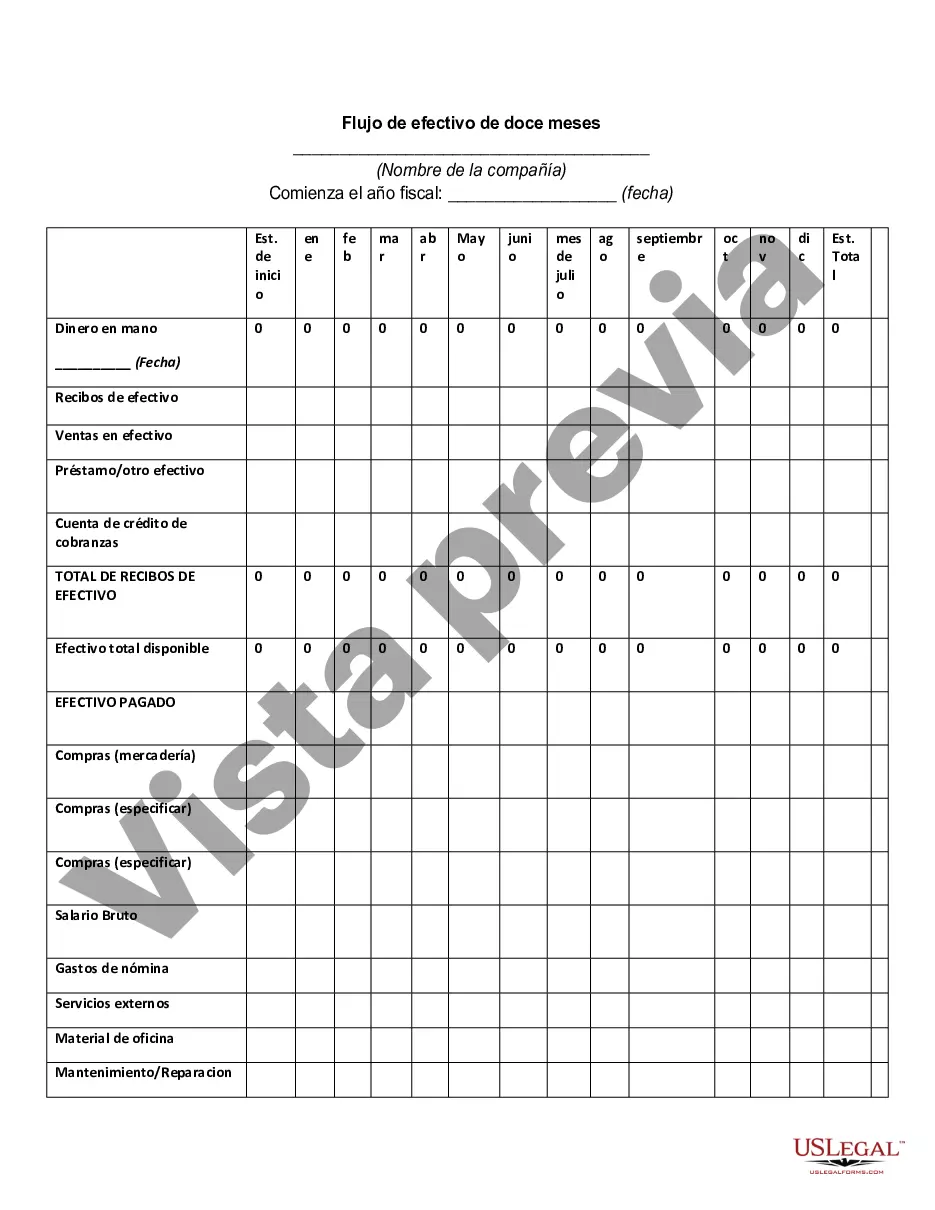

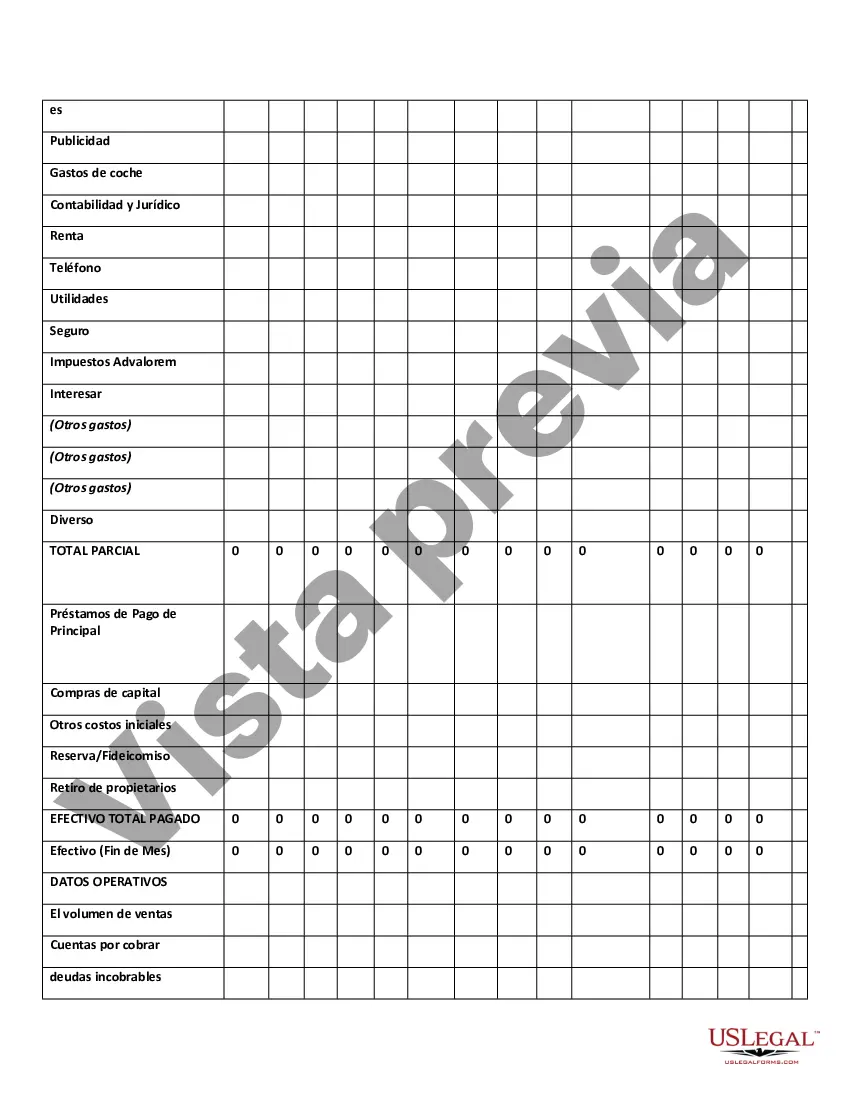

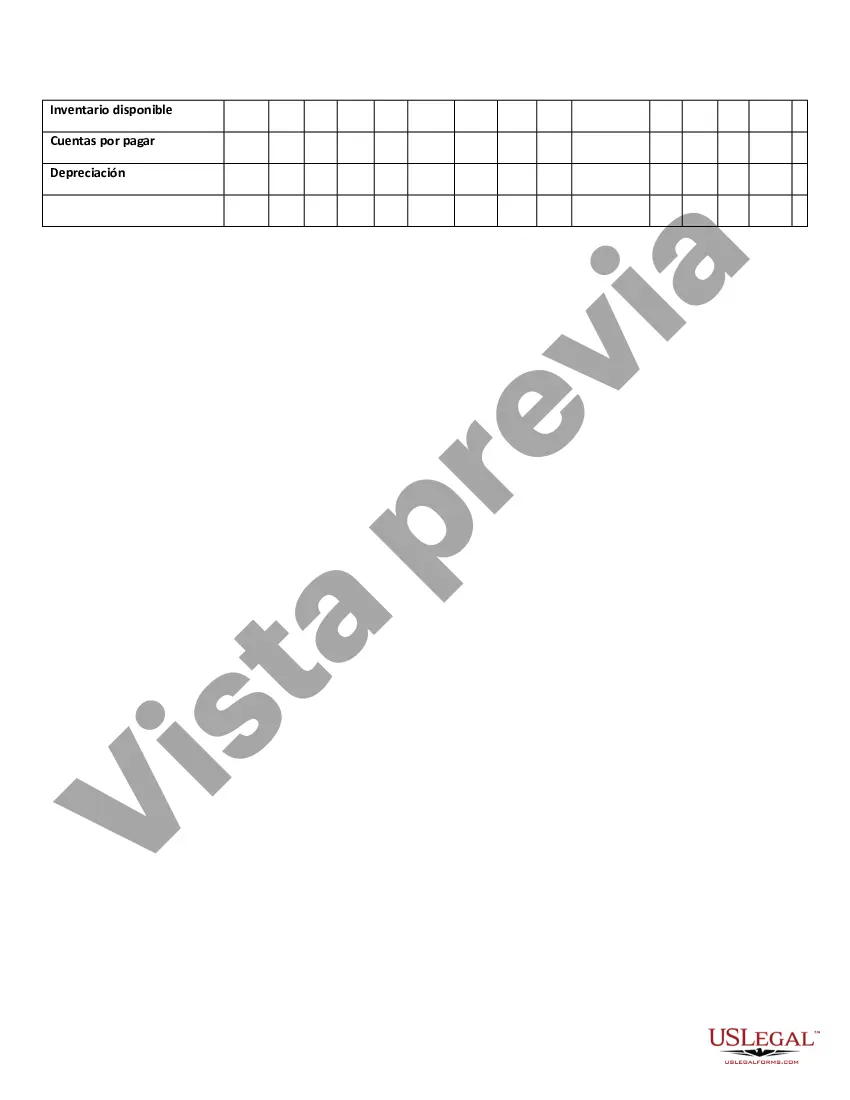

Wake North Carolina Twelve-Month Cash Flow is a comprehensive financial document that outlines the inflows and outflows of cash for a specific period of twelve months in Wake County, North Carolina. This cash flow statement is crucial for individuals, businesses, and organizations in understanding their financial health and planning for the future. Keywords: Wake North Carolina, cash flow, twelve-month, financial document, inflows, outflows, cash, period, financial health, planning. The Wake North Carolina Twelve-Month Cash Flow helps individuals and businesses gain insights into their financial situation by providing a detailed breakdown of all sources of cash inflows and outflows over a twelve-month period. This document enables users to assess their ability to meet financial obligations, anticipate cash shortages or surpluses, plan investments, make strategic decisions, and mitigate financial risks. The types of Wake North Carolina Twelve-Month Cash Flow statements may vary depending on the specific needs and characteristics of the entity. Some common types include: 1. Personal Cash Flow Statement: This type of cash flow statement focuses on an individual's personal finances, including their sources of income (such as salary, investments, or rental income) and expenses (such as rent, groceries, transportation, or loan payments). It helps individuals gain a holistic view of their financial position and make informed decisions regarding savings, investment opportunities, debt management, and budgeting. 2. Business Cash Flow Statement: This statement concentrates on the cash inflows and outflows of a business operating in Wake County, North Carolina. It encompasses revenue from sales, loans, investments, interest, grants, and other sources, as well as expenses related to raw materials, payroll, rent, utilities, marketing, and loan repayments. By analyzing this statement, businesses can effectively manage cash flow, identify areas of improvement, forecast financial performance, and plan for expansion or investment opportunities. 3. Nonprofit Cash Flow Statement: Nonprofit organizations in Wake County, North Carolina, can use this type of cash flow statement to track and manage their financial resources. It provides insights into the cash inflows and outflows associated with donations, grants, fundraising events, program expenses, administrative costs, and other revenue sources. Nonprofits can leverage this statement to ensure proper allocation of funds, maintain financial sustainability, and demonstrate accountability to donors and stakeholders. 4. Government Entity Cash Flow Statement: Government entities in Wake County, North Carolina, utilize this statement to monitor the inflow and outflow of cash in their operations. It encompasses taxes, intergovernmental grants, fees, fines, contracts, and various expenses related to public services, infrastructure development, salaries, benefits, and debt servicing. This statement assists governments in maintaining transparency, adhering to budgetary constraints, and ensuring efficient allocation of public funds. In summary, the Wake North Carolina Twelve-Month Cash Flow is an essential financial document that provides a comprehensive view of cash inflows and outflows for individuals, businesses, nonprofits, and government entities in Wake County, North Carolina. It assists in financial planning, decision-making, risk management, and maintaining a healthy financial position.Wake North Carolina Twelve-Month Cash Flow is a comprehensive financial document that outlines the inflows and outflows of cash for a specific period of twelve months in Wake County, North Carolina. This cash flow statement is crucial for individuals, businesses, and organizations in understanding their financial health and planning for the future. Keywords: Wake North Carolina, cash flow, twelve-month, financial document, inflows, outflows, cash, period, financial health, planning. The Wake North Carolina Twelve-Month Cash Flow helps individuals and businesses gain insights into their financial situation by providing a detailed breakdown of all sources of cash inflows and outflows over a twelve-month period. This document enables users to assess their ability to meet financial obligations, anticipate cash shortages or surpluses, plan investments, make strategic decisions, and mitigate financial risks. The types of Wake North Carolina Twelve-Month Cash Flow statements may vary depending on the specific needs and characteristics of the entity. Some common types include: 1. Personal Cash Flow Statement: This type of cash flow statement focuses on an individual's personal finances, including their sources of income (such as salary, investments, or rental income) and expenses (such as rent, groceries, transportation, or loan payments). It helps individuals gain a holistic view of their financial position and make informed decisions regarding savings, investment opportunities, debt management, and budgeting. 2. Business Cash Flow Statement: This statement concentrates on the cash inflows and outflows of a business operating in Wake County, North Carolina. It encompasses revenue from sales, loans, investments, interest, grants, and other sources, as well as expenses related to raw materials, payroll, rent, utilities, marketing, and loan repayments. By analyzing this statement, businesses can effectively manage cash flow, identify areas of improvement, forecast financial performance, and plan for expansion or investment opportunities. 3. Nonprofit Cash Flow Statement: Nonprofit organizations in Wake County, North Carolina, can use this type of cash flow statement to track and manage their financial resources. It provides insights into the cash inflows and outflows associated with donations, grants, fundraising events, program expenses, administrative costs, and other revenue sources. Nonprofits can leverage this statement to ensure proper allocation of funds, maintain financial sustainability, and demonstrate accountability to donors and stakeholders. 4. Government Entity Cash Flow Statement: Government entities in Wake County, North Carolina, utilize this statement to monitor the inflow and outflow of cash in their operations. It encompasses taxes, intergovernmental grants, fees, fines, contracts, and various expenses related to public services, infrastructure development, salaries, benefits, and debt servicing. This statement assists governments in maintaining transparency, adhering to budgetary constraints, and ensuring efficient allocation of public funds. In summary, the Wake North Carolina Twelve-Month Cash Flow is an essential financial document that provides a comprehensive view of cash inflows and outflows for individuals, businesses, nonprofits, and government entities in Wake County, North Carolina. It assists in financial planning, decision-making, risk management, and maintaining a healthy financial position.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.