A 401(k) is a type of retirement savings account in the United States, which takes its name from subsection 401(k) of the Internal Revenue Code (Title 26 of the United States Code). A contributor can begin to withdraw funds after reaching the age of 59 1/2 years. 401(k)s were first widely adopted as retirement plans for American workers, beginning in the 1980s. The 401(k) emerged as an alternative to the traditional retirement pension, which was paid by employers. Employer contributions with the 401(k) can vary, but in general the 401(k) had the effect of shifting the burden for retirement savings to workers themselves. In 2011, about 60% of American households nearing retirement age have 401(k)-type accounts .

Employers can help their employees save for retirement while reducing taxable income under this provision, and workers can choose to deposit part of their earnings into a 401(k) account and not pay income tax on it until the money is later withdrawn in retirement. Interest earned on money in a 401(k) account is never taxed before funds are withdrawn. Employers may choose to, and often do, match contributions that workers make. The 401(k) account is typically administered by the employer, while in the usual "participant-directed" plan, the employee may select from different kinds of investment options. Employees choose where their savings will be invested, usually, between a selection of mutual funds that emphasize stocks, bonds, money market investments, or some mix of the above. Many companies' 401(k) plans also offer the option to purchase the company's stock. The employee can generally re-allocate money among these investment choices at any time. In the less common trustee-directed 401(k) plans, the employer appoints trustees who decide how the plan's assets will be invested.

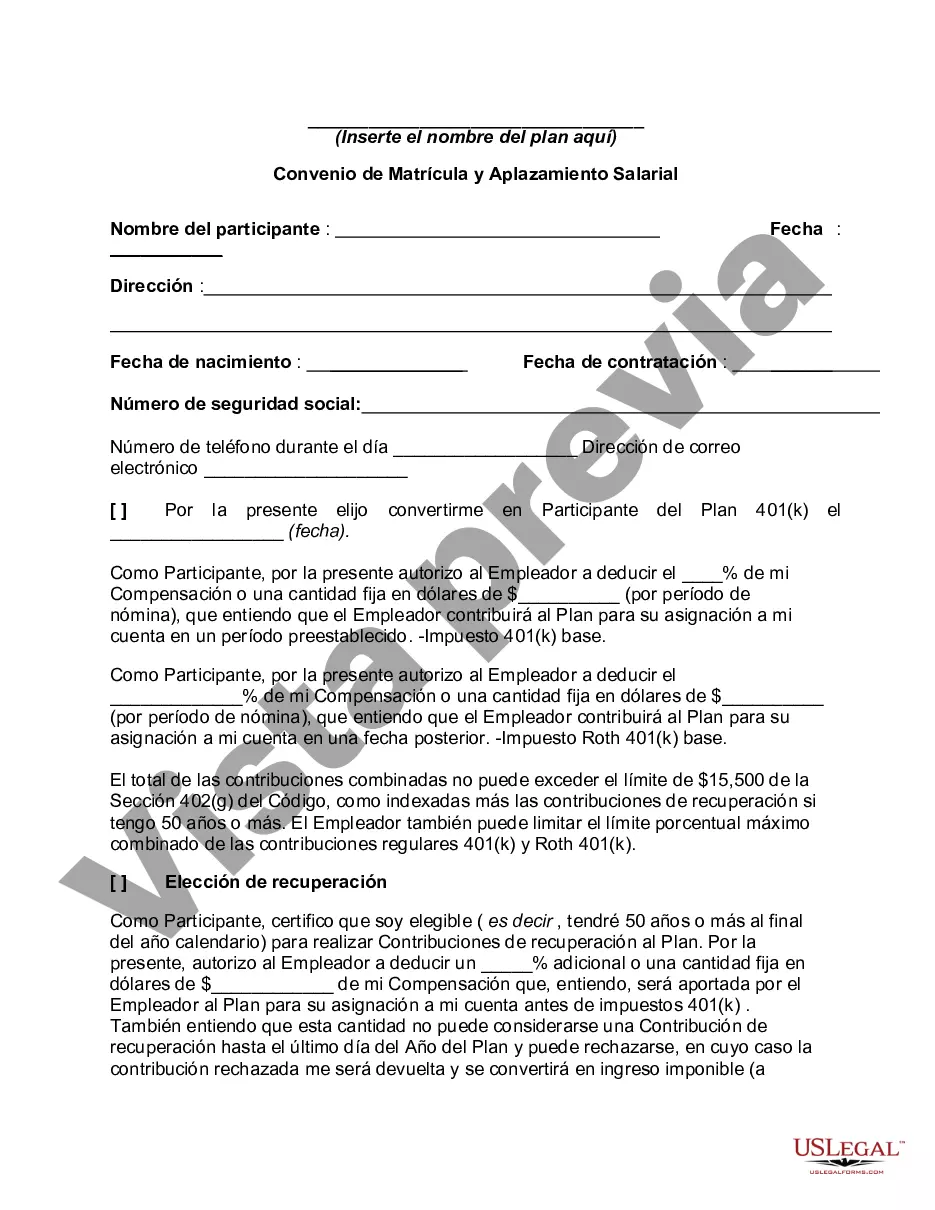

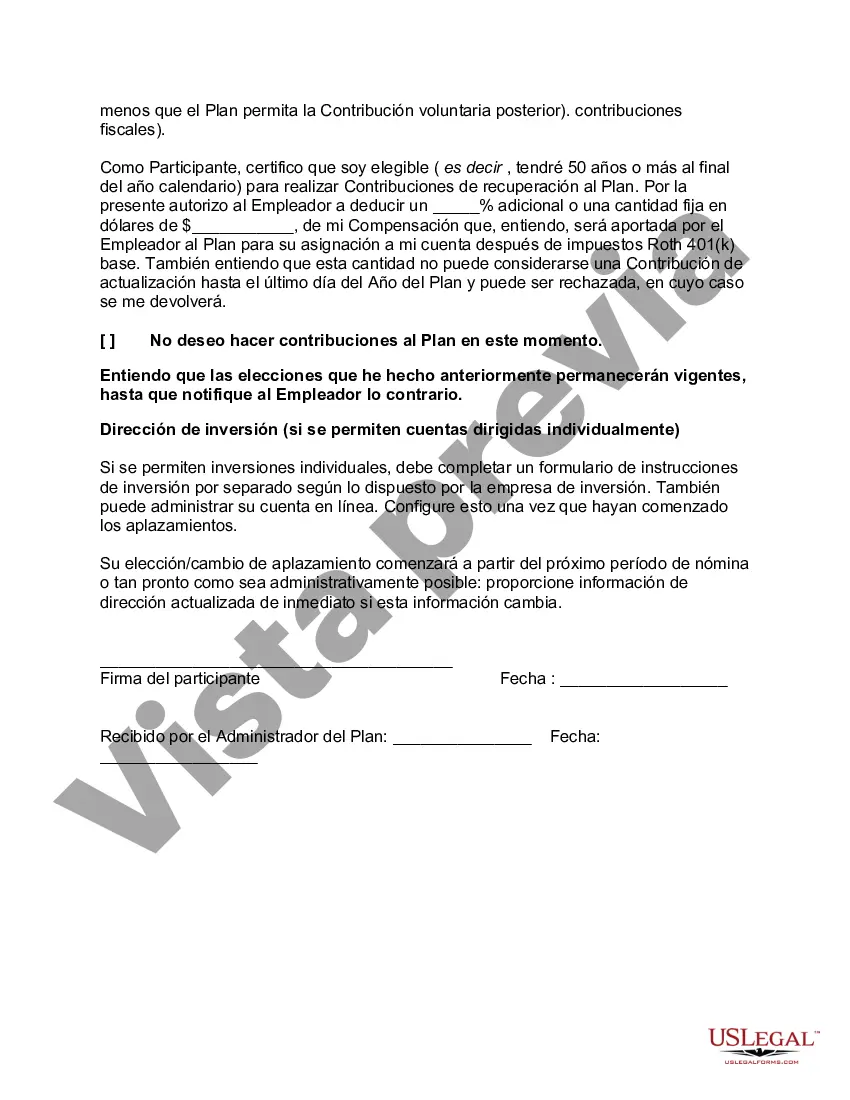

The Montgomery Maryland Enrollment and Salary Deferral Agreement is a legal document that outlines a specific arrangement between an employer and an employee in Montgomery, Maryland. This agreement allows employees to defer a portion of their salary and enroll in certain benefit programs offered by the employer. The purpose of the Montgomery Maryland Enrollment and Salary Deferral Agreement is to provide employees with the opportunity to contribute a portion of their salary towards various benefits, such as retirement savings plans and healthcare plans. This deferral arrangement allows employees to allocate a specific amount of their salary, up to a maximum limit, towards these benefit programs on a pre-tax basis. There are several types of Montgomery Maryland Enrollment and Salary Deferral Agreements, depending on the specific benefit programs offered by the employer. Here are some common types: 1. Retirement Savings Agreement: This agreement allows employees to defer a portion of their salary towards a retirement savings plan, such as a 401(k) or 403(b), provided by the employer. The deferred amount is invested in a tax-advantaged retirement account, helping employees save for their future. 2. Health Savings Agreement: This agreement enables employees to defer a portion of their salary towards a health savings account (HSA). Has are used to cover qualified medical expenses, and contributions made to an HSA are tax-deductible. 3. Flexible Spending Agreement: This agreement allows employees to set aside a portion of their salary to fund a flexible spending account (FSA). FSA's are used to pay for eligible healthcare expenses, such as deductibles, co-payments, and prescription medications. The contributions made to an FSA are typically tax-free. 4. Deferred Compensation Agreement: This type of agreement allows employees to defer a portion of their salary for a future period, typically after retirement. The deferred compensation is usually invested, and employees receive the payout at a later date, often in the form of regular payments. In conclusion, the Montgomery Maryland Enrollment and Salary Deferral Agreement is a significant document that enables employees in Montgomery, Maryland, to defer a portion of their salary towards various benefit programs provided by their employer. These agreements encompass retirement savings, health savings, flexible spending, and deferred compensation options, helping employees secure their financial well-being and plan for the future.The Montgomery Maryland Enrollment and Salary Deferral Agreement is a legal document that outlines a specific arrangement between an employer and an employee in Montgomery, Maryland. This agreement allows employees to defer a portion of their salary and enroll in certain benefit programs offered by the employer. The purpose of the Montgomery Maryland Enrollment and Salary Deferral Agreement is to provide employees with the opportunity to contribute a portion of their salary towards various benefits, such as retirement savings plans and healthcare plans. This deferral arrangement allows employees to allocate a specific amount of their salary, up to a maximum limit, towards these benefit programs on a pre-tax basis. There are several types of Montgomery Maryland Enrollment and Salary Deferral Agreements, depending on the specific benefit programs offered by the employer. Here are some common types: 1. Retirement Savings Agreement: This agreement allows employees to defer a portion of their salary towards a retirement savings plan, such as a 401(k) or 403(b), provided by the employer. The deferred amount is invested in a tax-advantaged retirement account, helping employees save for their future. 2. Health Savings Agreement: This agreement enables employees to defer a portion of their salary towards a health savings account (HSA). Has are used to cover qualified medical expenses, and contributions made to an HSA are tax-deductible. 3. Flexible Spending Agreement: This agreement allows employees to set aside a portion of their salary to fund a flexible spending account (FSA). FSA's are used to pay for eligible healthcare expenses, such as deductibles, co-payments, and prescription medications. The contributions made to an FSA are typically tax-free. 4. Deferred Compensation Agreement: This type of agreement allows employees to defer a portion of their salary for a future period, typically after retirement. The deferred compensation is usually invested, and employees receive the payout at a later date, often in the form of regular payments. In conclusion, the Montgomery Maryland Enrollment and Salary Deferral Agreement is a significant document that enables employees in Montgomery, Maryland, to defer a portion of their salary towards various benefit programs provided by their employer. These agreements encompass retirement savings, health savings, flexible spending, and deferred compensation options, helping employees secure their financial well-being and plan for the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.