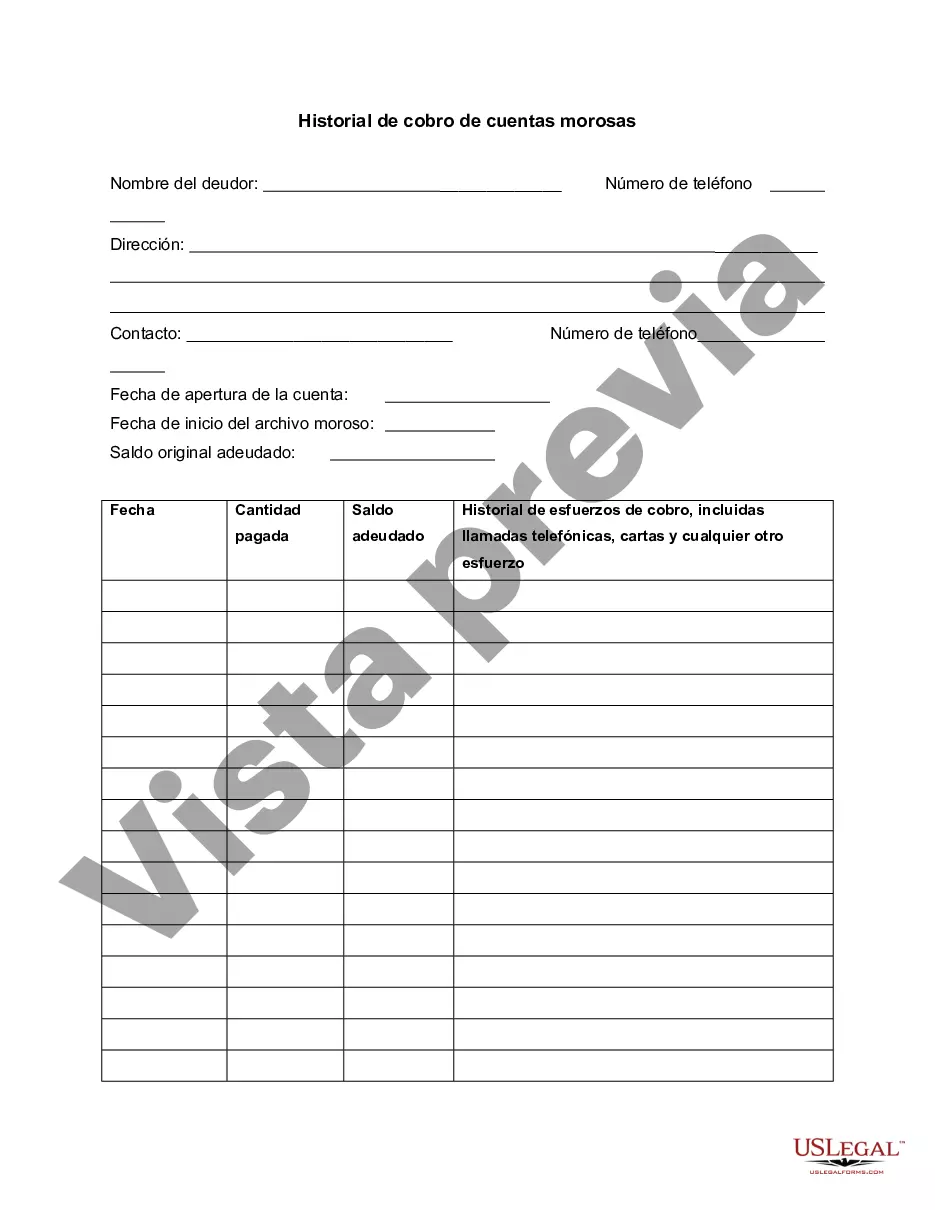

This is a form to track progress on a delinquent customer account and to record collection efforts.

Allegheny Pennsylvania Delinquent Account Collection History refers to the record of overdue payments and outstanding debts in Allegheny County, Pennsylvania. Delinquent accounts include unpaid bills, outstanding loans, past-due credit card balances, and other financial obligations that have not been settled within the specified time frame. The collection history includes information about the efforts made by creditors, collection agencies, or debt collectors to collect the delinquent payments. The Allegheny Pennsylvania Delinquent Account Collection History encompasses different types of delinquent accounts, such as: 1. Utility Bills: This category includes unpaid bills for services like electricity, water, gas, or sewage. If individuals fail to make timely payments towards their utility bills, they may be listed as delinquent accounts in the collection history. 2. Credit Cards: Delinquent credit card accounts refer to outstanding balances on credit cards that are not paid off within the stipulated due date. Failure to repay the minimum amount due or missing payments can result in delinquency, leading to negative marks on the collection history. 3. Loans: Various types of loans, such as personal loans, auto loans, student loans, or mortgages, can become delinquent if borrowers fail to adhere to the repayment schedules. Delinquent loan accounts impact credit scores, making it difficult to obtain future credit. 4. Medical Bills: Unpaid medical bills can also be included in the Allegheny Pennsylvania Delinquent Account Collection History. When patients do not pay their medical expenses on time, healthcare providers may report the delinquent accounts to collection agencies. 5. Taxes: Failure to pay property taxes, income taxes, or any other type of taxes within the specified time frame can lead to delinquency. Tax delinquencies can result in penalties and may be recorded in the collection history. It is important to note that the Allegheny Pennsylvania Delinquent Account Collection History is utilized by potential lenders, landlords, or employers to assess an individual's creditworthiness and financial responsibility. Negative marks on the collection history can make it challenging to secure loans, obtain rental housing, or gain employment. To mitigate the negative impact of delinquent accounts, individuals in Allegheny County, Pennsylvania should promptly address any overdue payments, negotiate payment plans if necessary, and work towards resolving outstanding debts.Allegheny Pennsylvania Delinquent Account Collection History refers to the record of overdue payments and outstanding debts in Allegheny County, Pennsylvania. Delinquent accounts include unpaid bills, outstanding loans, past-due credit card balances, and other financial obligations that have not been settled within the specified time frame. The collection history includes information about the efforts made by creditors, collection agencies, or debt collectors to collect the delinquent payments. The Allegheny Pennsylvania Delinquent Account Collection History encompasses different types of delinquent accounts, such as: 1. Utility Bills: This category includes unpaid bills for services like electricity, water, gas, or sewage. If individuals fail to make timely payments towards their utility bills, they may be listed as delinquent accounts in the collection history. 2. Credit Cards: Delinquent credit card accounts refer to outstanding balances on credit cards that are not paid off within the stipulated due date. Failure to repay the minimum amount due or missing payments can result in delinquency, leading to negative marks on the collection history. 3. Loans: Various types of loans, such as personal loans, auto loans, student loans, or mortgages, can become delinquent if borrowers fail to adhere to the repayment schedules. Delinquent loan accounts impact credit scores, making it difficult to obtain future credit. 4. Medical Bills: Unpaid medical bills can also be included in the Allegheny Pennsylvania Delinquent Account Collection History. When patients do not pay their medical expenses on time, healthcare providers may report the delinquent accounts to collection agencies. 5. Taxes: Failure to pay property taxes, income taxes, or any other type of taxes within the specified time frame can lead to delinquency. Tax delinquencies can result in penalties and may be recorded in the collection history. It is important to note that the Allegheny Pennsylvania Delinquent Account Collection History is utilized by potential lenders, landlords, or employers to assess an individual's creditworthiness and financial responsibility. Negative marks on the collection history can make it challenging to secure loans, obtain rental housing, or gain employment. To mitigate the negative impact of delinquent accounts, individuals in Allegheny County, Pennsylvania should promptly address any overdue payments, negotiate payment plans if necessary, and work towards resolving outstanding debts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.