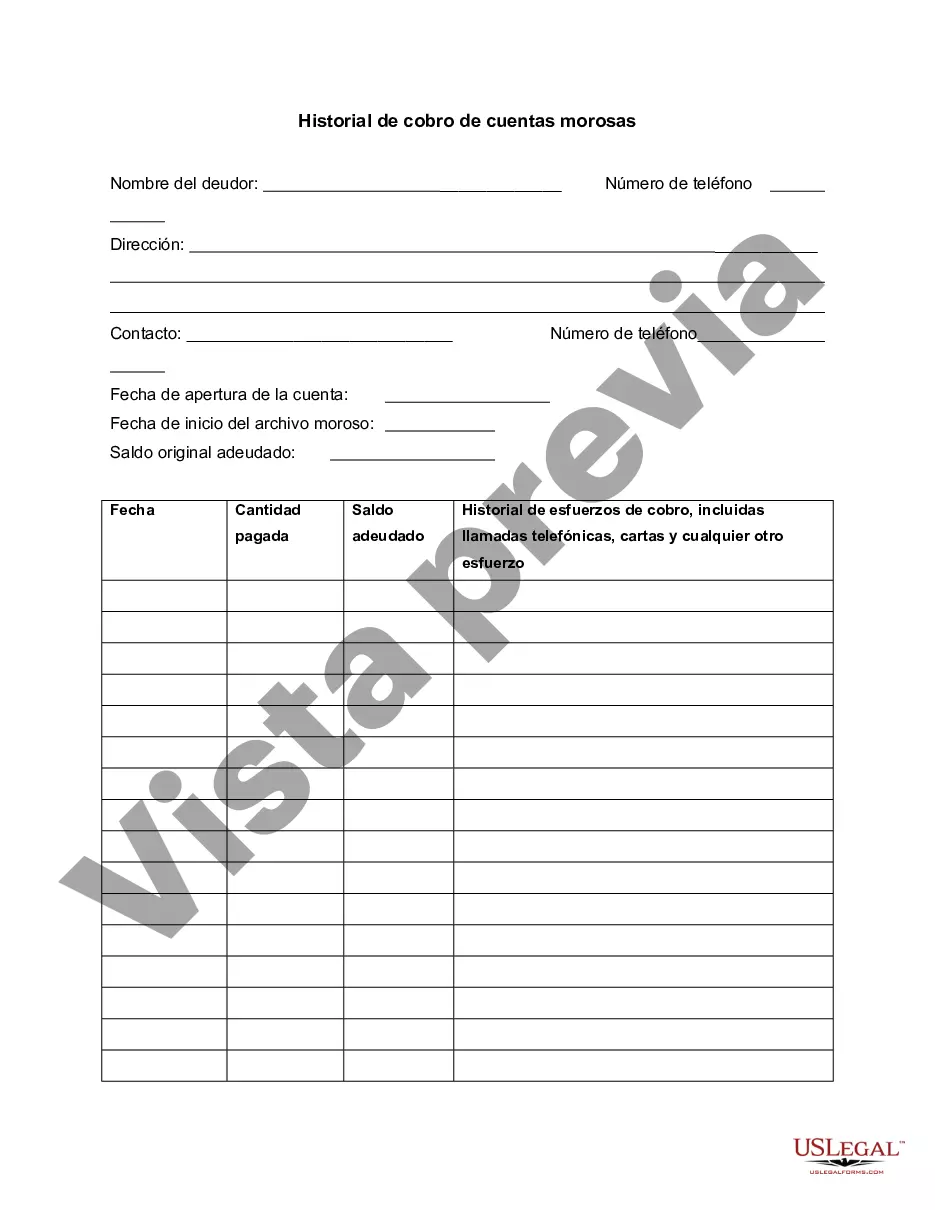

This is a form to track progress on a delinquent customer account and to record collection efforts.

Bexar Texas Delinquent Account Collection History is a record of past due accounts and their collection efforts within Bexar County, Texas. Delinquent accounts refer to outstanding debts owed by individuals or businesses that have not been paid within the specified timeframe. These unpaid debts can range from credit card bills, loans, medical bills, utility payments, or taxes, among others. The Bexar Texas Delinquent Account Collection History consists of various types, each encompassing specific contexts. Some different types of delinquent accounts in Bexar Texas include: 1. Credit Card Delinquency: Refers to credit card accounts that have not been paid on time, leading to a past due status. Collection agencies may be hired by credit card companies to recover the outstanding amounts. 2. Loan Delinquency: Encompasses various types of loans, such as personal loans, auto loans, student loans, or mortgages that have become overdue. Lenders or financial institutions generally initiate collection efforts to recover the outstanding loan amount. 3. Medical Bill Delinquency: Arises when individuals fail to pay medical bills within the specified timeframe. Healthcare providers or medical billing companies often engage in collection activities to recoup the unpaid amounts. 4. Utility Payment Delinquency: Occurs when individuals or businesses do not fulfill their obligations to pay utility bills, such as electricity, water, gas, or sewer services. Utility companies may employ collection methods to regain the unpaid dues. 5. Tax Delinquency: Pertains to unpaid taxes owed to local, state, or federal governments. Taxing authorities often pursue various collection actions, including wage garnishment, asset seizure, or placing liens on properties, to reclaim the outstanding tax amounts. Bexar Texas Delinquent Account Collection History is an essential tool for creditors, collection agencies, and financial institutions to assess an individual or business's creditworthiness and payment behavior. It provides valuable insights into a person's past record of handling financial obligations and unpaid debts.Bexar Texas Delinquent Account Collection History is a record of past due accounts and their collection efforts within Bexar County, Texas. Delinquent accounts refer to outstanding debts owed by individuals or businesses that have not been paid within the specified timeframe. These unpaid debts can range from credit card bills, loans, medical bills, utility payments, or taxes, among others. The Bexar Texas Delinquent Account Collection History consists of various types, each encompassing specific contexts. Some different types of delinquent accounts in Bexar Texas include: 1. Credit Card Delinquency: Refers to credit card accounts that have not been paid on time, leading to a past due status. Collection agencies may be hired by credit card companies to recover the outstanding amounts. 2. Loan Delinquency: Encompasses various types of loans, such as personal loans, auto loans, student loans, or mortgages that have become overdue. Lenders or financial institutions generally initiate collection efforts to recover the outstanding loan amount. 3. Medical Bill Delinquency: Arises when individuals fail to pay medical bills within the specified timeframe. Healthcare providers or medical billing companies often engage in collection activities to recoup the unpaid amounts. 4. Utility Payment Delinquency: Occurs when individuals or businesses do not fulfill their obligations to pay utility bills, such as electricity, water, gas, or sewer services. Utility companies may employ collection methods to regain the unpaid dues. 5. Tax Delinquency: Pertains to unpaid taxes owed to local, state, or federal governments. Taxing authorities often pursue various collection actions, including wage garnishment, asset seizure, or placing liens on properties, to reclaim the outstanding tax amounts. Bexar Texas Delinquent Account Collection History is an essential tool for creditors, collection agencies, and financial institutions to assess an individual or business's creditworthiness and payment behavior. It provides valuable insights into a person's past record of handling financial obligations and unpaid debts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.