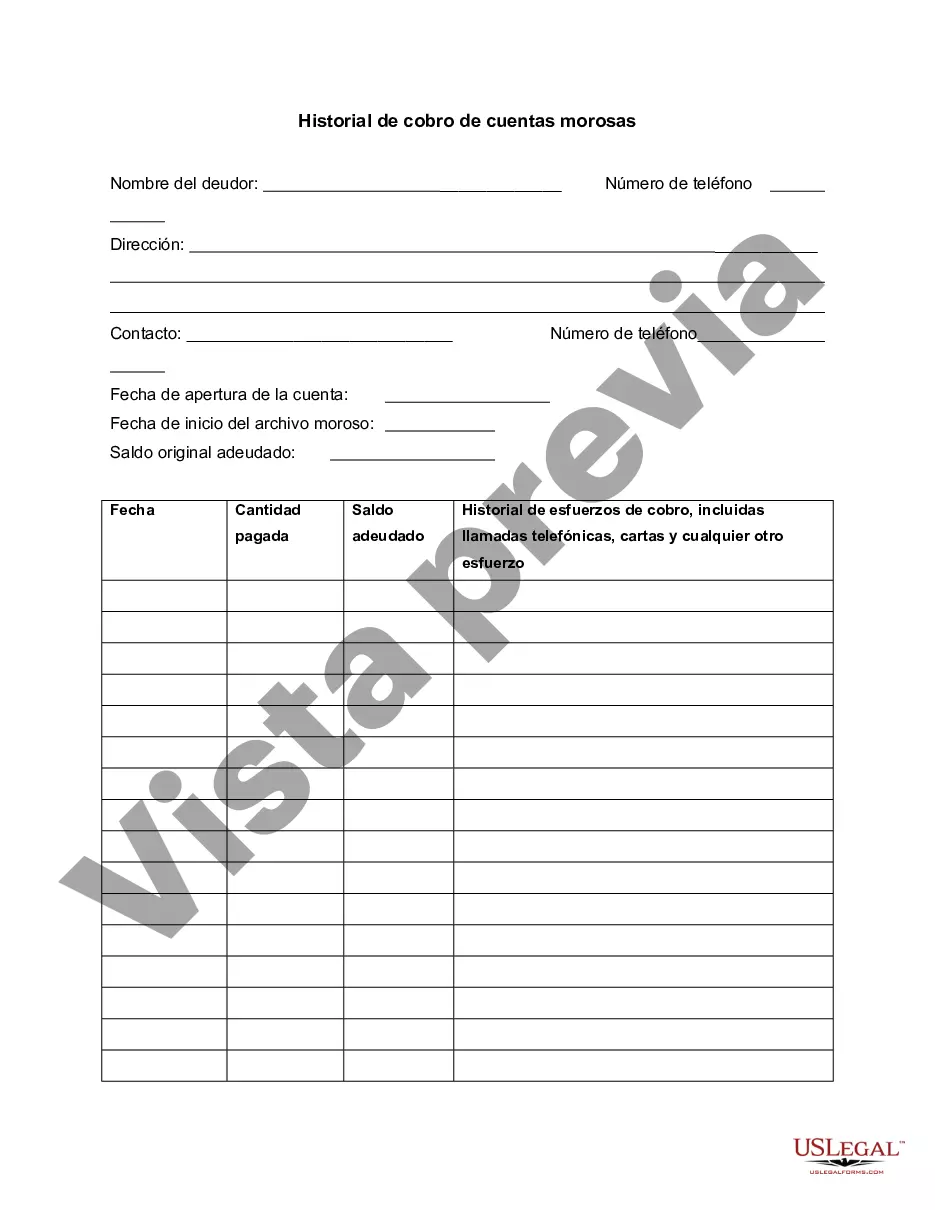

This is a form to track progress on a delinquent customer account and to record collection efforts.

Chicago, Illinois Delinquent Account Collection History In the bustling city of Chicago, Illinois, the Delinquent Account Collection History plays a crucial role in assessing an individual or organization's financial track record. It pertains to the records and documentation of unpaid or past-due accounts in the city of Chicago. Understanding the Chicago, Illinois Delinquent Account Collection History is vital for businesses, lenders, and even individuals to assess the creditworthiness and financial reliability of potential clients, customers, or partners before engaging in financial transactions. The Chicago, Illinois Delinquent Account Collection History encompasses various types of delinquent accounts, each with its own characteristics and implications. Here are a few distinct categories within this history: 1. Personal Delinquent Accounts: This category includes individual accounts held by residents of Chicago, Illinois, such as credit card bills, student loans, medical debt, personal loans, or mortgage payments that have defaulted or fallen behind schedule. The collection history of personal delinquent accounts aids in evaluating an individual's financial responsibility and may impact their ability to secure future loans or credit. 2. Commercial Delinquent Accounts: This segment focuses on delinquent accounts held by businesses or organizations within Chicago, Illinois. Examples could include unpaid invoices, defaulted business loans, outstanding vendor payments, or lease arrears. The history of commercial delinquent accounts provides crucial insights into a company's financial practices, as it reflects their promptness in meeting financial obligations. 3. Public Sector Delinquent Accounts: This division is related to delinquent accounts involving the public sector, including unpaid taxes, fines, or fees owed to governmental entities in Chicago, Illinois. It encompasses overdue property taxes, unpaid parking tickets, unpaid water bills, or late payment of other municipal services. Monitoring the collection history of public sector delinquent accounts is essential for regulatory agencies, as it contributes to revenue management and financial planning for local governments. 4. Legal Delinquent Accounts: This category refers specifically to accounts with a delinquent status that have reached the legal phase in Chicago, Illinois. These accounts may involve a pending lawsuit, a judgment obtained by a creditor through a court order, or accounts sent to collections agencies or law firms for legal action. The legal delinquent account collection history provides a comprehensive overview of the litigation process and highlights the crossroads between financial and legal aspects. Understanding the various facets of Chicago, Illinois Delinquent Account Collection History allows financial institutions, businesses, and individuals to make informed decisions about extending credit or entering into financial partnerships. It provides insights into an entity's financial reliability, helps mitigate risks associated with potential bad debts, and ensures sound financial practices within the Windy City.Chicago, Illinois Delinquent Account Collection History In the bustling city of Chicago, Illinois, the Delinquent Account Collection History plays a crucial role in assessing an individual or organization's financial track record. It pertains to the records and documentation of unpaid or past-due accounts in the city of Chicago. Understanding the Chicago, Illinois Delinquent Account Collection History is vital for businesses, lenders, and even individuals to assess the creditworthiness and financial reliability of potential clients, customers, or partners before engaging in financial transactions. The Chicago, Illinois Delinquent Account Collection History encompasses various types of delinquent accounts, each with its own characteristics and implications. Here are a few distinct categories within this history: 1. Personal Delinquent Accounts: This category includes individual accounts held by residents of Chicago, Illinois, such as credit card bills, student loans, medical debt, personal loans, or mortgage payments that have defaulted or fallen behind schedule. The collection history of personal delinquent accounts aids in evaluating an individual's financial responsibility and may impact their ability to secure future loans or credit. 2. Commercial Delinquent Accounts: This segment focuses on delinquent accounts held by businesses or organizations within Chicago, Illinois. Examples could include unpaid invoices, defaulted business loans, outstanding vendor payments, or lease arrears. The history of commercial delinquent accounts provides crucial insights into a company's financial practices, as it reflects their promptness in meeting financial obligations. 3. Public Sector Delinquent Accounts: This division is related to delinquent accounts involving the public sector, including unpaid taxes, fines, or fees owed to governmental entities in Chicago, Illinois. It encompasses overdue property taxes, unpaid parking tickets, unpaid water bills, or late payment of other municipal services. Monitoring the collection history of public sector delinquent accounts is essential for regulatory agencies, as it contributes to revenue management and financial planning for local governments. 4. Legal Delinquent Accounts: This category refers specifically to accounts with a delinquent status that have reached the legal phase in Chicago, Illinois. These accounts may involve a pending lawsuit, a judgment obtained by a creditor through a court order, or accounts sent to collections agencies or law firms for legal action. The legal delinquent account collection history provides a comprehensive overview of the litigation process and highlights the crossroads between financial and legal aspects. Understanding the various facets of Chicago, Illinois Delinquent Account Collection History allows financial institutions, businesses, and individuals to make informed decisions about extending credit or entering into financial partnerships. It provides insights into an entity's financial reliability, helps mitigate risks associated with potential bad debts, and ensures sound financial practices within the Windy City.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.