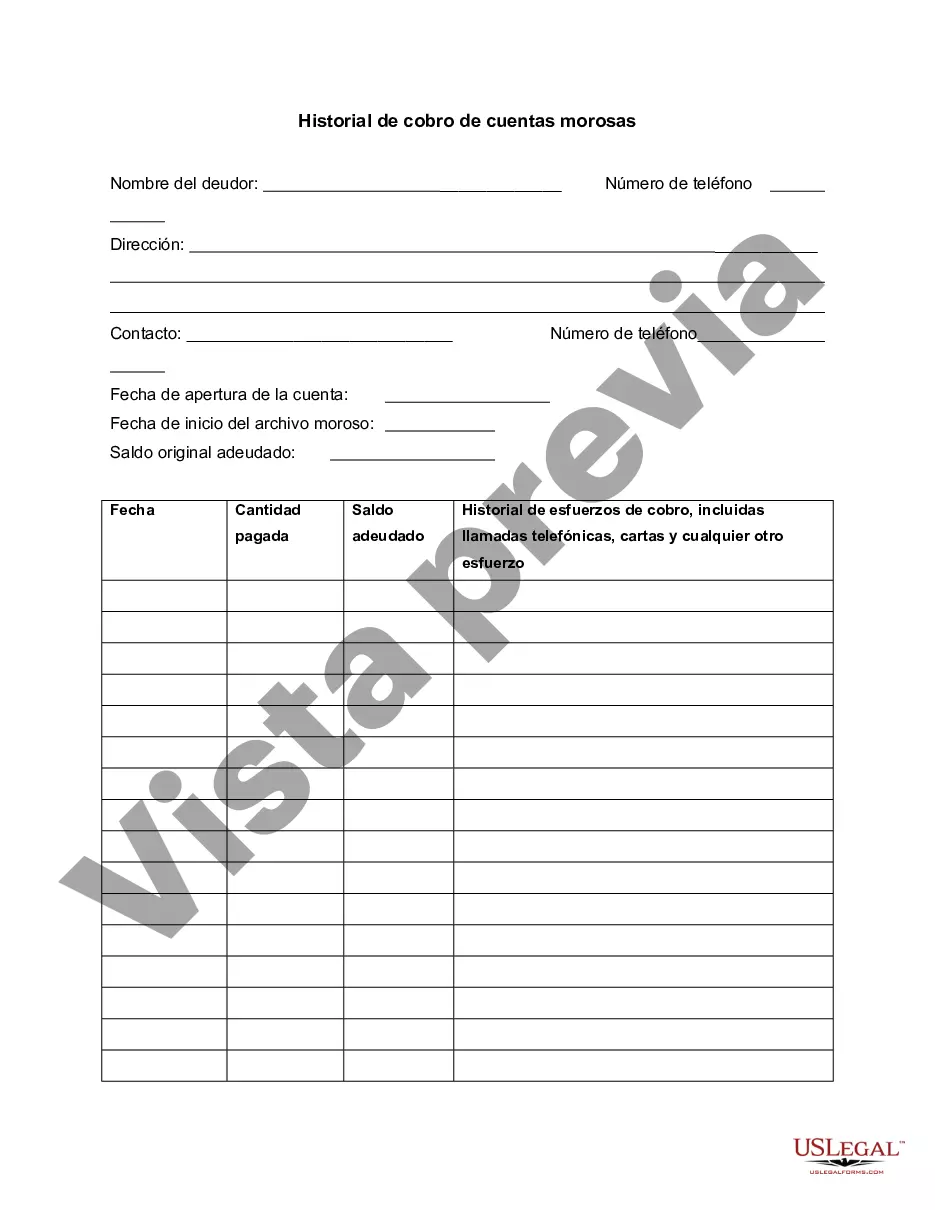

This is a form to track progress on a delinquent customer account and to record collection efforts.

Palm Beach Florida Delinquent Account Collection History is a comprehensive record of the unpaid debts that individuals or businesses have accumulated in Palm Beach County, Florida. Delinquent accounts refer to financial obligations, such as unpaid loans, overdue credit card bills, past-due utility bills, outstanding medical fees, and other unpaid debts. Collectors, debt collection agencies, or the original creditors attempt to recover these outstanding debts by various means, including phone calls, letters, and legal actions. The Palm Beach Florida Delinquent Account Collection History contains vital information about the nature of these debts, the date they became delinquent, the total amount owed, and any previous collection efforts made. There are different types of delinquent accounts that might be included in the Palm Beach Florida Delinquent Account Collection History. These can vary based on the type of creditor and the specific nature of the debt. Some common types include: 1. Credit Card Delinquencies: Unpaid balances and overdue payments on credit cards issued by various banks or financial institutions. 2. Mortgage Delinquencies: Outstanding payments or unpaid balances on mortgage loans for residential or commercial properties. 3. Auto Loan Delinquencies: Unpaid installments or overdue payments on auto loans for vehicles. 4. Student Loan Delinquencies: Unpaid student loan obligations, including federal and private loans, that have become delinquent. 5. Medical Debt Delinquencies: Unpaid medical bills, including hospital stays, surgeries, diagnostic tests, and other healthcare-related services. 6. Utility Bill Delinquencies: Overdue payments on household utilities such as electricity, gas, water, and waste management services. 7. Personal Loan Delinquencies: Unpaid personal loans or lines of credit acquired from financial institutions or individual lenders. This detailed Palm Beach Florida Delinquent Account Collection History is crucial for creditors, debt collectors, credit bureaus, and financial institutions as it helps to assess an individual's creditworthiness, determine potential risks, and make informed decisions regarding the extension of new credit. Additionally, it assists in analyzing the effectiveness of collection efforts and developing strategies for debt recovery.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.