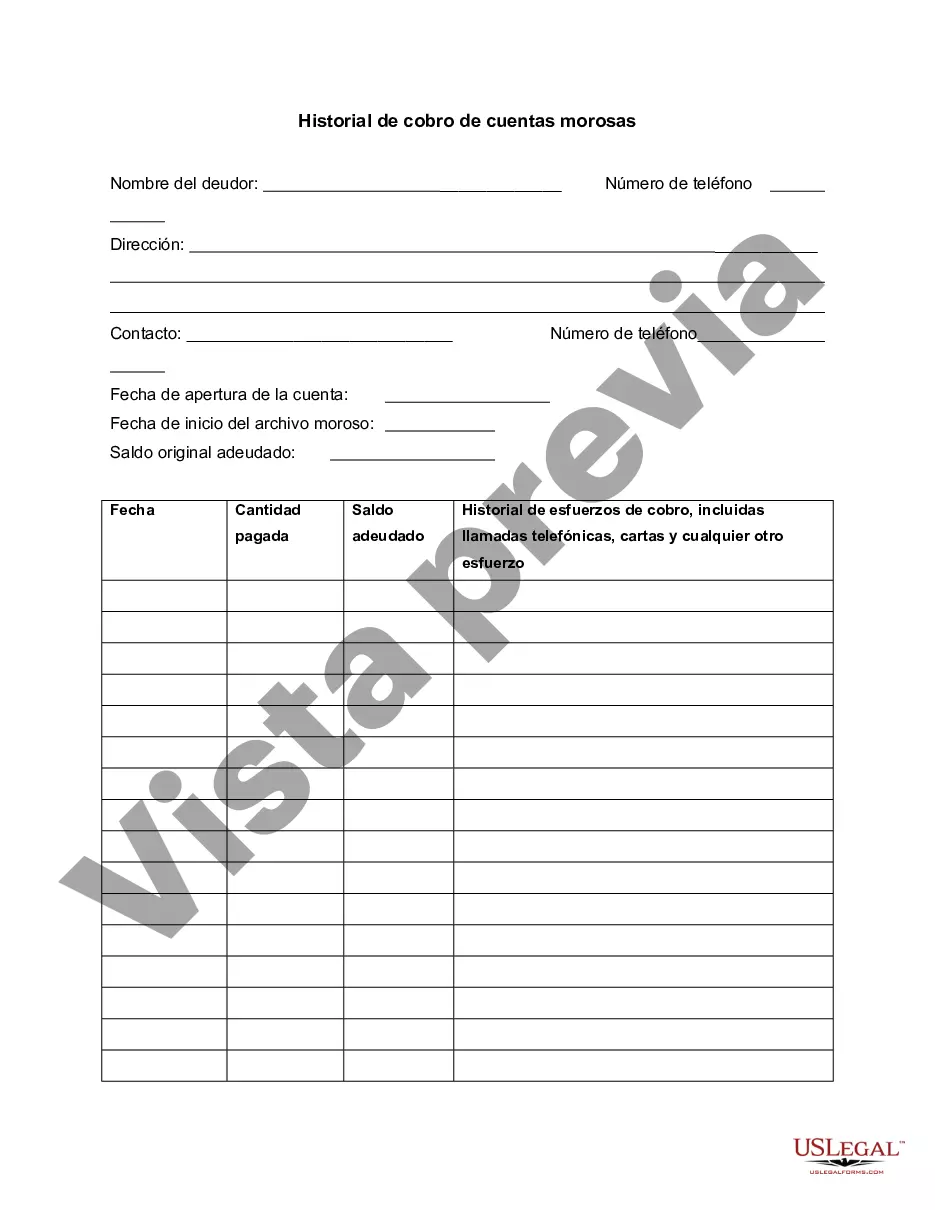

This is a form to track progress on a delinquent customer account and to record collection efforts.

San Diego California Delinquent Account Collection History refers to the record of accounts that have become delinquent in the city of San Diego, California, and the subsequent collection efforts made to recover the unpaid debts. Delinquent accounts are those that have not been repaid by the debtor within the agreed timeframe, leading to overdue payments. Delinquent account collection history in San Diego includes a variety of industries and sectors, such as credit card accounts, utility bill accounts, medical debt accounts, student loan accounts, and personal loan accounts, among others. Different types of San Diego California Delinquent Account Collection History may include: 1. Credit Card Delinquent Account Collection History: This includes records of credit card accounts that have become delinquent in San Diego. It involves efforts made by the credit card companies or debt collectors to collect the outstanding balance from the cardholders. 2. Utility Bill Delinquent Account Collection History: This refers to unpaid utility bills, such as electricity, water, gas, or phone bills, in San Diego. Utility companies or collection agencies may initiate collection procedures to recover the overdue amounts. 3. Medical Debt Delinquent Account Collection History: Medical debt accounts that have not been paid by patients within the specified timeframe fall under this category. Hospitals, healthcare providers, or debt collection agencies may pursue collection actions to retrieve the outstanding amounts. 4. Student Loan Delinquent Account Collection History: This entails the delinquent accounts of San Diego residents who have failed to repay their student loans. Lenders, educational institutions, or loan servicing agencies may employ collection strategies to recover the unpaid balances. 5. Personal Loan Delinquent Account Collection History: This involves delinquent accounts related to personal loans acquired by individuals in San Diego. Lenders or collection agencies may undertake various collection methods to retrieve the overdue amounts. In the San Diego California Delinquent Account Collection History, collection efforts can include sending reminders, debt collection calls or letters, negotiating repayment plans, reporting delinquencies to credit bureaus, and even initiating legal action if necessary. It is crucial for both creditors and debtors to understand the implications of delinquent account collection history in San Diego, as it can significantly affect credit scores, financial stability, and future borrowing opportunities. To avoid being part of this history, individuals and businesses are encouraged to make timely payments and communicate with creditors or collection agencies to resolve any financial difficulties promptly.San Diego California Delinquent Account Collection History refers to the record of accounts that have become delinquent in the city of San Diego, California, and the subsequent collection efforts made to recover the unpaid debts. Delinquent accounts are those that have not been repaid by the debtor within the agreed timeframe, leading to overdue payments. Delinquent account collection history in San Diego includes a variety of industries and sectors, such as credit card accounts, utility bill accounts, medical debt accounts, student loan accounts, and personal loan accounts, among others. Different types of San Diego California Delinquent Account Collection History may include: 1. Credit Card Delinquent Account Collection History: This includes records of credit card accounts that have become delinquent in San Diego. It involves efforts made by the credit card companies or debt collectors to collect the outstanding balance from the cardholders. 2. Utility Bill Delinquent Account Collection History: This refers to unpaid utility bills, such as electricity, water, gas, or phone bills, in San Diego. Utility companies or collection agencies may initiate collection procedures to recover the overdue amounts. 3. Medical Debt Delinquent Account Collection History: Medical debt accounts that have not been paid by patients within the specified timeframe fall under this category. Hospitals, healthcare providers, or debt collection agencies may pursue collection actions to retrieve the outstanding amounts. 4. Student Loan Delinquent Account Collection History: This entails the delinquent accounts of San Diego residents who have failed to repay their student loans. Lenders, educational institutions, or loan servicing agencies may employ collection strategies to recover the unpaid balances. 5. Personal Loan Delinquent Account Collection History: This involves delinquent accounts related to personal loans acquired by individuals in San Diego. Lenders or collection agencies may undertake various collection methods to retrieve the overdue amounts. In the San Diego California Delinquent Account Collection History, collection efforts can include sending reminders, debt collection calls or letters, negotiating repayment plans, reporting delinquencies to credit bureaus, and even initiating legal action if necessary. It is crucial for both creditors and debtors to understand the implications of delinquent account collection history in San Diego, as it can significantly affect credit scores, financial stability, and future borrowing opportunities. To avoid being part of this history, individuals and businesses are encouraged to make timely payments and communicate with creditors or collection agencies to resolve any financial difficulties promptly.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.