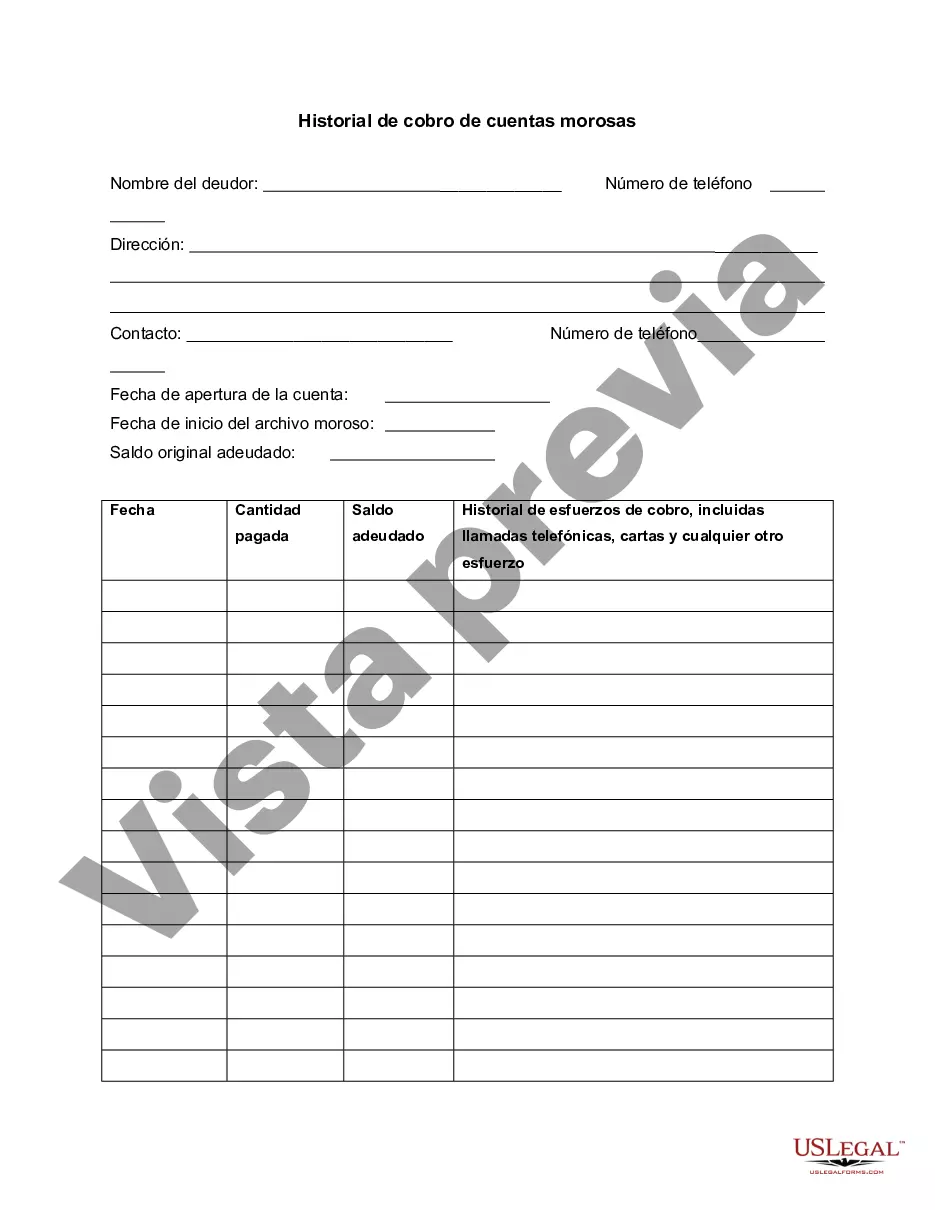

This is a form to track progress on a delinquent customer account and to record collection efforts.

Santa Clara County, located in California, maintains a comprehensive record of delinquent account collection history. This history pertains to individuals or entities who have outstanding debts or unpaid financial obligations within the county's jurisdiction. The collection process involves several stages, and understanding the various types of delinquent account collection history in Santa Clara California is crucial. 1. Property Taxes: One type of delinquent account collection history in Santa Clara California is related to unpaid property taxes. Property owners who fail to pay their property taxes on time may have a delinquent account associated with their property. The county initiates collection procedures to recover these outstanding taxes. 2. Fines and Penalties: Another category includes unpaid fines and penalties, such as traffic tickets or parking violations. Individuals who neglect to settle these financial obligations within the specified timeframe may face collection action by the relevant authorities. 3. Court-Ordered Debts: Delinquent account collection history also encompasses court-ordered debts resulting from legal proceedings. This may include outstanding restitution payments, child support arrears, or other court-ordered financial obligations. 4. County Services: Individuals or businesses with overdue payments for county services, such as water bills, sewage charges, or licensing fees, may also have a delinquent account collection history. Failure to clear these outstanding balances can result in further collection efforts. 5. Business Taxes: Santa Clara County also tracks delinquent accounts related to unpaid business taxes. These include delinquent accounts associated with business license taxes, sales and use taxes, and other taxes owed by local businesses operating within the county. All these types of delinquent accounts in Santa Clara California undergo a well-defined collection process. Initially, the county authorities send notices and reminders to the account holders, urging them to make prompt payments. If these reminders go unanswered, the county may employ phone calls, emails, or certified mail to elicit response and encourage resolution. Persistent failure to address delinquent accounts may lead to more aggressive collection methods. This includes engaging collection agencies or pursuing legal action, such as filing liens, garnishing wages, or placing levies on assets to satisfy the outstanding debts. Therefore, individuals or entities in Santa Clara California with delinquent account collection history should take immediate action to rectify their financial obligations. Prompt settlement of outstanding debts can prevent further consequences and potential damage to an individual's credit history. It is advisable to contact the relevant county departments or consult legal professionals for guidance on resolving delinquent accounts in Santa Clara California effectively.Santa Clara County, located in California, maintains a comprehensive record of delinquent account collection history. This history pertains to individuals or entities who have outstanding debts or unpaid financial obligations within the county's jurisdiction. The collection process involves several stages, and understanding the various types of delinquent account collection history in Santa Clara California is crucial. 1. Property Taxes: One type of delinquent account collection history in Santa Clara California is related to unpaid property taxes. Property owners who fail to pay their property taxes on time may have a delinquent account associated with their property. The county initiates collection procedures to recover these outstanding taxes. 2. Fines and Penalties: Another category includes unpaid fines and penalties, such as traffic tickets or parking violations. Individuals who neglect to settle these financial obligations within the specified timeframe may face collection action by the relevant authorities. 3. Court-Ordered Debts: Delinquent account collection history also encompasses court-ordered debts resulting from legal proceedings. This may include outstanding restitution payments, child support arrears, or other court-ordered financial obligations. 4. County Services: Individuals or businesses with overdue payments for county services, such as water bills, sewage charges, or licensing fees, may also have a delinquent account collection history. Failure to clear these outstanding balances can result in further collection efforts. 5. Business Taxes: Santa Clara County also tracks delinquent accounts related to unpaid business taxes. These include delinquent accounts associated with business license taxes, sales and use taxes, and other taxes owed by local businesses operating within the county. All these types of delinquent accounts in Santa Clara California undergo a well-defined collection process. Initially, the county authorities send notices and reminders to the account holders, urging them to make prompt payments. If these reminders go unanswered, the county may employ phone calls, emails, or certified mail to elicit response and encourage resolution. Persistent failure to address delinquent accounts may lead to more aggressive collection methods. This includes engaging collection agencies or pursuing legal action, such as filing liens, garnishing wages, or placing levies on assets to satisfy the outstanding debts. Therefore, individuals or entities in Santa Clara California with delinquent account collection history should take immediate action to rectify their financial obligations. Prompt settlement of outstanding debts can prevent further consequences and potential damage to an individual's credit history. It is advisable to contact the relevant county departments or consult legal professionals for guidance on resolving delinquent accounts in Santa Clara California effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.