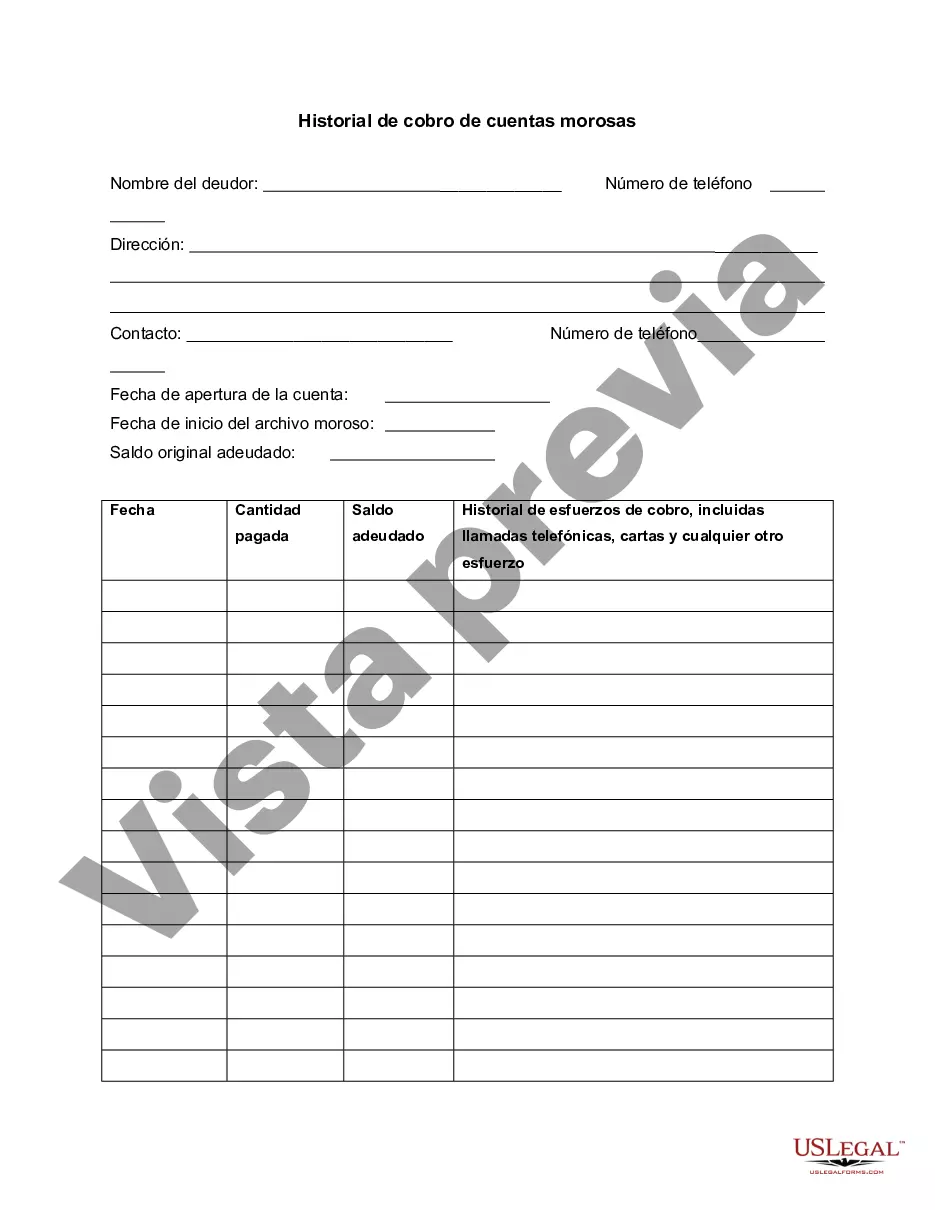

This is a form to track progress on a delinquent customer account and to record collection efforts.

Wake North Carolina Delinquent Account Collection History refers to the records and information regarding past due accounts in Wake County, North Carolina. Delinquent accounts pertain to those that have not been paid within the agreed-upon timeframe, resulting in arrears, outstanding balances, or unpaid debts. Understanding the delinquent account collection history helps individuals, businesses, and collectors to effectively manage and recover unpaid debts in Wake County. The Wake North Carolina Delinquent Account Collection History encompasses various types of delinquent accounts, including but not limited to: 1. Credit Card Delinquencies: This pertains to overdue credit card payments, where individuals or businesses have failed to make required payments on their credit card bills within the stipulated due date. 2. Loan Delinquencies: This category involves delinquent payments related to different types of loans, such as personal loans, student loans, auto loans, or mortgage loans. It indicates that borrowers in Wake County have not met their loan obligations, resulting in unpaid installments or defaults. 3. Utility Bill Delinquencies: These refer to outstanding payments related to utility services, such as electricity, water, gas, or internet bills. If individuals fail to make timely payments, their accounts become delinquent, and the collection history tracks such instances. 4. Medical Bill Delinquencies: This category encompasses unpaid medical bills, including fees for doctor visits, hospital stays, surgeries, or medications. When patients neglect to settle their medical debts, it results in delinquency, and the collection history records such occurrences. 5. Tax Delinquencies: This involves unpaid taxes, including federal, state, or local taxes, which individuals or entities owe to the government. Failure to remit taxes within the designated period leads to tax delinquency, and such cases are included in the collection history. 6. Rent Delinquencies: This type of delinquency relates to unpaid rent payments by tenants to landlords or property management companies. When renters fail to fulfil their rent obligations, it results in delinquent accounts recorded in the collection history. By maintaining detailed records of delinquent account collection history, Wake County authorities, debt collectors, and creditors can initiate appropriate actions to recover outstanding debts. These actions may include debt collection agencies contacting debtors, pursuing legal proceedings, or negotiating repayment plans to resolve delinquencies. It is essential for debtors to be aware of their delinquent account collection history to avoid potential negative consequences, such as damaged credit scores, legal actions, or difficulties in securing future credit or loans.Wake North Carolina Delinquent Account Collection History refers to the records and information regarding past due accounts in Wake County, North Carolina. Delinquent accounts pertain to those that have not been paid within the agreed-upon timeframe, resulting in arrears, outstanding balances, or unpaid debts. Understanding the delinquent account collection history helps individuals, businesses, and collectors to effectively manage and recover unpaid debts in Wake County. The Wake North Carolina Delinquent Account Collection History encompasses various types of delinquent accounts, including but not limited to: 1. Credit Card Delinquencies: This pertains to overdue credit card payments, where individuals or businesses have failed to make required payments on their credit card bills within the stipulated due date. 2. Loan Delinquencies: This category involves delinquent payments related to different types of loans, such as personal loans, student loans, auto loans, or mortgage loans. It indicates that borrowers in Wake County have not met their loan obligations, resulting in unpaid installments or defaults. 3. Utility Bill Delinquencies: These refer to outstanding payments related to utility services, such as electricity, water, gas, or internet bills. If individuals fail to make timely payments, their accounts become delinquent, and the collection history tracks such instances. 4. Medical Bill Delinquencies: This category encompasses unpaid medical bills, including fees for doctor visits, hospital stays, surgeries, or medications. When patients neglect to settle their medical debts, it results in delinquency, and the collection history records such occurrences. 5. Tax Delinquencies: This involves unpaid taxes, including federal, state, or local taxes, which individuals or entities owe to the government. Failure to remit taxes within the designated period leads to tax delinquency, and such cases are included in the collection history. 6. Rent Delinquencies: This type of delinquency relates to unpaid rent payments by tenants to landlords or property management companies. When renters fail to fulfil their rent obligations, it results in delinquent accounts recorded in the collection history. By maintaining detailed records of delinquent account collection history, Wake County authorities, debt collectors, and creditors can initiate appropriate actions to recover outstanding debts. These actions may include debt collection agencies contacting debtors, pursuing legal proceedings, or negotiating repayment plans to resolve delinquencies. It is essential for debtors to be aware of their delinquent account collection history to avoid potential negative consequences, such as damaged credit scores, legal actions, or difficulties in securing future credit or loans.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.