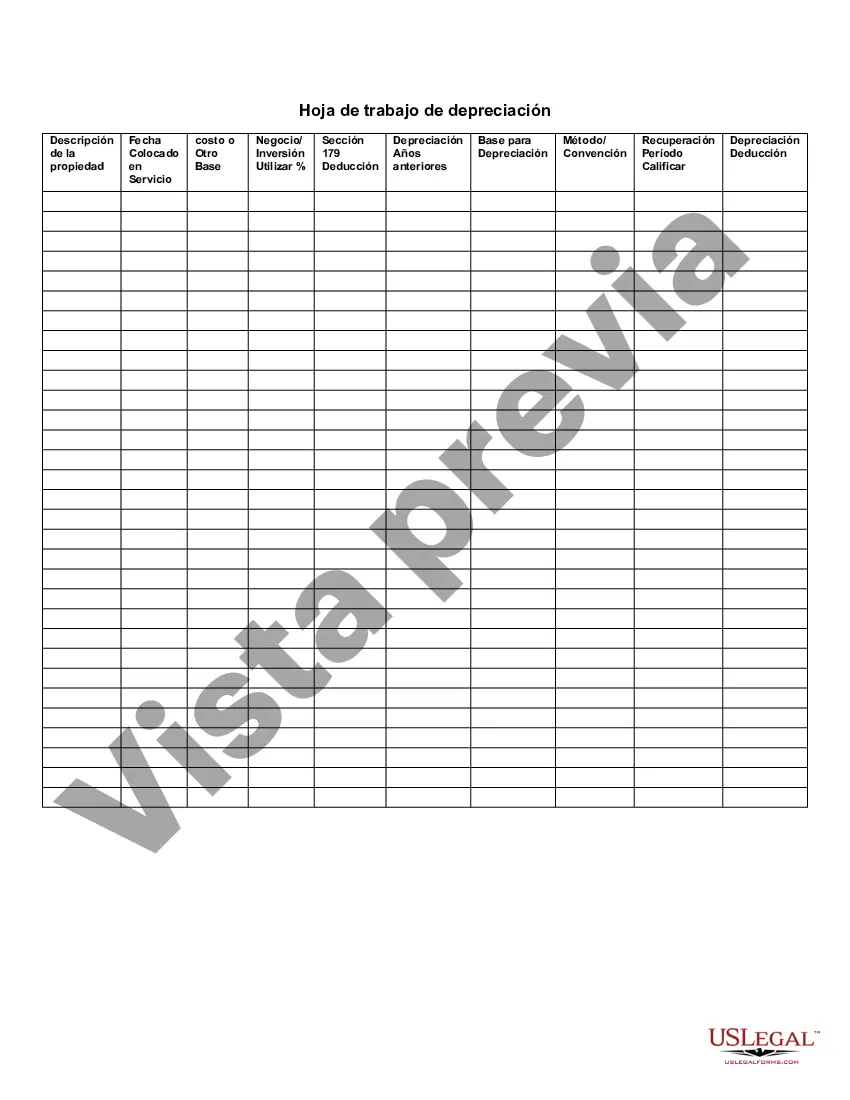

This Depreciation Worksheet is a template used by companies for creating a worksheet to evaluate depreciation expenses. The Depreciation Worksheet organizes and outlines a company's depreciation expenses and can be customized for a company's specific usage.

Miami-Dade Florida Depreciation Worksheet is an essential tool used for calculating and recording depreciation expenses for tangible assets owned by businesses or individuals in Miami-Dade County, Florida. It helps in accurately assessing the decrease in an asset's value over time due to wear and tear, obsolescence, or other factors. Utilizing this worksheet is vital for financial planning, tax reporting, and maintaining accurate asset records. The Miami-Dade Florida Depreciation Worksheet allows users to input important asset details such as the asset's original cost, estimated useful life, salvage value, and method of depreciation. There are various methods of calculating depreciation, including straight-line, declining balance, units of production, and sum-of-years' digits, among others. This worksheet allows flexibility in choosing the most appropriate method to determine the asset's depreciation expense. Furthermore, the Miami-Dade Florida Depreciation Worksheet helps to allocate and distribute depreciation expenses over the asset's useful life. This allocation is crucial for accurately determining the yearly financial impact and reduces the burden of a significant expense in a particular year. By utilizing this worksheet, businesses can plan their cash flows and budgetary needs more efficiently. In Miami-Dade County, several types of depreciation worksheets may be used depending on the specific requirements and assets being depreciated. Some specific types include: 1. Building Depreciation Worksheet: Used for calculating depreciation expenses related to buildings or other structures owned by businesses or individuals. 2. Vehicle Depreciation Worksheet: Helps track and calculate depreciation expenses for vehicles used for business purposes, including cars, trucks, and other motorized assets. 3. Equipment Depreciation Worksheet: Utilized for determining depreciation expenses associated with various equipment used in business operations, such as machinery, computers, furniture, or fixtures. 4. Land Improvements Depreciation Worksheet: This worksheet is used to track depreciation related to enhancements made to land, such as driveways, landscaping, parking lots, or fences. 5. Intangible Asset Depreciation Worksheet: Used for tracking and calculating depreciation expenses for intangible assets like patents, copyrights, trademarks, or software. The Miami-Dade Florida Depreciation Worksheet ensures accurate and compliant depreciation reporting, assisting businesses and individuals in correctly reflecting the decrease in asset value over time. It helps to optimize financial planning, maintain comprehensive asset records, and fulfill tax obligations. Using the appropriate depreciation worksheet is essential for businesses in Miami-Dade County to effectively manage their assets and make informed financial decisions.Miami-Dade Florida Depreciation Worksheet is an essential tool used for calculating and recording depreciation expenses for tangible assets owned by businesses or individuals in Miami-Dade County, Florida. It helps in accurately assessing the decrease in an asset's value over time due to wear and tear, obsolescence, or other factors. Utilizing this worksheet is vital for financial planning, tax reporting, and maintaining accurate asset records. The Miami-Dade Florida Depreciation Worksheet allows users to input important asset details such as the asset's original cost, estimated useful life, salvage value, and method of depreciation. There are various methods of calculating depreciation, including straight-line, declining balance, units of production, and sum-of-years' digits, among others. This worksheet allows flexibility in choosing the most appropriate method to determine the asset's depreciation expense. Furthermore, the Miami-Dade Florida Depreciation Worksheet helps to allocate and distribute depreciation expenses over the asset's useful life. This allocation is crucial for accurately determining the yearly financial impact and reduces the burden of a significant expense in a particular year. By utilizing this worksheet, businesses can plan their cash flows and budgetary needs more efficiently. In Miami-Dade County, several types of depreciation worksheets may be used depending on the specific requirements and assets being depreciated. Some specific types include: 1. Building Depreciation Worksheet: Used for calculating depreciation expenses related to buildings or other structures owned by businesses or individuals. 2. Vehicle Depreciation Worksheet: Helps track and calculate depreciation expenses for vehicles used for business purposes, including cars, trucks, and other motorized assets. 3. Equipment Depreciation Worksheet: Utilized for determining depreciation expenses associated with various equipment used in business operations, such as machinery, computers, furniture, or fixtures. 4. Land Improvements Depreciation Worksheet: This worksheet is used to track depreciation related to enhancements made to land, such as driveways, landscaping, parking lots, or fences. 5. Intangible Asset Depreciation Worksheet: Used for tracking and calculating depreciation expenses for intangible assets like patents, copyrights, trademarks, or software. The Miami-Dade Florida Depreciation Worksheet ensures accurate and compliant depreciation reporting, assisting businesses and individuals in correctly reflecting the decrease in asset value over time. It helps to optimize financial planning, maintain comprehensive asset records, and fulfill tax obligations. Using the appropriate depreciation worksheet is essential for businesses in Miami-Dade County to effectively manage their assets and make informed financial decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.