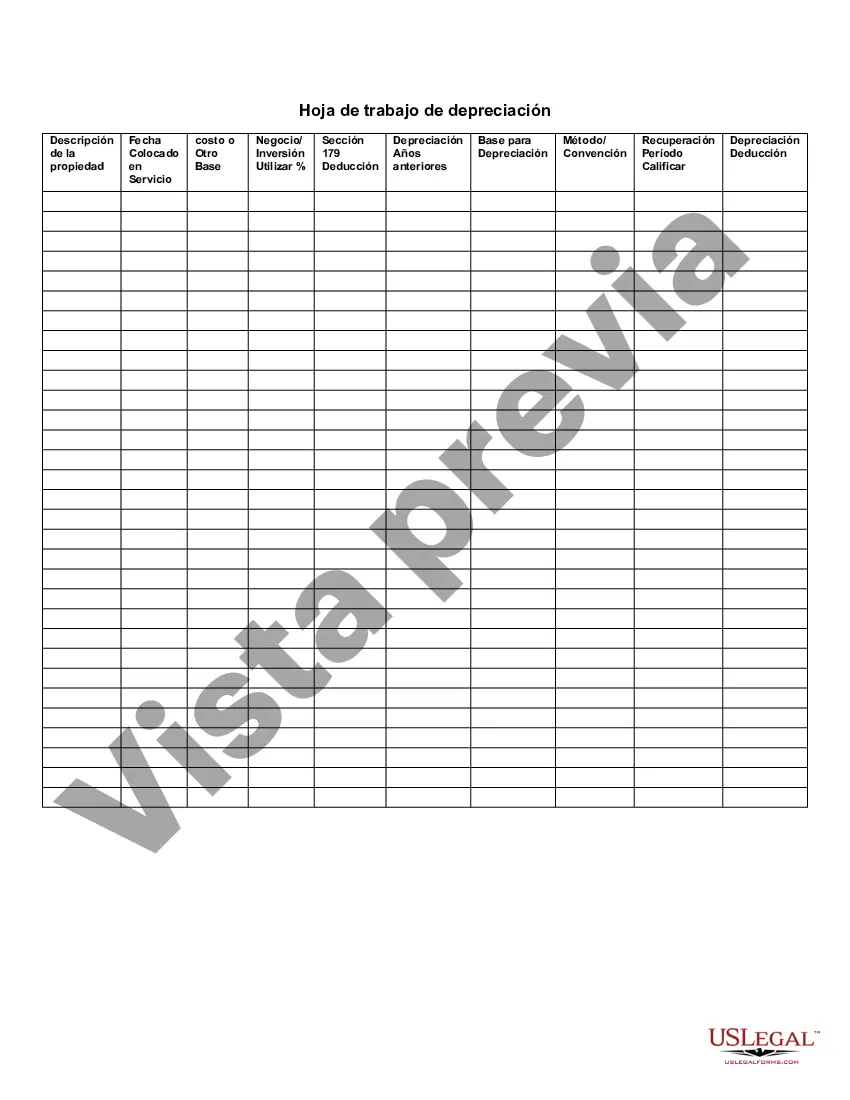

This Depreciation Worksheet is a template used by companies for creating a worksheet to evaluate depreciation expenses. The Depreciation Worksheet organizes and outlines a company's depreciation expenses and can be customized for a company's specific usage.

Philadelphia Pennsylvania Depreciation Worksheet is a comprehensive tool used for calculating and recording depreciation expenses related to assets located in Philadelphia, Pennsylvania. This worksheet allows individuals, businesses, and organizations to accurately determine the decrease in value of their assets over time, in accordance with the specific regulations and guidelines in Philadelphia, Pennsylvania. The Philadelphia Pennsylvania Depreciation Worksheet takes into consideration various factors such as the useful life of the asset, salvage value, and the depreciation method used. This helps users determine the annual depreciation expense and accurately track the asset's current value for reporting and tax purposes. Different types of Philadelphia Pennsylvania Depreciation Worksheets may include: 1. Straight-line Depreciation Worksheet: This type of worksheet calculates depreciation expenses by allocating an equal amount over the useful life of the asset. It is considered the simplest and most commonly used method. 2. Declining Balance Depreciation Worksheet: This type of worksheet uses a depreciation rate that is higher in the earlier years and gradually decreases over time. This method is often used for assets that experience more significant wear and tear in the initial years. 3. MARS Depreciation Worksheet: The Modified Accelerated Cost Recovery System (MARS) is a tax method prescribed by the IRS. This worksheet helps individuals and businesses in Philadelphia, Pennsylvania, to calculate depreciation expenses based on the MARS depreciation tables. 4. Section 179 Expense Deduction Worksheet: This worksheet specifically pertains to the Section 179 tax code provision, which allows businesses to deduct the full purchase price of qualifying assets in the year of acquisition. The worksheet assists in determining the depreciation expense for assets qualifying under Section 179 in Philadelphia, Pennsylvania. 5. Bonus Depreciation Worksheet: Bonus depreciation is an additional depreciation allowance that allows businesses to deduct a percentage of the qualified asset's cost in the first year of use. This worksheet helps calculate the bonus depreciation expense for assets located in Philadelphia, Pennsylvania. To accurately utilize the Philadelphia Pennsylvania Depreciation Worksheet, it is essential to understand the specific depreciation regulations and guidelines laid out by the city. These guidelines may differ from federal regulations, so it is crucial to consult local tax authorities or professionals for accurate and up-to-date information. By employing the appropriate Philadelphia Pennsylvania Depreciation Worksheet, individuals and businesses can adequately track, calculate, and report depreciation expenses, ensuring compliance with local regulations while maximizing tax benefits.Philadelphia Pennsylvania Depreciation Worksheet is a comprehensive tool used for calculating and recording depreciation expenses related to assets located in Philadelphia, Pennsylvania. This worksheet allows individuals, businesses, and organizations to accurately determine the decrease in value of their assets over time, in accordance with the specific regulations and guidelines in Philadelphia, Pennsylvania. The Philadelphia Pennsylvania Depreciation Worksheet takes into consideration various factors such as the useful life of the asset, salvage value, and the depreciation method used. This helps users determine the annual depreciation expense and accurately track the asset's current value for reporting and tax purposes. Different types of Philadelphia Pennsylvania Depreciation Worksheets may include: 1. Straight-line Depreciation Worksheet: This type of worksheet calculates depreciation expenses by allocating an equal amount over the useful life of the asset. It is considered the simplest and most commonly used method. 2. Declining Balance Depreciation Worksheet: This type of worksheet uses a depreciation rate that is higher in the earlier years and gradually decreases over time. This method is often used for assets that experience more significant wear and tear in the initial years. 3. MARS Depreciation Worksheet: The Modified Accelerated Cost Recovery System (MARS) is a tax method prescribed by the IRS. This worksheet helps individuals and businesses in Philadelphia, Pennsylvania, to calculate depreciation expenses based on the MARS depreciation tables. 4. Section 179 Expense Deduction Worksheet: This worksheet specifically pertains to the Section 179 tax code provision, which allows businesses to deduct the full purchase price of qualifying assets in the year of acquisition. The worksheet assists in determining the depreciation expense for assets qualifying under Section 179 in Philadelphia, Pennsylvania. 5. Bonus Depreciation Worksheet: Bonus depreciation is an additional depreciation allowance that allows businesses to deduct a percentage of the qualified asset's cost in the first year of use. This worksheet helps calculate the bonus depreciation expense for assets located in Philadelphia, Pennsylvania. To accurately utilize the Philadelphia Pennsylvania Depreciation Worksheet, it is essential to understand the specific depreciation regulations and guidelines laid out by the city. These guidelines may differ from federal regulations, so it is crucial to consult local tax authorities or professionals for accurate and up-to-date information. By employing the appropriate Philadelphia Pennsylvania Depreciation Worksheet, individuals and businesses can adequately track, calculate, and report depreciation expenses, ensuring compliance with local regulations while maximizing tax benefits.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.