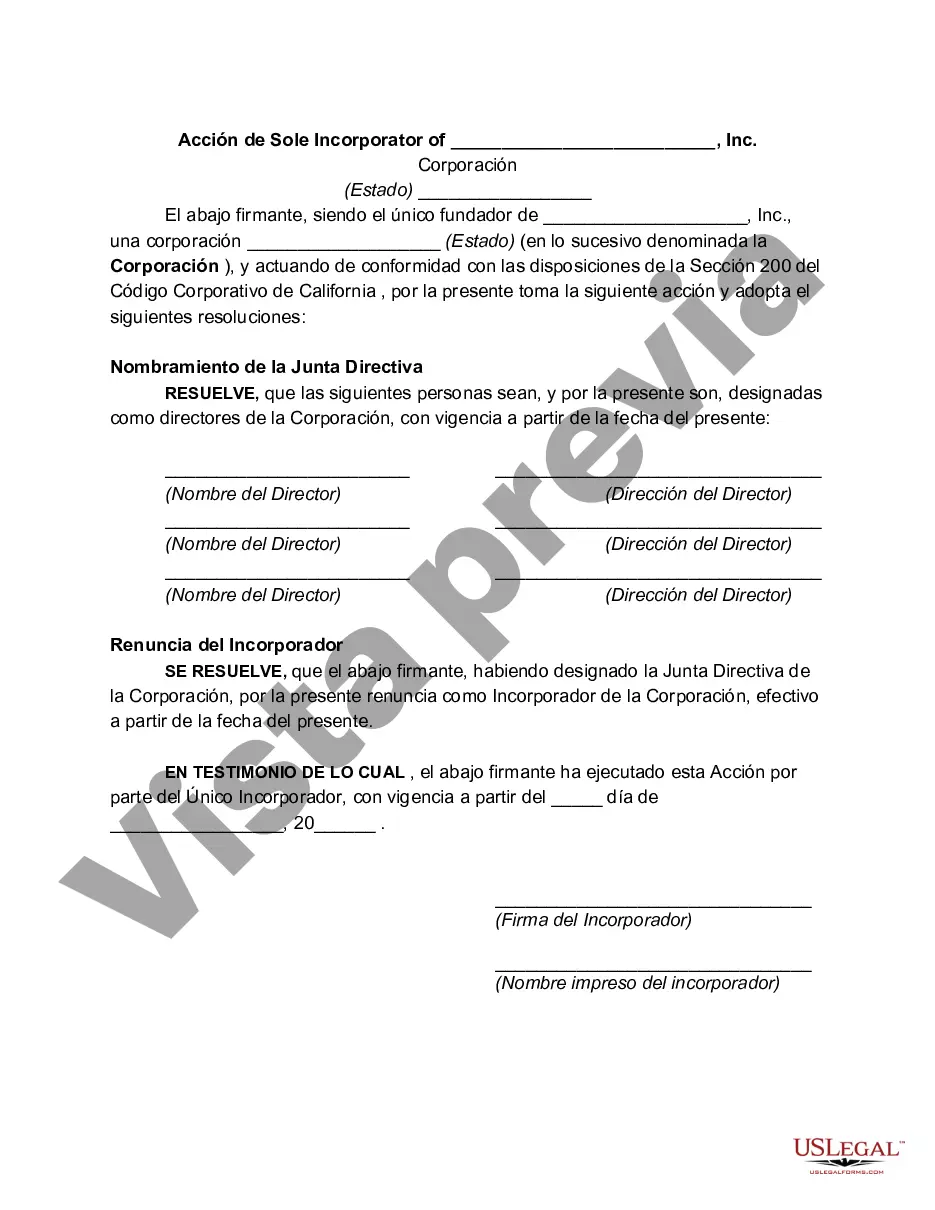

This multistate form relates to Section 200 of the California Corporate Code that provides in part as follows:

(a) One or more natural persons, partnerships, associations or corporations, domestic or foreign, may form a corporation under this division by executing and filing articles of incorporation.

(b) If initial directors are named in the articles, each director named in the articles shall sign and acknowledge the articles; if initial directors are not named in the articles, the articles shall be signed by one or more persons described in subdivision (a) who thereupon are the incorporators of the corporation.

(c) The corporate existence begins upon the filing of the articles and continues perpetually, unless otherwise expressly provided by law or in the articles.

Clark Nevada Action by Sole Incorporated of Corporation refers to the legal process that allows an individual to incorporate a company in the state of Nevada as the sole incorporated. This means that a single individual takes on the responsibility of establishing the corporation and completing all required actions, without the need for any additional incorporates. This process provides a simplified and streamlined approach for entrepreneurs or business owners who wish to form a corporation and assume complete control over its operations. The Clark Nevada Action by Sole Incorporated of Corporation involves several steps that must be followed to ensure compliance with the legal requirements. These steps can be summarized as follows: 1. Name Reservation: The sole incorporated must select a unique and distinguishable name for the corporation and submit a name reservation request to the Secretary of State in Clark County, Nevada. Once approved, the chosen name will be reserved for a specified period, typically 90 days, during which the incorporation process must be completed. 2. Drafting and Filing Articles of Incorporation: The sole incorporated is responsible for preparing the articles of incorporation, a legal document that outlines the basic details of the corporation, such as its name, purpose, duration, and stock structure. The articles of incorporation must be accurately completed and submitted to the Secretary of State for filing. 3. Appointment of Directors: The sole incorporated can appoint themselves or other individuals as directors of the corporation. Directors are responsible for managing the affairs of the company and making strategic decisions, and their names and addresses must be included in the articles of incorporation. 4. Issuance of Stock: The sole incorporated may choose to authorize and issue shares of stock for the corporation. This process involves determining the number and types of shares, their par value (if any), and the issuance of stock certificates to the incorporated and any other shareholders. 5. Compliance with Tax and Regulatory Requirements: After completing the incorporation process, the sole incorporated must ensure compliance with various tax and regulatory obligations. This includes obtaining an Employer Identification Number (EIN) from the Internal Revenue Service (IRS), registering for applicable state and local taxes, and fulfilling any licensing or permitting requirements specific to the nature of the business. These are the main steps involved in the Clark Nevada Action by Sole Incorporated of Corporation. By adhering to the legal requirements and following these steps diligently, the sole incorporated can establish a legally recognized corporation in the state of Nevada.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.