This multistate form relates to Section 200 of the California Corporate Code that provides in part as follows:

(a) One or more natural persons, partnerships, associations or corporations, domestic or foreign, may form a corporation under this division by executing and filing articles of incorporation.

(b) If initial directors are named in the articles, each director named in the articles shall sign and acknowledge the articles; if initial directors are not named in the articles, the articles shall be signed by one or more persons described in subdivision (a) who thereupon are the incorporators of the corporation.

(c) The corporate existence begins upon the filing of the articles and continues perpetually, unless otherwise expressly provided by law or in the articles.

Collin Texas Action by Sole Incorporated of Corporation refers to the legal process that takes place when a sole incorporated, in the context of Collin County, Texas, initiates the formation and establishment of a corporation. This incorporation process entails numerous necessary steps and actions which the sole incorporated must undertake to successfully create a legally recognized corporation. The first step in Collin Texas Action by Sole Incorporated of Corporation involves selecting a unique business name for the corporation, which should comply with the rules and regulations set forth by the Texas Secretary of State. The chosen name should not be similar to any existing corporations within the state to avoid confusion. Next, the sole incorporated must draft the corporation's articles of incorporation. These articles include essential information about the corporation, such as its purpose, management structure, registered agent details, and the number of shares the corporation is authorized to issue. While preparing the articles, the sole incorporated should ensure compliance with the Texas Business Organizations Code. Once the articles of incorporation are completed, the sole incorporated must file them with the Texas Secretary of State. This filing establishes the corporation's existence as a separate legal entity from its incorporated. The sole incorporated should pay close attention to the requirements and fees associated with the filing process to ensure proper submission. After filing, the incorporated should obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) for tax purposes. The EIN will enable the corporation to open a bank account, hire employees, and conduct various financial activities. Additionally, the sole incorporated must hold an organizational meeting or prepare written consents to adopt corporate bylaws. These bylaws outline the internal rules and regulations of the corporation, including procedures for holding meetings, electing directors, and appointing officers. Upon completion of these steps, the sole incorporated must issue stock certificates to the initial shareholders. These certificates represent ownership in the corporation and should be documented accordingly. Different types of Collin Texas Action by Sole Incorporated of Corporation may include variations based on the specific industry or purpose of the corporation. For instance, one might differentiate between a technology-based corporation, non-profit corporation, or professional services' corporation. Each type would require the sole incorporated to adhere to additional legal requirements specific to their respective industry or purpose. In conclusion, Collin Texas Action by Sole Incorporated of Corporation involves the comprehensive process initiated by a single individual to legally create a corporation in Collin County, Texas. Adhering to the necessary steps, from selecting a business name to issuing stock certificates, is vital to successfully establish a corporation in compliance with the Texas Business Organizations Code.

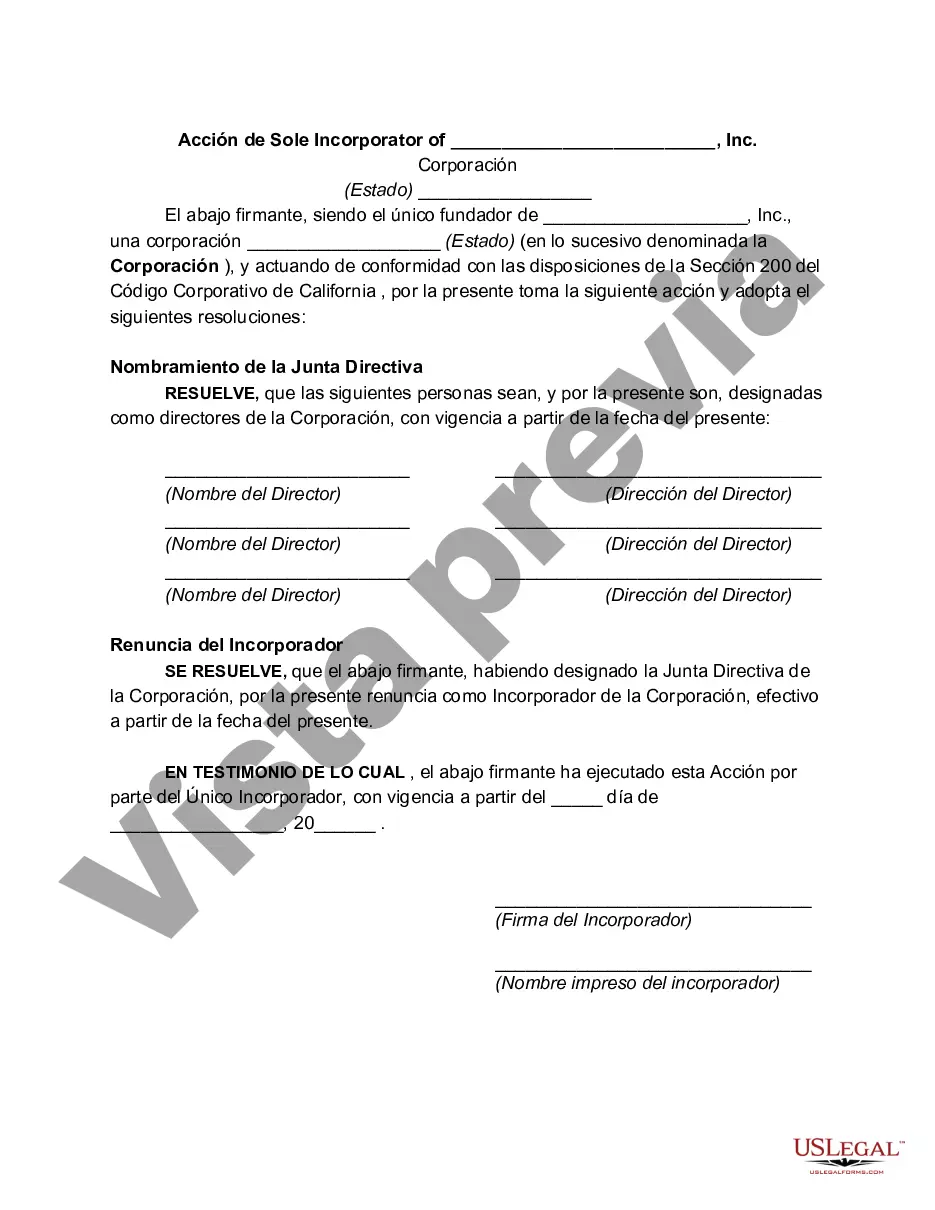

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.