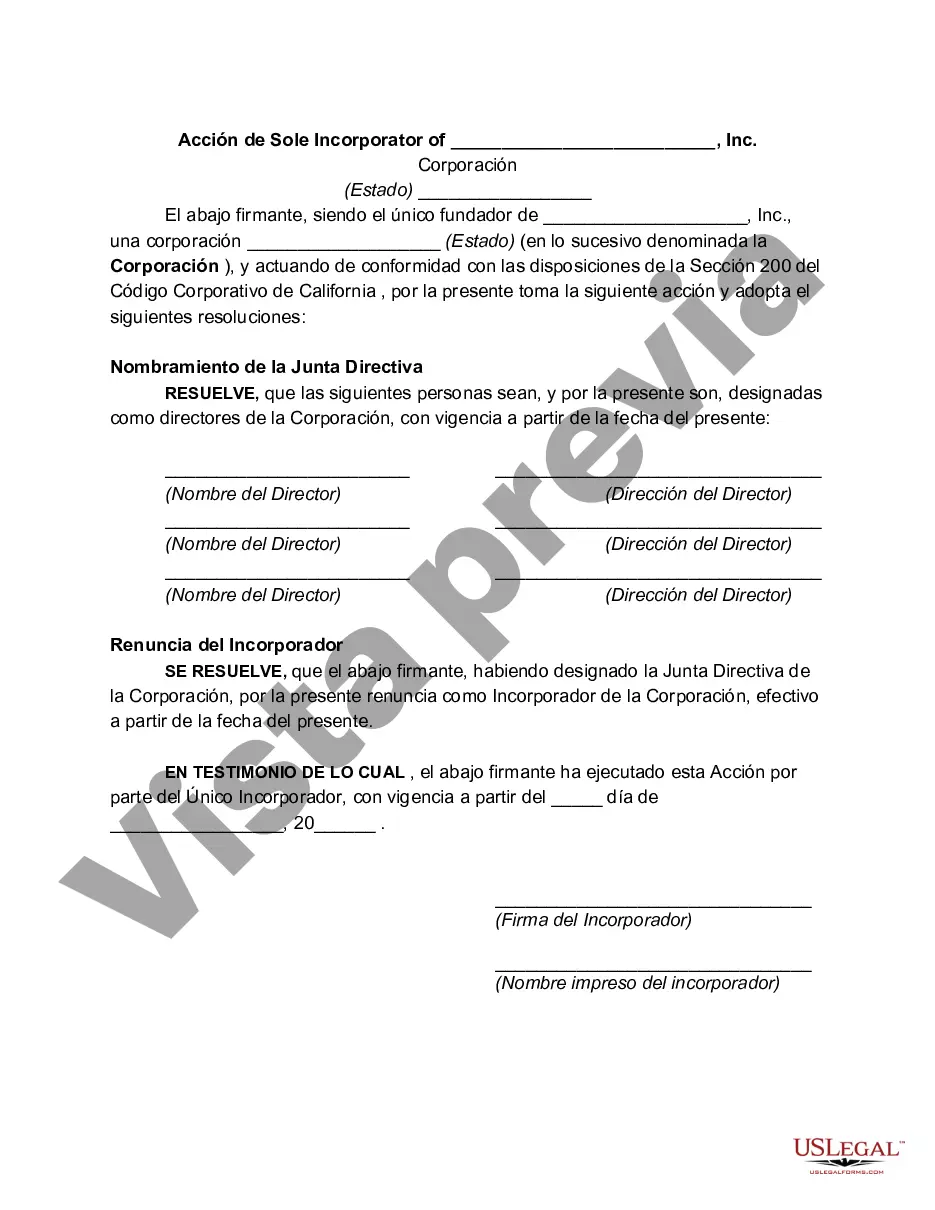

This multistate form relates to Section 200 of the California Corporate Code that provides in part as follows:

(a) One or more natural persons, partnerships, associations or corporations, domestic or foreign, may form a corporation under this division by executing and filing articles of incorporation.

(b) If initial directors are named in the articles, each director named in the articles shall sign and acknowledge the articles; if initial directors are not named in the articles, the articles shall be signed by one or more persons described in subdivision (a) who thereupon are the incorporators of the corporation.

(c) The corporate existence begins upon the filing of the articles and continues perpetually, unless otherwise expressly provided by law or in the articles.

Fairfax Virginia Action by Sole Incorporated of Corporation is a legal process through which an individual incorporates a business on their own without involving any other parties. This type of incorporation is particularly suited for entrepreneurs seeking to establish their companies quickly and efficiently. Here is a detailed description of Fairfax Virginia Action by Sole Incorporated of Corporation, highlighting its key aspects and its different types: 1. Definition and Process: Fairfax Virginia Action by Sole Incorporated of Corporation refers to the process where a single individual, known as the "sole incorporated," establishes a corporation for their business without the need for additional individuals or shareholders. By taking this action, the sole incorporated assumes complete responsibility for the formation, decision-making, and management of the corporation. In Fairfax, Virginia, this action is accomplished by filing the necessary legal documents with the State Corporation Commission (SCC). The sole incorporated must draft and sign the articles of incorporation, which outline vital information about the company, including its name, purpose, registered agent, shares of stock, and governance structure. 2. Key Steps Involved: a. Choosing a Business Name: The sole incorporated must select a unique and distinguishable name for the corporation, ensuring it complies with Virginia's naming requirements. b. Drafting Articles of Incorporation: The sole incorporated prepares the articles of incorporation, including essential details such as the corporation's name, purpose, and registered agent information. c. Filing with the SCC: The articles of incorporation are filed with the SCC, along with the payment of applicable fees. d. Obtaining an Employer Identification Number (EIN): The sole incorporated obtains an EIN from the Internal Revenue Service (IRS) to identify the corporation for tax purposes. e. Complying with Additional Requirements: The sole incorporated must fulfill other legal obligations, such as drafting corporate bylaws, appointing directors, and issuing stock certificates. 3. Types of Fairfax Virginia Action by Sole Incorporated of Corporation: a. For-Profit Corporation: This type of corporation is established for conducting a profit-driven business, where the primary objective is generating earnings for shareholders. b. Non-Profit Corporation: Here, the sole incorporated forms a corporation aimed at serving a specific purpose or benefiting society without generating profits for individuals. Non-profit corporations can pursue charitable, educational, religious, or scientific activities. c. Professional Corporation: Professionals in certain fields, such as lawyers, doctors, or accountants, can utilize this corporate structure to establish their practices. d. Close Corporation: The sole incorporated may establish a close corporation, also known as a closely held corporation, where the corporation's shares are restricted and not publicly traded. In conclusion, Fairfax Virginia Action by Sole Incorporated of Corporation is a legal process that enables an individual to establish a corporation independently. By carefully following the prescribed steps, including filing the articles of incorporation with the SCC, the sole incorporated can create their business entity, which can be a for-profit, non-profit, professional, or close corporation, depending on their specific needs and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.