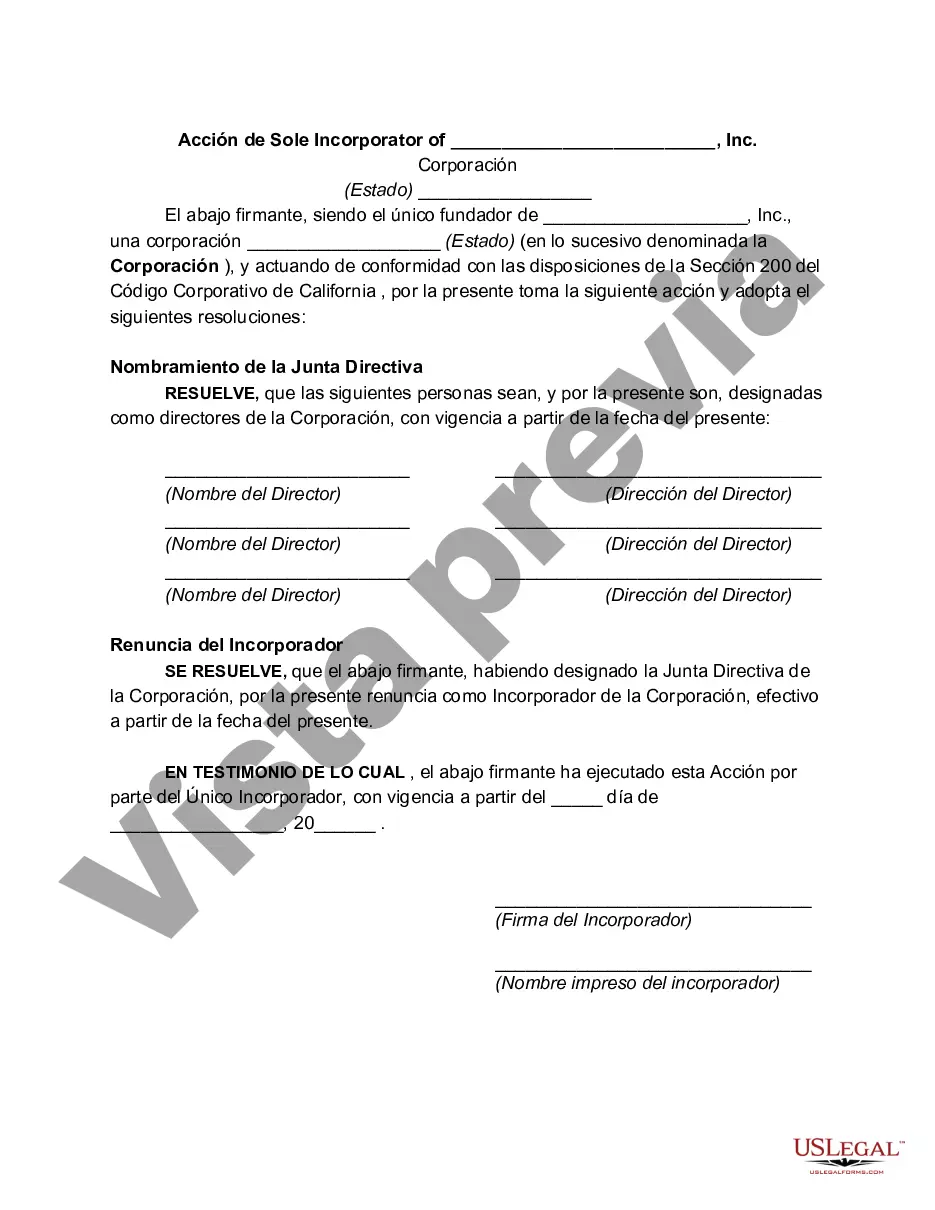

This multistate form relates to Section 200 of the California Corporate Code that provides in part as follows:

(a) One or more natural persons, partnerships, associations or corporations, domestic or foreign, may form a corporation under this division by executing and filing articles of incorporation.

(b) If initial directors are named in the articles, each director named in the articles shall sign and acknowledge the articles; if initial directors are not named in the articles, the articles shall be signed by one or more persons described in subdivision (a) who thereupon are the incorporators of the corporation.

(c) The corporate existence begins upon the filing of the articles and continues perpetually, unless otherwise expressly provided by law or in the articles.

Franklin Ohio Action by Sole Incorporated of Corporation refers to a legal process that allows a single individual, known as the "sole incorporated," to establish a corporation in Franklin, Ohio. This action grants the incorporated the authority to undertake all necessary steps to form a corporation in compliance with state laws and regulations. It is essential to follow this procedure meticulously to ensure a smooth and lawful incorporation process in Franklin, Ohio. The Franklin Ohio Action by Sole Incorporated of Corporation includes several crucial steps and requirements. First and foremost, the sole incorporated must prepare and file the necessary documents with the Ohio Secretary of State or applicable state agencies. These documents typically include the Articles of Incorporation, which provide essential details about the corporation, such as its name, purpose, registered agent, and other pertinent information. Moreover, the sole incorporated must appoint the initial board of directors and officers of the corporation, which will play a vital role in the company's governance and decision-making. Careful consideration should be given to the individuals chosen for these positions, as their qualifications, experience, and commitment to the corporation's success can significantly impact its future. Additionally, a thorough understanding of relevant Franklin, Ohio laws and regulations is crucial throughout the Action by Sole Incorporated of Corporation process. Compliance with state laws and adherence to required filings, such as annual reports and tax obligations, are necessary to maintain the corporation's legal status. Different types of Franklin Ohio Action by Sole Incorporated of Corporation may include: 1. Non-profit corporation: The sole incorporated establishes a non-profit corporation to pursue charitable, educational, religious, scientific, or other socially beneficial purposes. Several specific legal requirements, such as obtaining tax-exempt status, must be met in this type of incorporation. 2. For-profit corporation: The sole incorporated establishes a corporation with the primary objective of conducting business activities for profit-making purposes. This type of incorporation involves complying with various state and federal regulations and typically requires more comprehensive documentation and filings. 3. Professional corporation: In certain licensed professions, such as law, medicine, or accounting, a sole incorporated may choose to establish a professional corporation. This type of incorporation allows professionals to enjoy certain liability protections while adhering to specific regulations applicable to their profession. By carefully following the Franklin Ohio Action by Sole Incorporated of Corporation process, entrepreneurs can establish a legally recognized and well-structured corporation in Franklin, Ohio. It is crucial to seek professional legal advice or utilize online resources provided by the Ohio Secretary of State or Franklin local government to ensure compliance with all legal requirements throughout the incorporation process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.