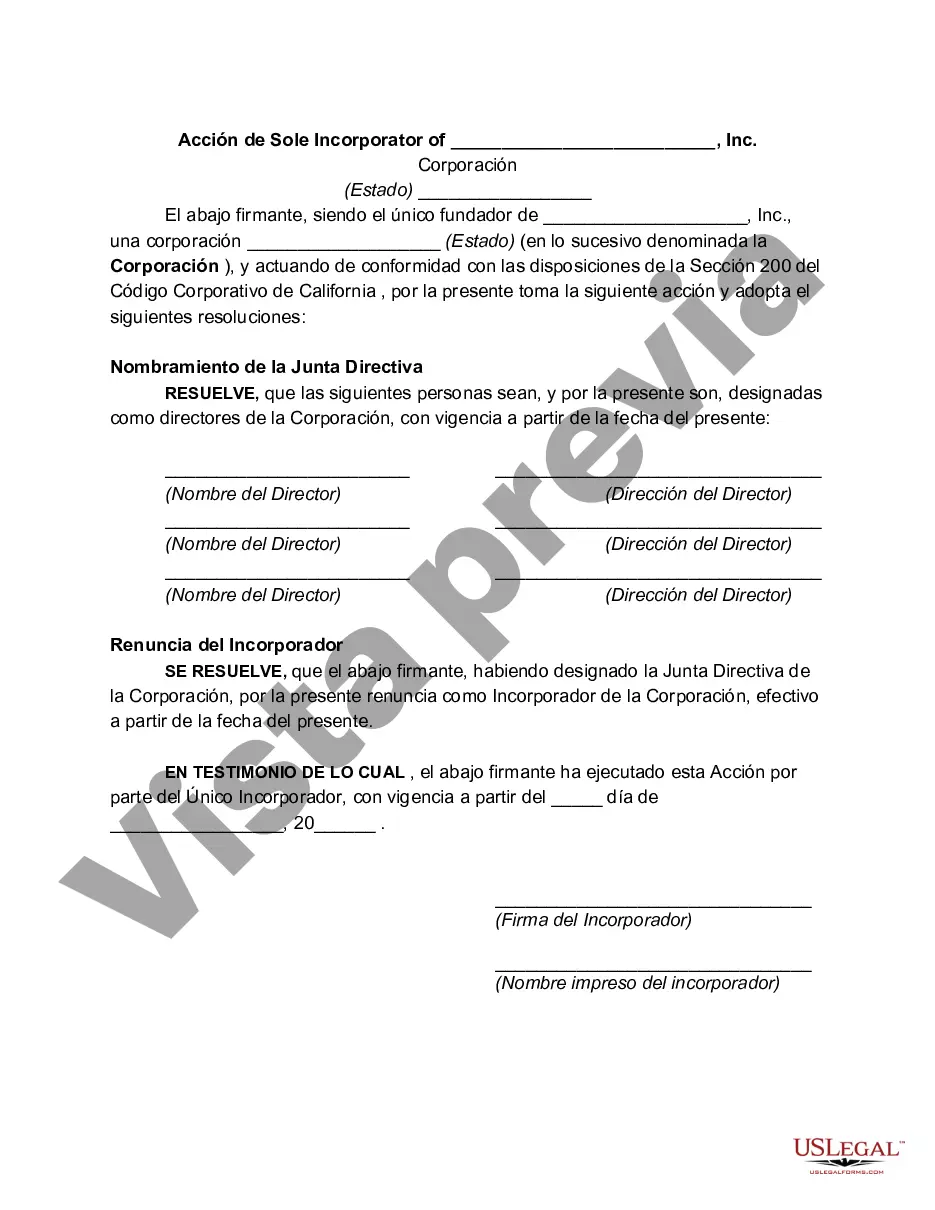

This multistate form relates to Section 200 of the California Corporate Code that provides in part as follows:

(a) One or more natural persons, partnerships, associations or corporations, domestic or foreign, may form a corporation under this division by executing and filing articles of incorporation.

(b) If initial directors are named in the articles, each director named in the articles shall sign and acknowledge the articles; if initial directors are not named in the articles, the articles shall be signed by one or more persons described in subdivision (a) who thereupon are the incorporators of the corporation.

(c) The corporate existence begins upon the filing of the articles and continues perpetually, unless otherwise expressly provided by law or in the articles.

Title: Harris Texas Action by Sole Incorporated of Corporation: A Detailed Explanation Introduction: When forming a corporation in Harris County, Texas, the actions taken by the sole incorporated play a crucial role in establishing the company's legal foundation. This article will provide a comprehensive overview of the Harris Texas Action by Sole Incorporated of Corporation, highlighting its significance and exploring any variations or specific types that exist within this process. 1. Definition and Importance of Harris Texas Action by Sole Incorporated of Corporation: The Harris Texas Action by Sole Incorporated refers to the initial steps taken by the sole individual forming a corporation to establish its legal existence in Harris County. As the sole incorporated, this person is responsible for executing several key activities that shape the corporation's structure, governance, and legal compliance. 2. Key Steps in Harris Texas Action by Sole Incorporated: a. Selecting the Corporation's Name: The sole incorporated must choose a unique and distinguishable name for the corporation, complying with Texas law and conducting a thorough name availability search. b. Drafting and Filing Articles of Incorporation: The next crucial action is preparing the Articles of Incorporation, which outline the corporation's purpose, share structure, registered agent information, and other necessary details. These articles are then filed with the appropriate Texas state agency, usually the Secretary of State. c. Appointing Initial Directors: The sole incorporated designates the initial board of directors, detailing their names, addresses, and roles in governing the corporation. d. Bylaws and Initial Organizational Policies: The sole incorporated may adopt bylaws and establish initial organizational policies, contributing to the corporation's governance framework and operational procedures. e. Issuing Stock and Capitalization: If the corporation will issue shares to shareholders, the sole incorporated determines the initial stock ownership and capitalization structure, including authorized and issued shares. f. Obtaining Required Permits and Licenses: Depending on the nature of the business, the sole incorporated may need to obtain specific permits or licenses from relevant government entities to comply with local regulations. 3. Variations and Types of Harris Texas Action by Sole Incorporated: a. Standard Harris Texas Action by Sole Incorporated: This type involves the regular process of forming a for-profit corporation in Harris County, Texas. It encompasses the steps mentioned above, ensuring legal compliance and establishing the framework for corporate operations. b. Nonprofit Harris Texas Action by Sole Incorporated: For individuals interested in forming a nonprofit corporation, which operates for charitable, religious, educational, or similar purposes, the necessary steps undertaken by the sole incorporated differ slightly. The main distinction lies in filing for tax-exempt status, engaging in compliance with 501(c)(3) requirements imposed by the Internal Revenue Service (IRS). c. Professional Corporation Harris Texas Action by Sole Incorporated: To establish a professional corporation (PC), such as a law firm, medical practice, or engineering firm, the sole incorporated must observe additional regulations imposed by the Texas Occupations Code governing the specific profession. These regulations often focus on licensing and compliance with professional standards. Conclusion: Understanding the Harris Texas Action by Sole Incorporated of Corporation is essential for anyone seeking to establish a legally recognized and structured corporation in Harris County. By navigating the steps diligently and adhering to relevant legal requirements, the sole incorporated can lay a strong foundation for the future success and growth of the corporation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.