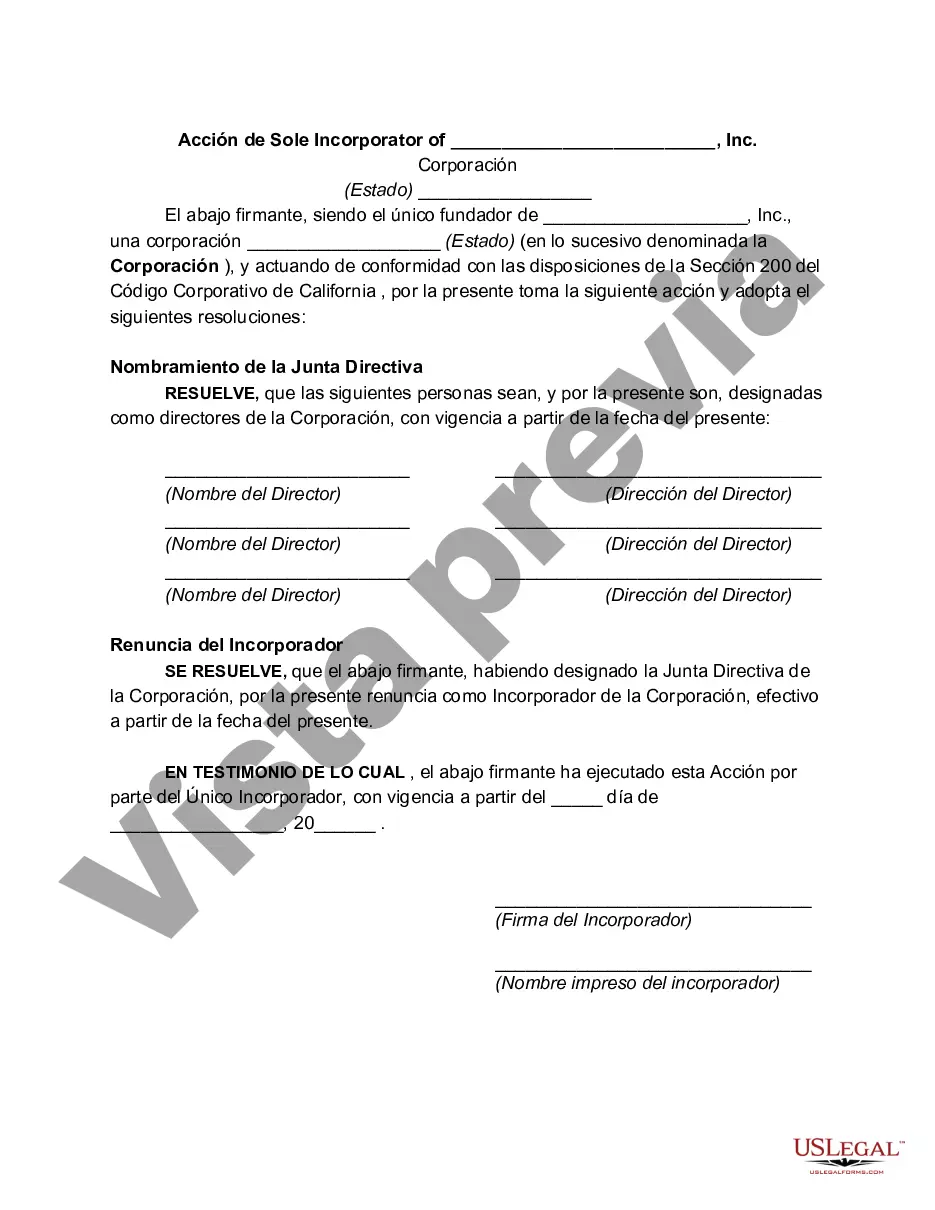

This multistate form relates to Section 200 of the California Corporate Code that provides in part as follows:

(a) One or more natural persons, partnerships, associations or corporations, domestic or foreign, may form a corporation under this division by executing and filing articles of incorporation.

(b) If initial directors are named in the articles, each director named in the articles shall sign and acknowledge the articles; if initial directors are not named in the articles, the articles shall be signed by one or more persons described in subdivision (a) who thereupon are the incorporators of the corporation.

(c) The corporate existence begins upon the filing of the articles and continues perpetually, unless otherwise expressly provided by law or in the articles.

Hillsborough Florida Action by Sole Incorporated of Corporation refers to the legal process followed by the sole incorporated in Hillsborough County, Florida, when forming a corporation. This detailed description will outline the process, requirements, and relevant keywords associated with Hillsborough Florida Action by Sole Incorporated of Corporation. Hillsborough County, located on the west coast of Florida, is a popular area for business and commercial activities. When an individual or entity wants to establish a corporation in Hillsborough County, they will typically follow a specific set of procedures. In some cases, there may be a sole incorporated, meaning a single person or entity responsible for initiating the incorporation process. The key steps involved in Hillsborough Florida Action by Sole Incorporated of Corporation include: 1. Name Reservation: The sole incorporated must choose a unique and distinguishable name for the corporation and ensure it is not already in use by another company. This step often involves conducting a name search through the division of corporations' database to check for name availability. 2. Prepare Articles of Incorporation: The sole incorporated needs to prepare the Articles of Incorporation, which is a legal document detailing essential information about the corporation. This includes the corporate name, principal place of business, purpose of the corporation, details about initial directors, and the type and number of shares the corporation can issue. 3. File Articles of Incorporation: The completed and signed Articles of Incorporation form, along with the necessary filing fee, must be submitted to the Division of Corporations in Hillsborough County. This can usually be done online or through mail. 4. Obtain EIN and State Tax ID: After the corporation is established, the sole incorporated needs to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) and a State Tax Identification Number from the Florida Department of Revenue. These identification numbers are essential for tax purposes and other financial transactions. 5. Draft Corporate Bylaws: The sole incorporated should create corporate bylaws, which are internal rules and regulations governing the corporation's operations. Bylaws typically cover matters such as shareholder meetings, director responsibilities, officer appointments, and decision-making procedures. 6. Initial Organizational Meeting: Once the corporation is formed, the sole incorporated may need to hold an initial organizational meeting. During this meeting, directors (if any) are appointed, bylaws are adopted, and other necessary actions are taken to establish the corporation's basic structure. Relevant keywords associated with Hillsborough Florida Action by Sole Incorporated of Corporation include: — Hillsborough CountForlornotheda - Sole incorporato— - Corporation formation — ArticlesIncorporationatio— - Name reservation — EIN (Employer Identification Number— - State Tax ID — Bylaws - Organizational meeting Examples of different types of Hillsborough Florida Action by Sole Incorporated of Corporation could include Hillsborough Florida Nonprofit Action by Sole Incorporated of Corporation, Hillsborough Florida Professional Corporation Action by Sole Incorporated, or Hillsborough Florida Foreign Corporation Action by Sole Incorporated, depending on the specific nature and purpose of the corporation being formed.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.