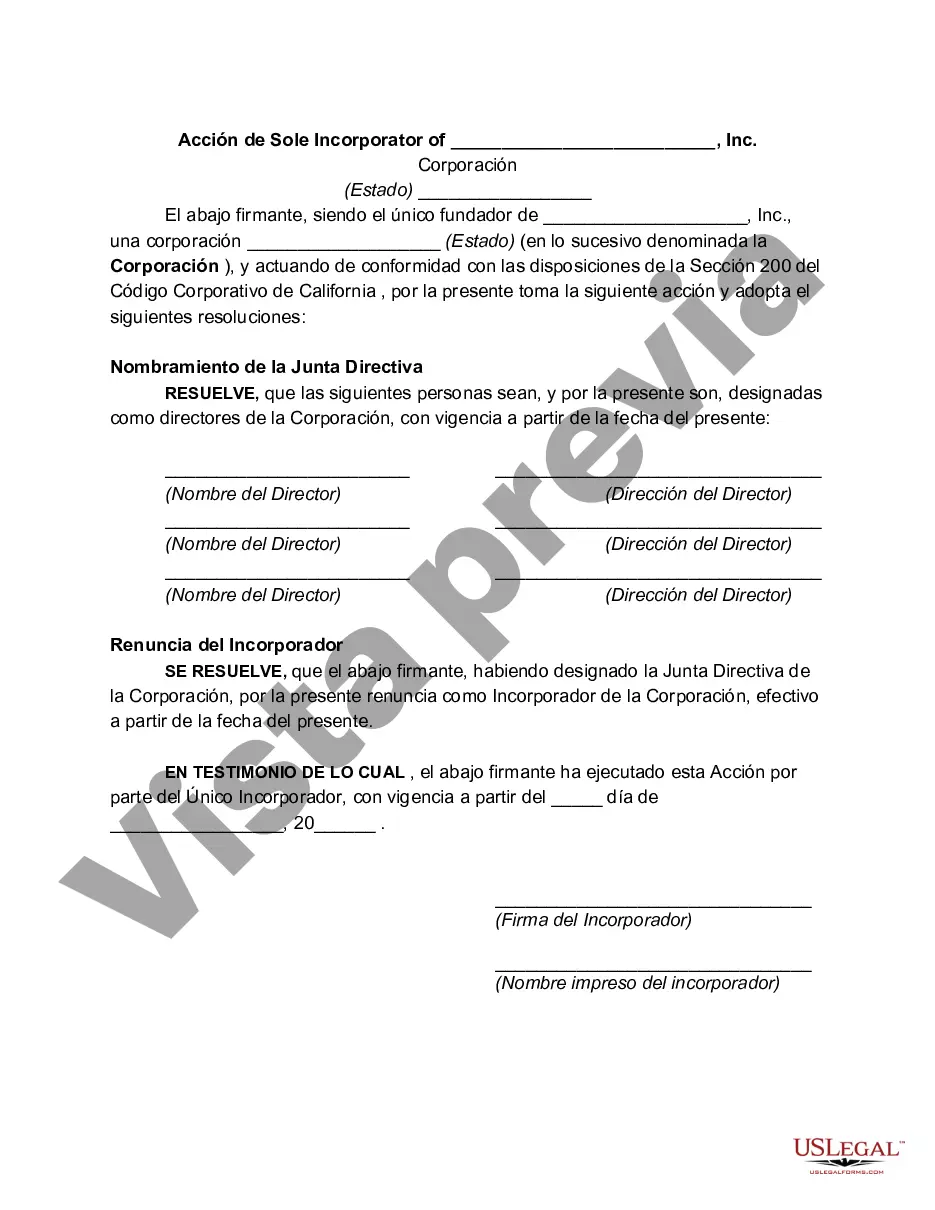

This multistate form relates to Section 200 of the California Corporate Code that provides in part as follows:

(a) One or more natural persons, partnerships, associations or corporations, domestic or foreign, may form a corporation under this division by executing and filing articles of incorporation.

(b) If initial directors are named in the articles, each director named in the articles shall sign and acknowledge the articles; if initial directors are not named in the articles, the articles shall be signed by one or more persons described in subdivision (a) who thereupon are the incorporators of the corporation.

(c) The corporate existence begins upon the filing of the articles and continues perpetually, unless otherwise expressly provided by law or in the articles.

Houston Texas Action by Sole Incorporated of Corporation refers to the legal process and actions taken by an individual who is the sole incorporated of a corporation in Houston, Texas. Incorporating a business is an essential step that allows individuals or groups to establish a legal entity separate from its owners. This process provides limited liability protection and various tax benefits while allowing the business to operate under a formal structure. The Houston Texas Action by Sole Incorporated of Corporation involves several key steps: 1. Entity Selection: The sole incorporated must decide on the type of entity they wish to establish. Houston, Texas offers several options, such as a C Corporation, S Corporation, Limited Liability Company (LLC), or a Non-Profit Corporation, each with different advantages and requirements. 2. Name Reservation: The sole incorporated should select a unique and suitable name for the corporation and reserve it with the Texas Secretary of State's office to ensure its availability. 3. Preparation of Articles of Incorporation: The next step involves preparing the Articles of Incorporation. This legal document outlines essential information about the corporation, including its name, purpose, business address, registered agent, incorporated's name, and the number of authorized shares. 4. Filing the Incorporation Documents: The sole incorporated must file the Articles of Incorporation with the Texas Secretary of State's office and pay the required fees. This step officially establishes the corporation as a legal entity. 5. Drafting Bylaws: Bylaws are a set of rules and regulations governing the management and operation of the corporation. The sole incorporated is responsible for creating or adopting these bylaws, outlining the roles of directors, officers, and shareholders. 6. Appointing Initial Directors and Officers: The sole incorporated must appoint initial directors and officers for the corporation. The specific roles and responsibilities assigned to each will depend on the corporation's structure and size. It is important to note that while the process described above represents the general steps involved in the Houston Texas Action by Sole Incorporated of Corporation, it is essential to consult with a legal professional, such as an attorney or a business law expert, to ensure compliance with all state and federal requirements. Different types of Houston Texas Action by Sole Incorporated of Corporation may include: 1. Houston Texas Action by Sole Incorporated of C Corporation: The sole incorporated establishes a C Corporation, which is a separate legal entity from its owners, providing limited liability protection. 2. Houston Texas Action by Sole Incorporated of S Corporation: The sole incorporated forms an S Corporation, a pass-through entity for federal tax purposes, avoiding double taxation. 3. Houston Texas Action by Sole Incorporated of LLC: The sole incorporated creates a Limited Liability Company (LLC), which combines the limited liability protection of a corporation with the flexibility and tax advantages of a partnership or sole proprietorship. 4. Houston Texas Action by Sole Incorporated of Non-Profit Corporation: The sole incorporated establishes a Non-Profit Corporation, aiming to pursue charitable, educational, religious, or scientific purposes while enjoying certain tax-exempt benefits. Remember, a professional legal advisor should be consulted to ensure compliance with Texas state laws and appropriate filing procedures during the Houston Texas Action by Sole Incorporated of Corporation process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.