Chicago Illinois Revocable Trust Agreement with Corporate Trustee is a legal document designed to manage and distribute assets held in trust in accordance with the wishes of the creator, also known as the granter or settler. This type of trust agreement is commonly used in estate planning to ensure the smooth transfer of assets and continuity of wealth management even after the granter's death. The corporate trustee, typically a fiduciary institution or a bank, is entrusted with the responsibility of administering the trust according to the terms outlined in the agreement. The Chicago Illinois Revocable Trust Agreement provides flexibility to the granter, allowing them to make changes, amend or revoke the trust at any time during their lifetime. Since it is a revocable trust, the granter retains control over the assets held in the trust and has the freedom to make decisions regarding management and distribution. This type of agreement offers various advantages, including the possibility of avoiding probate, maintaining privacy, and providing for appointed successors or beneficiaries. There are a few notable variations of the Chicago Illinois Revocable Trust Agreement with Corporate Trustee, including: 1. Living Revocable Trust: Also known as an inter vivos trust, this agreement takes effect during the granter's lifetime and allows for the seamless transfer of assets to beneficiaries, bypassing the probate process. 2. Irrevocable Revocable Trust: Unlike the standard revocable trust, this type of agreement cannot be modified or revoked by the granter once it is established. The granter relinquishes control over the assets, which may have certain tax advantages. 3. Testamentary Revocable Trust: This trust comes into effect upon the granter's death and is established through a will. It allows for the controlled distribution of assets, ensuring that they are managed and distributed according to the granter's wishes. A Chicago Illinois Revocable Trust Agreement with a Corporate Trustee offers individuals the peace of mind that their assets will be taken care of, managed, and distributed as outlined in the agreement. By utilizing the expertise of a corporate trustee, there is an added layer of professionalism, expertise, and unbiased decision-making in the administration of the trust.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Contrato de Fideicomiso Revocable con Fideicomisario Corporativo - Revocable Trust Agreement with Corporate Trustee

Description

How to fill out Chicago Illinois Contrato De Fideicomiso Revocable Con Fideicomisario Corporativo?

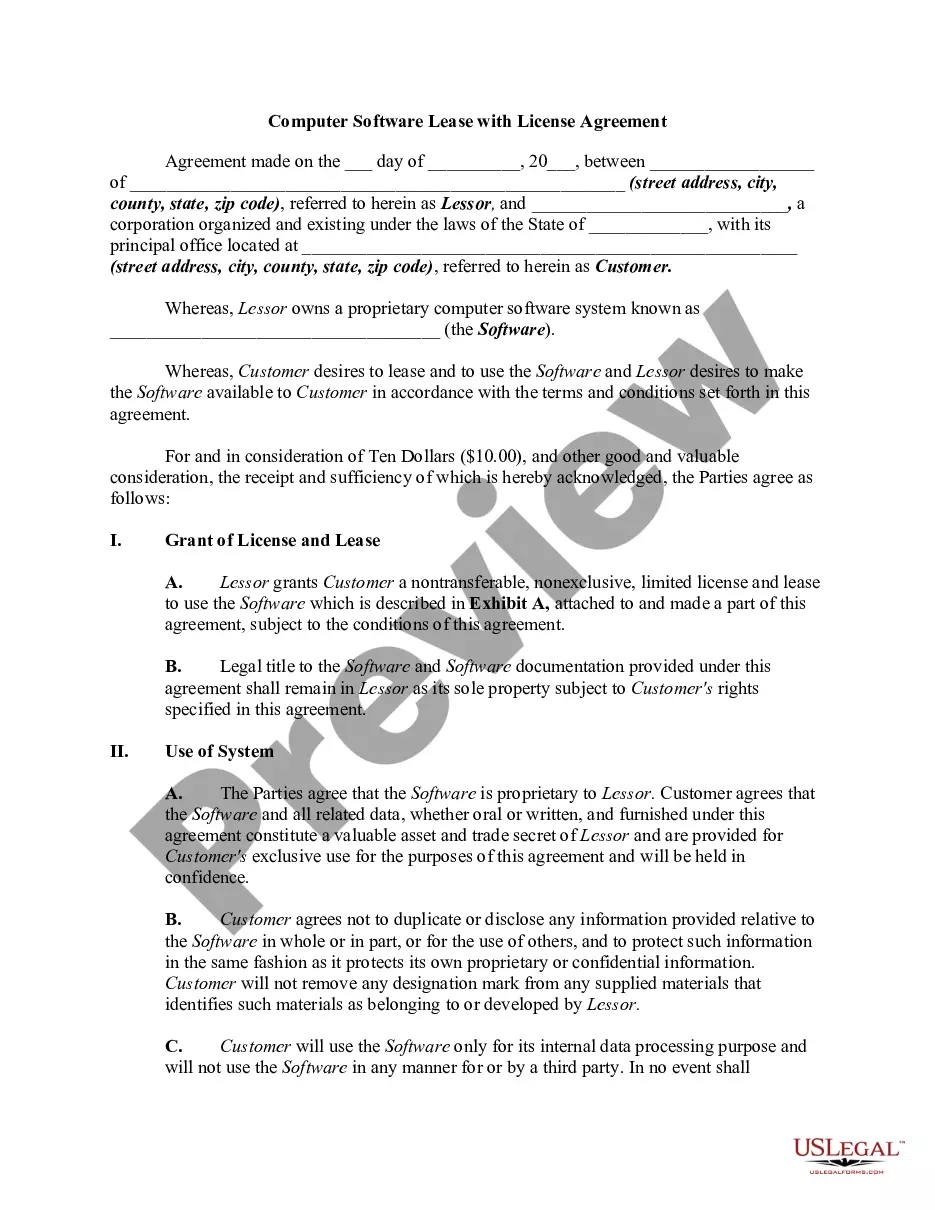

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Chicago Revocable Trust Agreement with Corporate Trustee, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Consequently, if you need the latest version of the Chicago Revocable Trust Agreement with Corporate Trustee, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Chicago Revocable Trust Agreement with Corporate Trustee:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Chicago Revocable Trust Agreement with Corporate Trustee and download it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!