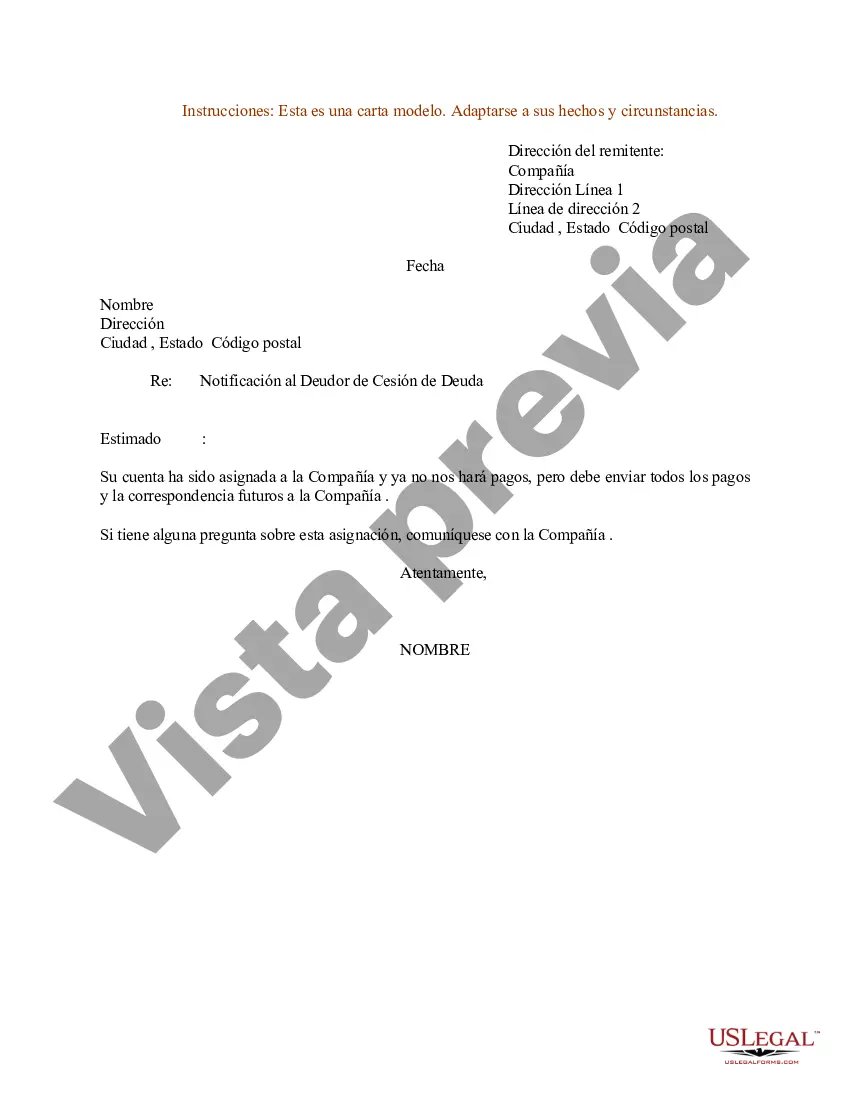

Title: Harris Texas Sample Letter for Notice to Debtor of Assignment of Debt — Detailed Description and Types Introduction: A Harris Texas Sample Letter for Notice to Debtor of Assignment of Debt is an official communication sent by a creditor or debt collector to inform a debtor about the transfer or assignment of their debt to a different entity. This letter is an essential part of the debt collection process and aims to provide crucial information to debtors while maintaining compliance with relevant laws and regulations. Known for its effectiveness, the Harris Texas Sample Letter serves as a legally binding acknowledgement of the debt assignment. Key Components of the Letter: 1. Identifying Information: The letter contains the debtor's full name, address, and account number to ensure accurate identification and tracking of the assigned debt. The creditor's details, including name, contact information, and any assigned reference numbers, are included as well. 2. Debt Assignment Details: The letter clearly states that the debt in question has been assigned or transferred to a new creditor or collections agency. Specific details such as the date of transfer, name of the new creditor, and account number with the new entity are provided. This ensures transparency and allows the debtor to channel future payments or inquiries to the correct party. 3. Relevant Parties' Rights and Obligations: The letter typically explains the debtor's rights and obligations related to the assigned debt. It may include information about payment due dates, methods of payment, interest charges, and any applicable late fees. Additionally, it should inform debtors about their rights to dispute or validate the debt, if applicable. 4. Contact Information and Instructions: To facilitate communication, the letter provides the contact details of the new creditor or collections agency, including their address, phone number, and email address. Debtors are encouraged to direct any inquiries, concerns, or payment arrangements to the designated contact person. Types of Harris Texas Sample Letters for Notice to Debtor of Assignment of Debt: 1. Preliminary Letter: This type of letter serves as an initial notice to inform the debtor about the debt assignment. It provides essential details regarding the transfer and outlines the debtor's rights and obligations. A preliminary letter acts as a formal introduction to the new creditor or collections agency. 2. Follow-up Letter: A follow-up letter is sent if the debtor fails to respond or take necessary action after receiving the preliminary letter. It serves as a reminder of the debt assignment and urges the debtor to communicate or address the outstanding debt promptly. 3. Validation Letter: If the debtor disputes the assigned debt or requests validation, a validation letter will be issued. This letter acts as a response to the debtor's dispute, providing necessary documentation and proof of debt validity upon request. Conclusion: Harris Texas Sample Letters for Notice to Debtor of Assignment of Debt are vital communications in the debt collection process. By providing debtors with clear information regarding the assignment of their debt, these letters ensure transparency and compliance with legal requirements. The various types of letters allow creditors and collections agencies to effectively interact with debtors and resolve outstanding debts while upholding debtor rights.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Modelo de carta de notificación al deudor de la cesión de la deuda - Sample Letter for Notice to Debtor of Assignment of Debt

Description

How to fill out Harris Texas Modelo De Carta De Notificación Al Deudor De La Cesión De La Deuda?

If you need to get a trustworthy legal form provider to obtain the Harris Sample Letter for Notice to Debtor of Assignment of Debt, consider US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can browse from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, number of learning materials, and dedicated support make it easy to find and complete various paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

You can simply select to search or browse Harris Sample Letter for Notice to Debtor of Assignment of Debt, either by a keyword or by the state/county the document is intended for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Harris Sample Letter for Notice to Debtor of Assignment of Debt template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be immediately available for download once the payment is completed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less expensive and more reasonably priced. Set up your first company, organize your advance care planning, draft a real estate contract, or execute the Harris Sample Letter for Notice to Debtor of Assignment of Debt - all from the comfort of your sofa.

Join US Legal Forms now!