Dear [Tax Authority], I am writing to request an exemption from ad valor em taxes for my property located in Franklin, Ohio. As a responsible property owner, I believe that my property qualifies for this exemption due to the following reasons: 1. [Insert relevant reason]. For instance, my property is classified as a nonprofit organization, such as a religious institution or a charity, which is exempt from paying ad valor em taxes under Ohio law. I have attached the necessary documentation, including the certification of our nonprofit status, for your review and consideration. 2. [Insert another relevant reason]. In this case, my property may qualify for an exemption if it serves a specific purpose that benefits the community, such as a public library or a government-owned facility. Please find enclosed supporting documentation, such as testimonials or official records, to demonstrate the positive impact of my property on the Franklin community. It is my sincere belief that granting this exemption would be in alignment with the objectives of fairness and equity within the local tax system. By exempting my property from ad valor em taxes, I can continue to contribute to the Franklin community in a meaningful way through the important services I provide. I understand that the exemption of ad valor em taxes is subject to specific criteria outlined by the Ohio tax laws and regulations. Therefore, I kindly request that you provide me with any additional forms or documentation necessary to complete this application accurately. Furthermore, I am more than willing to schedule a meeting or provide further clarification regarding my exemption request, should you require it. Thank you for your attention to this matter. Should you require any additional information or have any questions, please do not hesitate to contact me at [Phone Number] or [Email Address]. I appreciate your prompt consideration of my application. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code] --- Different types of Franklin Ohio Sample Letter for Exemption of Ad Valor em Taxes may include: 1. Sample Letter for Exemption of Ad Valor em Taxes for Nonprofit Organizations 2. Sample Letter for Exemption of Ad Valor em Taxes for Community Serving Properties 3. Sample Letter for Exemption of Ad Valor em Taxes for Government-Owned Facilities 4. Sample Letter for Exemption of Ad Valor em Taxes for Public Libraries 5. Sample Letter for Exemption of Ad Valor em Taxes for Charitable Institutions.

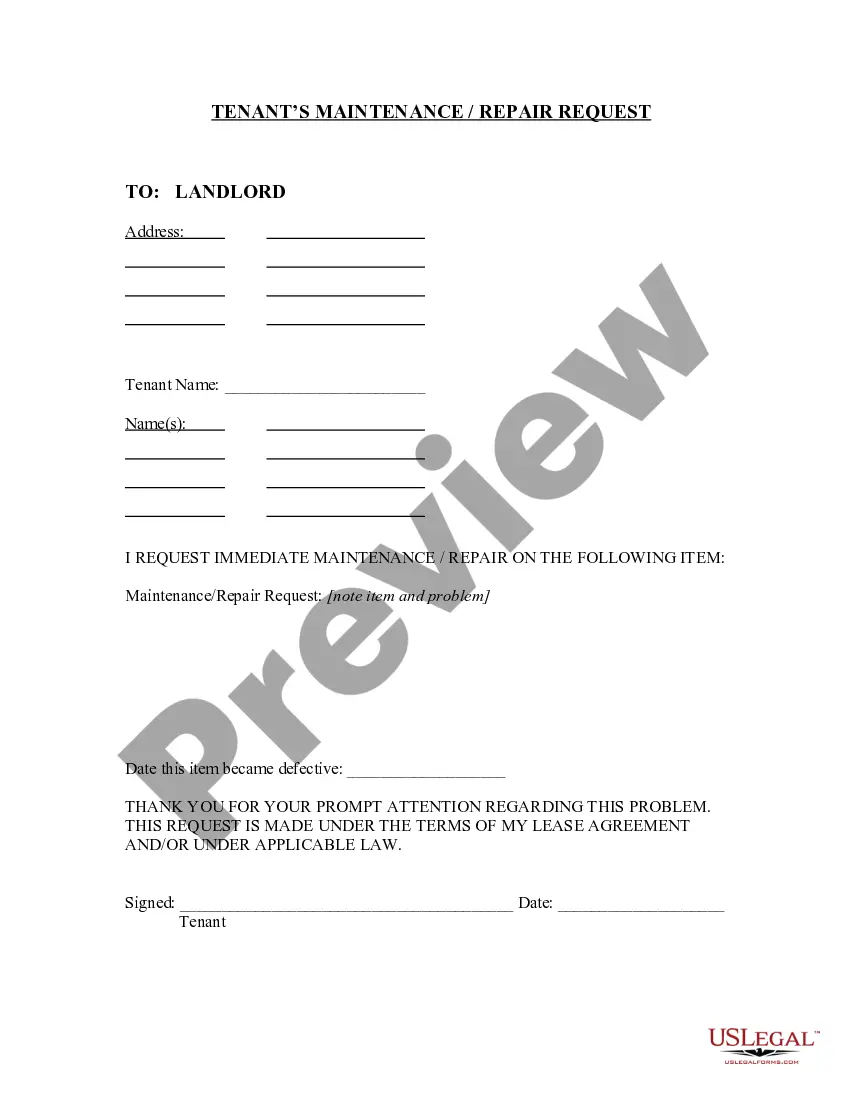

Ohio Tax Exempt Form Example

Description

How to fill out Franklin Ohio Sample Letter For Exemption Of Ad Valorem Taxes?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Franklin Sample Letter for Exemption of Ad Valorem Taxes, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Franklin Sample Letter for Exemption of Ad Valorem Taxes from the My Forms tab.

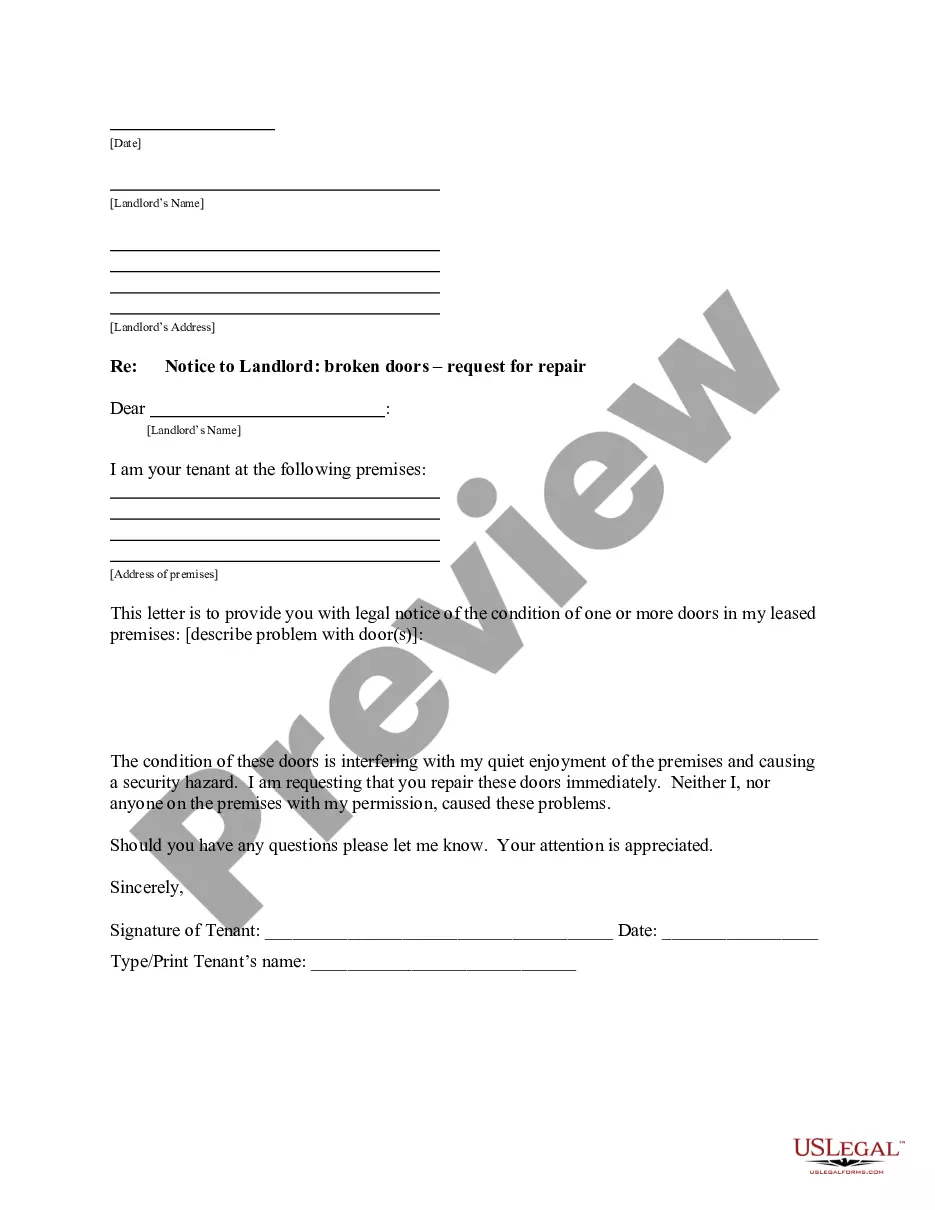

For new users, it's necessary to make a few more steps to get the Franklin Sample Letter for Exemption of Ad Valorem Taxes:

- Take a look at the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!