An assignment of wages is the transfer of the right to collect wages from the wage earner to a creditor. The assignment of wages is usually effectuated by deducting from an employee's earnings the amount necessary to pay off a debt.

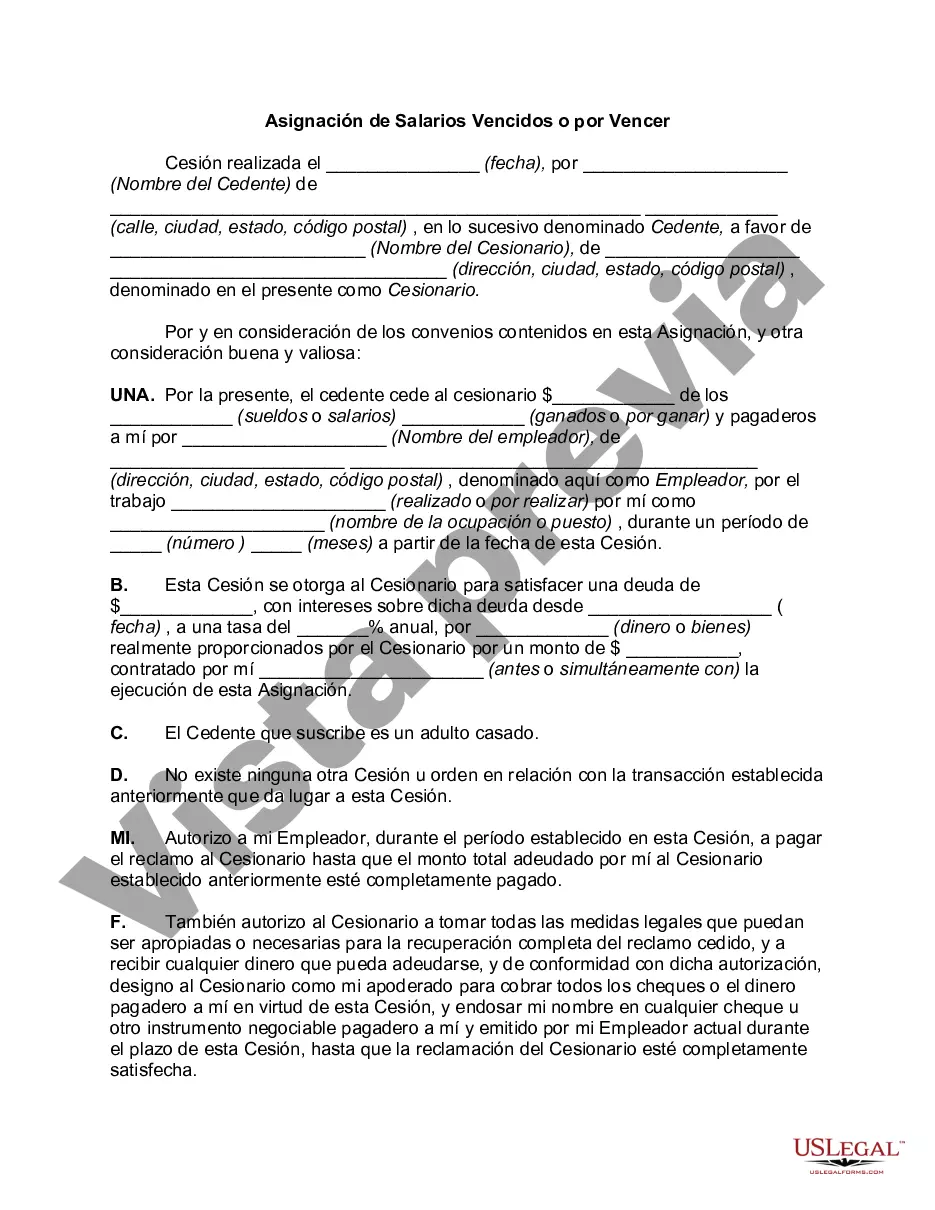

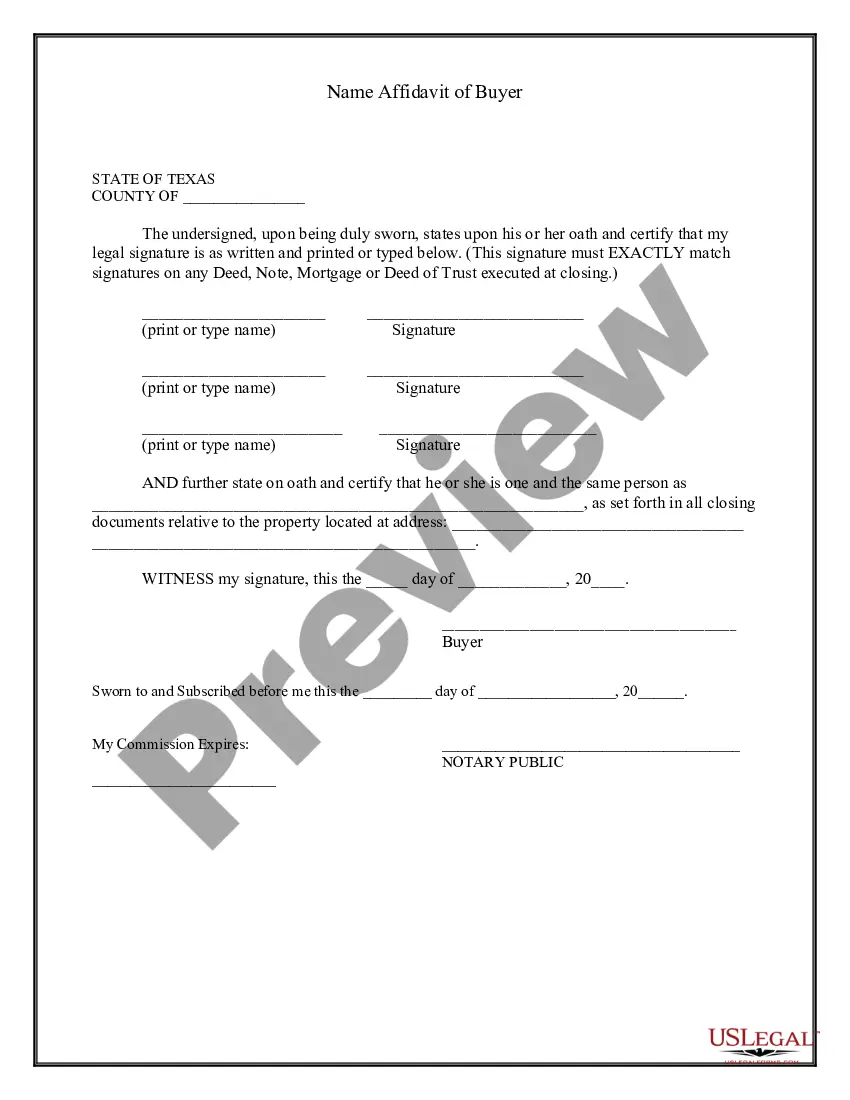

An assignment of wages should be contained in a separate written instrument, signed by the person who has earned or will earn the wages or salary. The assignment should include statements identifying the transaction to which the assignment relates, the personal status of the assignor, and a recital, where appropriate, that no other assignment or order exists in connection with the same transaction.

Many jurisdictions have enacted statutory provisions concerning wage assignments that prescribe various requisites of or conditions to the validity of assignments of wages. Compliance with these statutes is essential to make such assignments effective.

Los Angeles, California is a vibrant city located on the West Coast of the United States. Known for its glamorous Hollywood culture, diverse population, and iconic landmarks, it is a city that captivates millions of visitors each year. In this bustling metropolis, several types of Assignment of Wages Due or to Become Due are prevalent. One common type of Assignment of Wages Due or to Become Due in Los Angeles is wage garnishment. This occurs when a court orders an employer to withhold a certain percentage of an employee's wages to satisfy a debt owed by the employee. Wage garnishment can be used for various purposes, such as child support payments, tax debts, or unpaid student loans. It is essential for employers in Los Angeles to understand the legal requirements and process involved in complying with wage garnishment orders. Another type of Assignment of Wages Due or to Become Due in Los Angeles is an assignment of wages for payday loans. Payday loans are short-term, high-interest loans that are typically repaid through automatic deductions from the borrower's next paycheck. Lenders may require borrowers to sign an agreement allowing for wage assignments to secure repayment of the loan. This type of assignment gives the lender the right to directly access a portion of the borrower's wages when they become due. Los Angeles employers should also be aware of the wage assignment process related to employee benefits such as health insurance or retirement plans. Some employers offer voluntary wage assignments in which employees can authorize deductions from their wages to cover the cost of these benefits. Such arrangements are often made to ensure timely and regular payments to insurance providers or retirement plan administrators. In conclusion, Los Angeles, California, offers various types of Assignment of Wages Due or to Become Due. These include wage garnishment, assignment of wages for payday loans, and voluntary wage assignments for employee benefits. Employers and employees both should thoroughly understand the legal implications and requirements surrounding these assignments to ensure compliance and prevent any potential disputes.Los Angeles, California is a vibrant city located on the West Coast of the United States. Known for its glamorous Hollywood culture, diverse population, and iconic landmarks, it is a city that captivates millions of visitors each year. In this bustling metropolis, several types of Assignment of Wages Due or to Become Due are prevalent. One common type of Assignment of Wages Due or to Become Due in Los Angeles is wage garnishment. This occurs when a court orders an employer to withhold a certain percentage of an employee's wages to satisfy a debt owed by the employee. Wage garnishment can be used for various purposes, such as child support payments, tax debts, or unpaid student loans. It is essential for employers in Los Angeles to understand the legal requirements and process involved in complying with wage garnishment orders. Another type of Assignment of Wages Due or to Become Due in Los Angeles is an assignment of wages for payday loans. Payday loans are short-term, high-interest loans that are typically repaid through automatic deductions from the borrower's next paycheck. Lenders may require borrowers to sign an agreement allowing for wage assignments to secure repayment of the loan. This type of assignment gives the lender the right to directly access a portion of the borrower's wages when they become due. Los Angeles employers should also be aware of the wage assignment process related to employee benefits such as health insurance or retirement plans. Some employers offer voluntary wage assignments in which employees can authorize deductions from their wages to cover the cost of these benefits. Such arrangements are often made to ensure timely and regular payments to insurance providers or retirement plan administrators. In conclusion, Los Angeles, California, offers various types of Assignment of Wages Due or to Become Due. These include wage garnishment, assignment of wages for payday loans, and voluntary wage assignments for employee benefits. Employers and employees both should thoroughly understand the legal implications and requirements surrounding these assignments to ensure compliance and prevent any potential disputes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.