An assignment of wages is the transfer of the right to collect wages from the wage earner to a creditor. The assignment of wages is usually effectuated by deducting from an employee's earnings the amount necessary to pay off a debt.

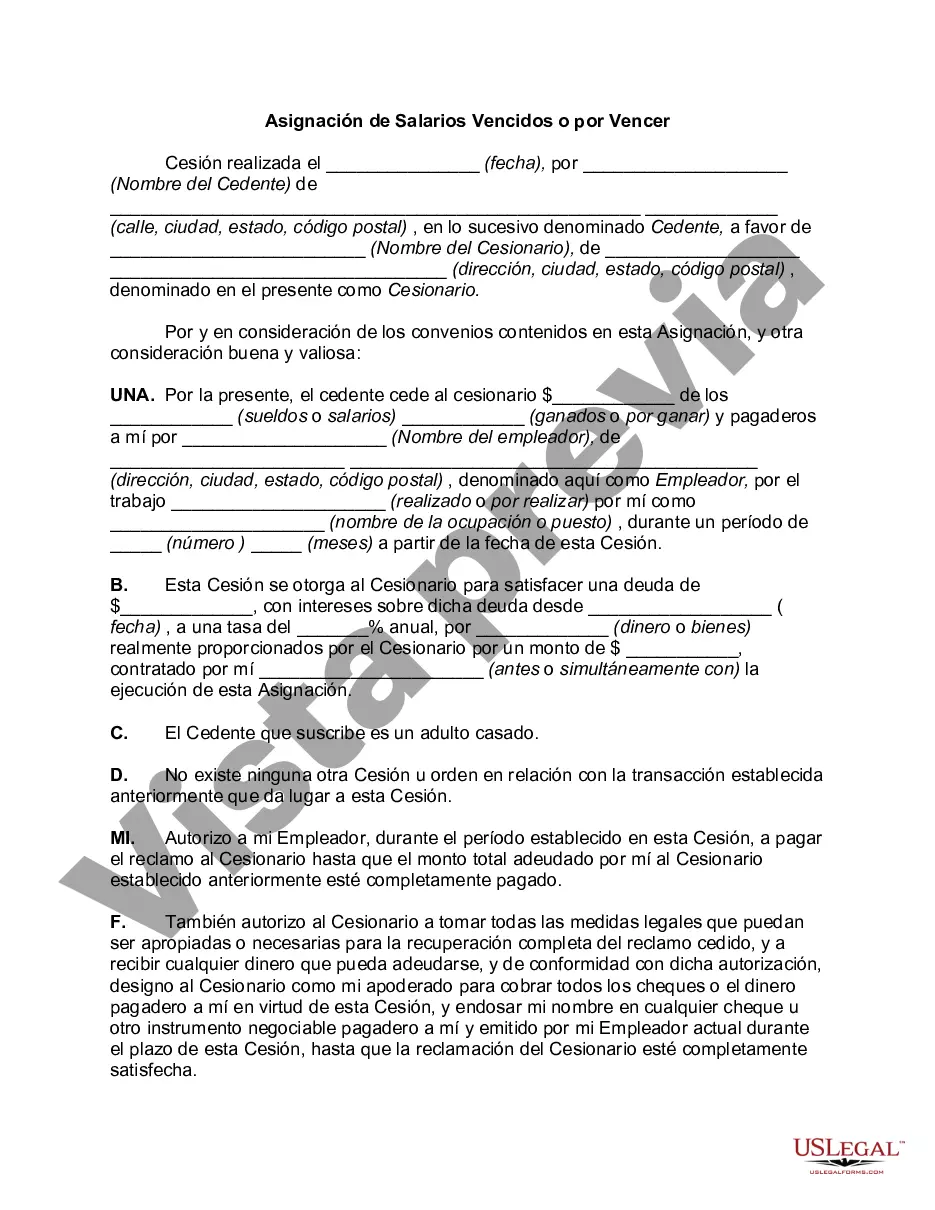

An assignment of wages should be contained in a separate written instrument, signed by the person who has earned or will earn the wages or salary. The assignment should include statements identifying the transaction to which the assignment relates, the personal status of the assignor, and a recital, where appropriate, that no other assignment or order exists in connection with the same transaction.

Many jurisdictions have enacted statutory provisions concerning wage assignments that prescribe various requisites of or conditions to the validity of assignments of wages. Compliance with these statutes is essential to make such assignments effective.

Title: Understanding San Jose California Assignment of Wages Due or to Become Due Introduction: In San Jose, California, the Assignment of Wages Due or to Become Due is a legal framework that allows individuals or organizations to assign a portion of their future wages to a creditor or lender. This process helps debtors fulfill their financial obligations and provides creditors with security for repayment. This article aims to provide a comprehensive overview of what assignment of wages is, its key features, and the different types available in San Jose, California. I. What is Assignment of Wages Due or to Become Due? Assignment of Wages Due or to Become Due is a mechanism that enables debtors to voluntarily transfer a portion of their future wages to a designated creditor. This arrangement allows creditors to receive a reliable source of repayment, while debtors can fulfill their financial obligations conveniently. The assignment is typically executed through a written agreement between the debtor (assignor), the creditor (assignee), and the employer. II. Key Features of Assignment of Wages Due or to Become Due: 1. Voluntary: The assignment is a voluntary agreement between the debtor and creditor without any legal coercion or force. 2. Portion of Future Wages: Debtors assign only a portion of their future wages, ensuring a balance between repayment ability and meeting the basic needs of the debtor. 3. Written Agreement: Assignment of wages requires a formal written agreement signed by all relevant parties, outlining the terms and conditions of the arrangement. 4. Employer Involvement: The employer plays a significant role by withholding and redirecting the assigned portion of the debtor's wages to the designated creditor. III. Types of San Jose California Assignment of Wages Due or to Become Due: 1. Traditional Assignment of Wages: This type of assignment involves the transfer of a fixed percentage or amount of the debtor's future wages to the creditor until the debt is repaid. The assignment remains valid until the debt is settled, or a specific duration mentioned in the agreement expires. 2. Revocable Assignment of Wages: A revocable assignment allows debtors to terminate the assignment at their discretion. This type provides debtors with more flexibility, as they can modify or terminate the agreement should their financial circumstances change. 3. Non-Revocable Assignment of Wages: In contrast to the revocable assignment, the non-revocable assignment establishes an irrevocable commitment from the debtor. Once assigned, the debtor cannot revoke or modify the agreement unilaterally. This type provides creditors with greater certainty and security. 4. Absolute Assignment of Wages: Absolute assignment involves the complete transfer of all wages due or to become due to the creditor. It allows the debtor to satisfy a particular debt entirely using future wages. Conclusion: San Jose, California provides various types of assignment of wages due or to become due to assist debtors in meeting their financial obligations. Whether it is a traditional, revocable, non-revocable, or absolute assignment, debtors and creditors have the flexibility to establish agreements that align with their specific needs and circumstances. It is crucial to seek legal advice and understand the terms and conditions before entering into any assignment of wages agreement.Title: Understanding San Jose California Assignment of Wages Due or to Become Due Introduction: In San Jose, California, the Assignment of Wages Due or to Become Due is a legal framework that allows individuals or organizations to assign a portion of their future wages to a creditor or lender. This process helps debtors fulfill their financial obligations and provides creditors with security for repayment. This article aims to provide a comprehensive overview of what assignment of wages is, its key features, and the different types available in San Jose, California. I. What is Assignment of Wages Due or to Become Due? Assignment of Wages Due or to Become Due is a mechanism that enables debtors to voluntarily transfer a portion of their future wages to a designated creditor. This arrangement allows creditors to receive a reliable source of repayment, while debtors can fulfill their financial obligations conveniently. The assignment is typically executed through a written agreement between the debtor (assignor), the creditor (assignee), and the employer. II. Key Features of Assignment of Wages Due or to Become Due: 1. Voluntary: The assignment is a voluntary agreement between the debtor and creditor without any legal coercion or force. 2. Portion of Future Wages: Debtors assign only a portion of their future wages, ensuring a balance between repayment ability and meeting the basic needs of the debtor. 3. Written Agreement: Assignment of wages requires a formal written agreement signed by all relevant parties, outlining the terms and conditions of the arrangement. 4. Employer Involvement: The employer plays a significant role by withholding and redirecting the assigned portion of the debtor's wages to the designated creditor. III. Types of San Jose California Assignment of Wages Due or to Become Due: 1. Traditional Assignment of Wages: This type of assignment involves the transfer of a fixed percentage or amount of the debtor's future wages to the creditor until the debt is repaid. The assignment remains valid until the debt is settled, or a specific duration mentioned in the agreement expires. 2. Revocable Assignment of Wages: A revocable assignment allows debtors to terminate the assignment at their discretion. This type provides debtors with more flexibility, as they can modify or terminate the agreement should their financial circumstances change. 3. Non-Revocable Assignment of Wages: In contrast to the revocable assignment, the non-revocable assignment establishes an irrevocable commitment from the debtor. Once assigned, the debtor cannot revoke or modify the agreement unilaterally. This type provides creditors with greater certainty and security. 4. Absolute Assignment of Wages: Absolute assignment involves the complete transfer of all wages due or to become due to the creditor. It allows the debtor to satisfy a particular debt entirely using future wages. Conclusion: San Jose, California provides various types of assignment of wages due or to become due to assist debtors in meeting their financial obligations. Whether it is a traditional, revocable, non-revocable, or absolute assignment, debtors and creditors have the flexibility to establish agreements that align with their specific needs and circumstances. It is crucial to seek legal advice and understand the terms and conditions before entering into any assignment of wages agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.