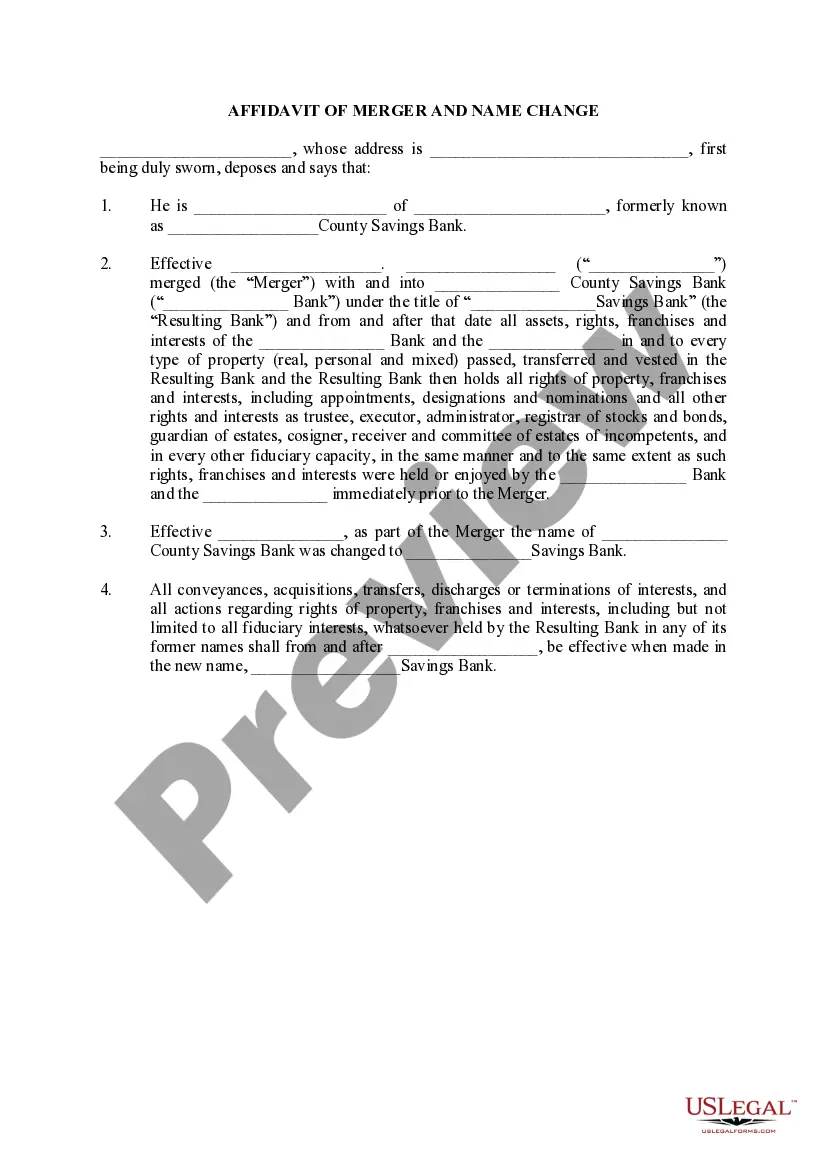

The Fairfax Virginia Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock is a legal document that outlines the process, terms, and conditions for incorporating a business in Fairfax, Virginia as an S Corporation while also qualifying for Section 1244 Stock status. This agreement is essential for small businesses looking to benefit from the advantages offered by both S Corporation status and Section 1244 Stock qualification. The Fairfax Virginia Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock ensures that the business complies with all the legal requirements for S Corporation status, including having no more than 100 shareholders, all of whom must be individuals, estates, or certain types of trusts. It also allows the business to take advantage of specific tax benefits and limited liability protection provided to S Corporations. Additionally, this agreement incorporates the eligibility for Section 1244 Stock qualification, which is a unique provision in the Internal Revenue Code. Section 1244 allows shareholders of small business corporations to claim ordinary loss treatment if the stock becomes worthless, subject to certain limitations. This provision is especially significant for investors and shareholders as it allows them to offset losses against ordinary income, potentially resulting in substantial tax benefits. There are no distinct types of Fairfax Virginia Agreements to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock. However, the agreement may vary depending on the specific details of the business and its shareholders. The essential elements typically included in the agreement are: 1. Business Information: This section specifies the name, address, and nature of the business seeking incorporation. It outlines the purpose and objectives of the business, its proposed structure, and the number of shares to be issued. 2. Shareholder Details: This section outlines the names, addresses, and contribution amounts of each shareholder involved in the incorporation. It also specifies their roles, responsibilities, and respective ownership percentages. 3. S Corp Qualification: This section includes provisions that ensure the business meets all the necessary requirements to be classified as an S Corporation according to federal and state laws. It covers restrictions on shareholder types, number of shareholders, and necessary tax elections. 4. Section 1244 Stock Qualification: This section specifies the intent of the shareholders to seek qualification for Section 1244 Stock. It outlines the conditions and limitations to be met to receive ordinary loss treatment in case of stock worthlessness. 5. Bylaws and Management: This section defines the internal rules and regulations governing the business, such as the election of officers, meeting procedures, and decision-making processes. It details the roles and responsibilities of directors and officers, as well as other corporate governance matters. 6. Dissolution and Liquidation: This section outlines the procedures and conditions for dissolving the corporation if necessary. It addresses the distribution of assets and liabilities, as well as any potential obligations or liabilities that may arise during the liquidation process. To ensure the accuracy and legality of the Fairfax Virginia Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock, it is always recommended consulting with a qualified attorney or legal professional familiar with business incorporation and tax laws in Virginia.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Acuerdo para constituirse como una corporación S y como una corporación de pequeña empresa con calificación para acciones de la Sección 1244 - Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

How to fill out Fairfax Virginia Acuerdo Para Constituirse Como Una Corporación S Y Como Una Corporación De Pequeña Empresa Con Calificación Para Acciones De La Sección 1244?

How much time does it normally take you to create a legal document? Considering that every state has its laws and regulations for every life situation, finding a Fairfax Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. In addition to the Fairfax Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock, here you can get any specific document to run your business or individual deeds, complying with your regional requirements. Experts check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can get the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Fairfax Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Fairfax Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!