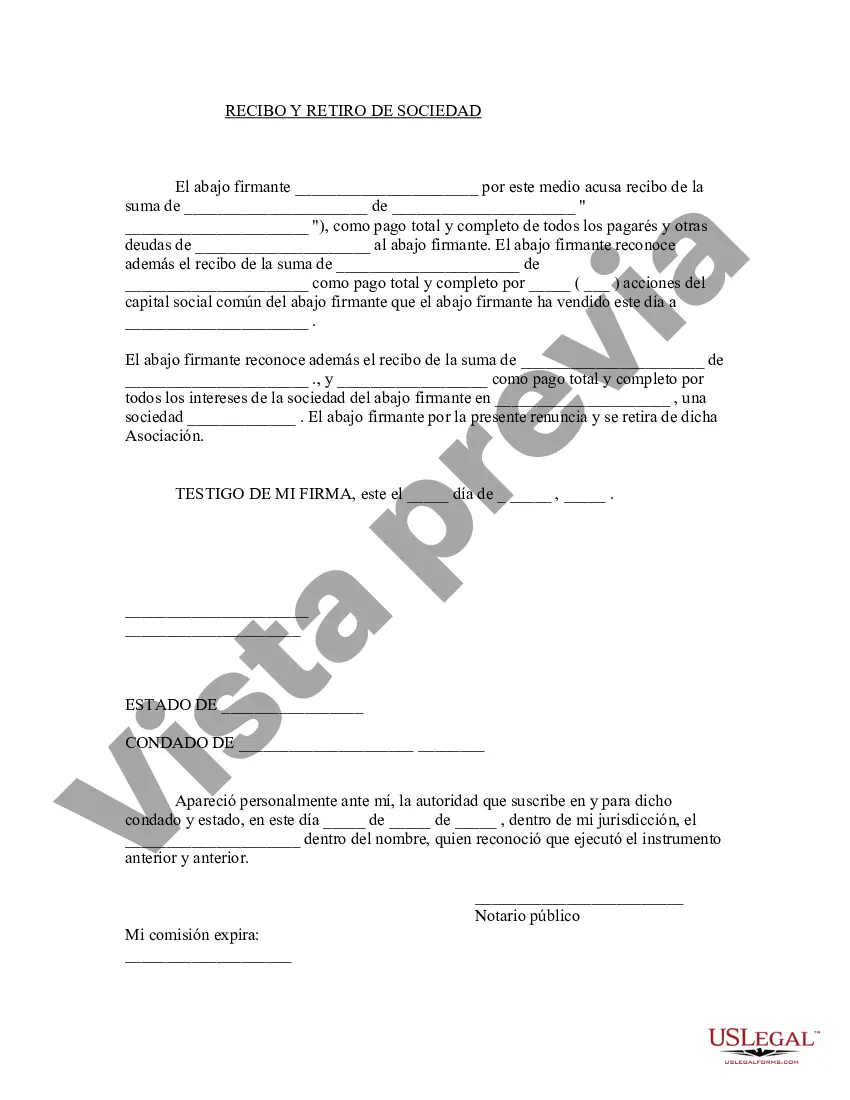

Allegheny Pennsylvania Receipt and Withdrawal from Partnership is a legal process involving the documentation and management of financial transactions when an individual or entity enters or exits a partnership within the state of Pennsylvania. Keywords: Allegheny Pennsylvania, receipt, withdrawal, partnership, legal process, financial transactions, documentation, management. Types of Allegheny Pennsylvania Receipt and Withdrawal from Partnership may include: 1. Partnership Formation: This type encompasses the initial phase when two or more parties come together to establish a formal partnership. The process usually involves the formation of a partnership agreement, outlining the terms and conditions of the partnership, the roles and responsibilities of each partner, contributions, distribution of profits or losses, and other relevant aspects. 2. Partner's Admission: When a new partner joins an existing partnership, a receipt and withdrawal process is carried out to document the change officially. It involves filing legal forms, updating partnership documents, recording new partner's capital contributions, and amending the partnership agreement to include the newly admitted partner. 3. Partner's Retirement: When a partner decides to retire from a partnership, the withdrawal process takes place. It involves settling the retiring partner's accounts, determining the value of their partnership interest, and making necessary adjustments to partnership financial records. The retiring partner's capital can be distributed to the remaining partners or used to fund a buyout by other partners. 4. Partner's Resignation: A partner may decide to voluntarily resign from a partnership due to various reasons. In such cases, a receipt and withdrawal process is carried out to document the resignation and distribute the partner's share of the partnership assets or liabilities. This process includes updating partnership records, making necessary financial adjustments, and potentially amending the partnership agreement. 5. Dissolution of Partnership: In some cases, a partnership may be dissolved either voluntarily or involuntarily due to various reasons such as bankruptcy, death of a partner, or expiration of a partnership term. This complex process involves multiple steps, including filing dissolution paperwork, settling partnership debts, distributing remaining assets to partners, and fulfilling other legal requirements. Overall, Allegheny Pennsylvania Receipt and Withdrawal from Partnership encompasses a range of transactions and legal procedures. It ensures transparency, clarity, and compliance within partnership arrangements in Allegheny County, Pennsylvania.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Recepción y retiro de la sociedad - Receipt and Withdrawal from Partnership

Description

How to fill out Allegheny Pennsylvania Recepción Y Retiro De La Sociedad?

Creating legal forms is a necessity in today's world. However, you don't always need to seek professional help to draft some of them from scratch, including Allegheny Receipt and Withdrawal from Partnership, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various categories varying from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less frustrating. You can also find information resources and tutorials on the website to make any activities related to paperwork completion straightforward.

Here's how to purchase and download Allegheny Receipt and Withdrawal from Partnership.

- Go over the document's preview and description (if available) to get a basic information on what you’ll get after getting the form.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can impact the legality of some records.

- Check the similar document templates or start the search over to locate the correct document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment method, and buy Allegheny Receipt and Withdrawal from Partnership.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Allegheny Receipt and Withdrawal from Partnership, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney completely. If you need to deal with an extremely difficult case, we advise using the services of a lawyer to examine your form before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Become one of them today and purchase your state-compliant documents with ease!