Bexar Texas Receipt and Withdrawal from Partnership is a legal process involving the documentation and formalities associated with the receiving and departing of individuals or entities from a partnership in Bexar County, Texas. It is a crucial step in partnerships that ensures transparency, accountability, and legal compliance. In Bexar County, Texas, there are specific forms and regulations that need to be adhered to for both receipt and withdrawal from a partnership. These processes may vary based on the type of partnership, such as general partnership, limited partnership, or limited liability partnership (LLP). Let's explore these three types in more detail: 1. General Partnership Receipt and Withdrawal: In this type of partnership, two or more individuals or entities come together to conduct a business. When someone joins an existing general partnership, they need to go through the receipt process. This typically involves signing a partnership agreement, which outlines the terms of the partnership, including profit-sharing, decision-making, and responsibilities. Withdrawal from a general partnership is also a formal process that requires notifying all partners in writing and completing necessary legal documentation, such as a withdrawal agreement. It is crucial to settle any outstanding financial obligations and resolve the distribution of assets and liabilities upon withdrawal. 2. Limited Partnership Receipt and Withdrawal: In a limited partnership, there are two types of partners: general partners and limited partners. General partners have unlimited liability and actively manage the partnership, while limited partners have limited liability but are passive investors. The receipt and withdrawal processes in a limited partnership involve different procedures for general and limited partners. For receiving a new partner, the general partners may need to execute a certificate of limited partnership, while limited partners usually need to sign a limited partnership agreement. On the other hand, withdrawal from a limited partnership may require filing a certificate of withdrawal with the Secretary of State, notifying other partners, and settling financial matters as per the partnership agreement. 3. Limited Liability Partnership (LLP) Receipt and Withdrawal: A limited liability partnership is formed by professional individuals, such as doctors, lawyers, or accountants, in Texas. Laps have limited liability protection, meaning that partners are generally not personally responsible for the negligence or malpractice of other partners. In terms of receipt, LLP partners need to complete a certificate of formation and file it with the Secretary of State. This document verifies the establishment of the partnership. If a partner wishes to withdraw from an LLP, they usually need to provide written notice to both the other partners and the Secretary of State, ensuring a smooth transition and settling financial matters. In conclusion, Bexar Texas Receipt and Withdrawal from Partnership is a legal process that involves documenting the entry and exit of partners from different types of partnerships, such as general partnerships, limited partnerships, and limited liability partnerships. These processes require adherence to specific forms, regulations, and legal formalities to ensure transparency and legal compliance within the partnership framework.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Recepción y retiro de la sociedad - Receipt and Withdrawal from Partnership

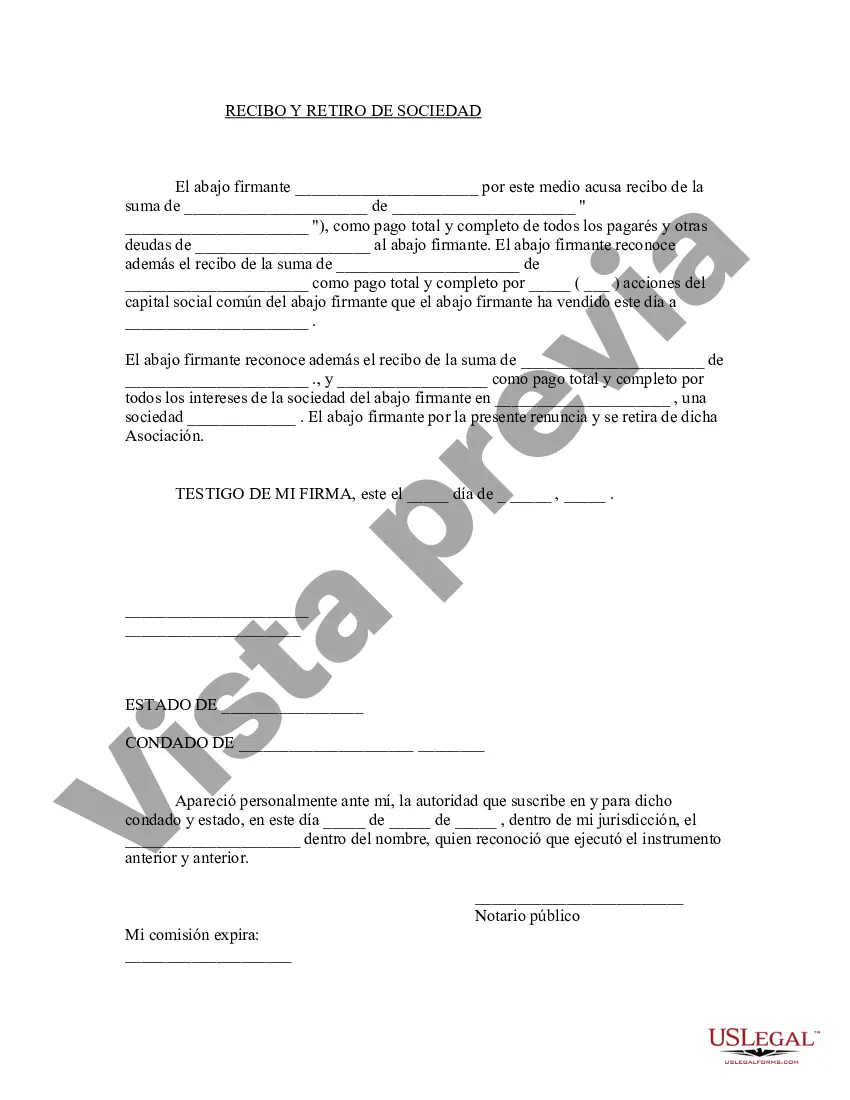

Description

How to fill out Bexar Texas Recepción Y Retiro De La Sociedad?

Drafting papers for the business or individual demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft Bexar Receipt and Withdrawal from Partnership without professional assistance.

It's easy to avoid wasting money on lawyers drafting your paperwork and create a legally valid Bexar Receipt and Withdrawal from Partnership on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, adhere to the step-by-step guide below to get the Bexar Receipt and Withdrawal from Partnership:

- Look through the page you've opened and check if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any scenario with just a couple of clicks!