Collin Texas Receipt and Withdrawal from Partnership refers to the legal process followed in Collin County, Texas, when a partner exits or joins a partnership. This process involves the receipt of funds and assets by the departing partner and the withdrawal from the partnership. When a partner decides to leave a partnership, the partnership agreement usually outlines the steps and procedures for this withdrawal. One crucial aspect of the withdrawal process is the documentation of the transaction to ensure transparency and legal compliance. These documents are commonly referred to as "Collin Texas Receipt and Withdrawal from Partnership." There are different types of Collin Texas Receipt and Withdrawal from Partnership, depending on the circumstances and reasons behind the withdrawal or the incoming partner's participation. Let's explore some of these types: 1. Retirement Withdrawal: When a partner retires from a partnership, they may choose to receive a lump sum payment or periodic payments as their share of the partnership assets. The Collin Texas Receipt and Withdrawal from Partnership in this case would outline the retiree's financial settlement, the transfer of ownership in the partnership, and any ongoing responsibilities for the retiring partner. 2. Buyout Withdrawal: In some cases, a partner may choose to leave the partnership by selling their share to the remaining partners or outside investors. The Collin Texas Receipt and Withdrawal from Partnership would document the buyout agreement, including the valuation of the partner's share, payment terms, and any related legal obligations involved in the transaction. 3. New Partner Admission: When a new partner joins an existing partnership, a Collin Texas Receipt and Withdrawal from Partnership is also crucial. The document would outline the terms of the new partner's investment, profit-sharing, decision-making authority, and any restrictions or limitations on their involvement in the partnership. 4. Dissolution Withdrawal: In some instances, a partnership may dissolve, leading to the exit of all partners. The Collin Texas Receipt and Withdrawal from Partnership would detail the distribution of assets, the settlement of liabilities, and the formal termination of the partnership's existence. Please note that these are just a few examples of the various types of Collin Texas Receipt and Withdrawal from Partnership, and each case may have specific variations based on the partnership agreement and applicable laws. Understanding the intricacies of Collin Texas Receipt and Withdrawal from Partnership is crucial to navigate the legal processes involved in establishing, modifying, or terminating partnerships. Consulting legal professionals familiar with partnership law in Collin County, Texas, is highly recommended ensuring compliance and protect the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Recepción y retiro de la sociedad - Receipt and Withdrawal from Partnership

Description

How to fill out Collin Texas Recepción Y Retiro De La Sociedad?

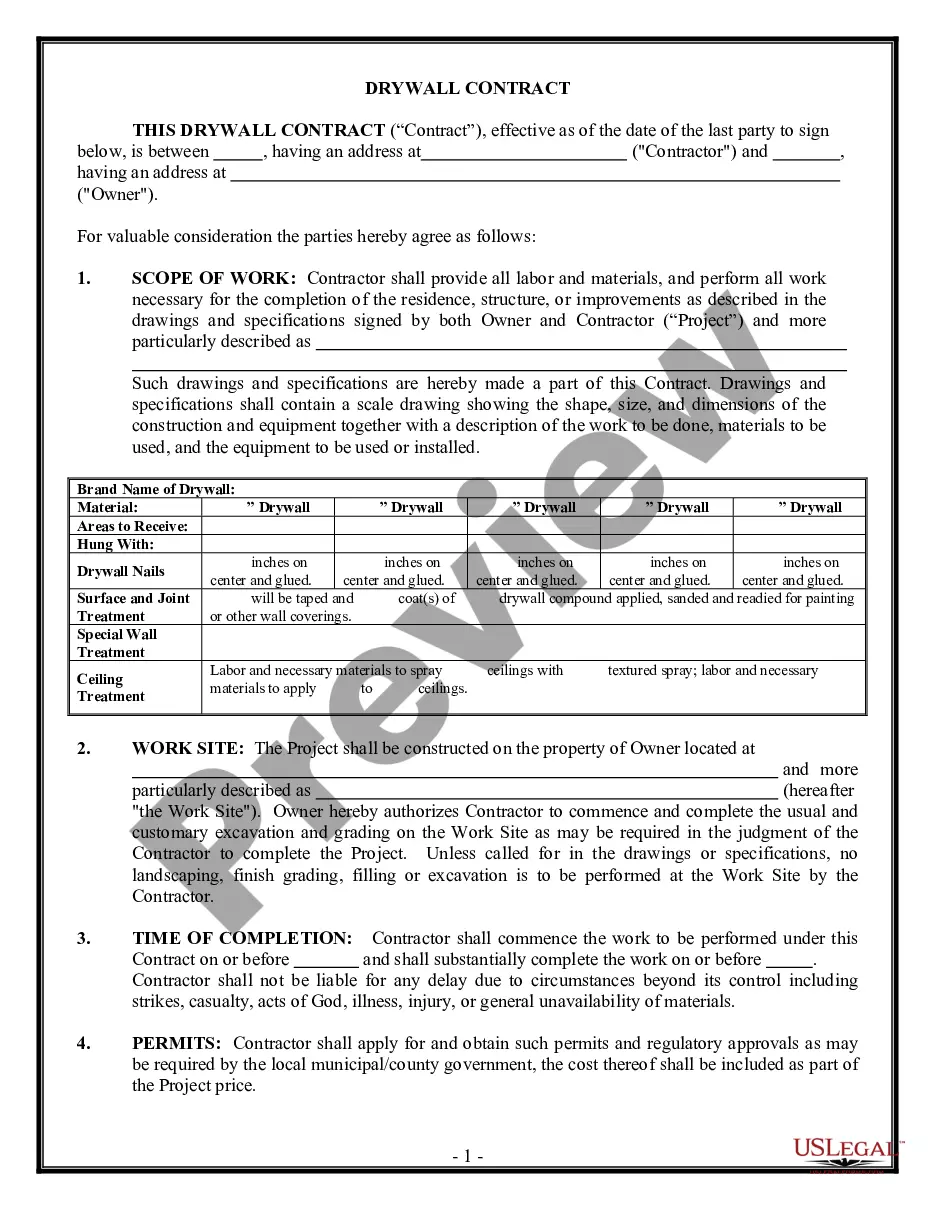

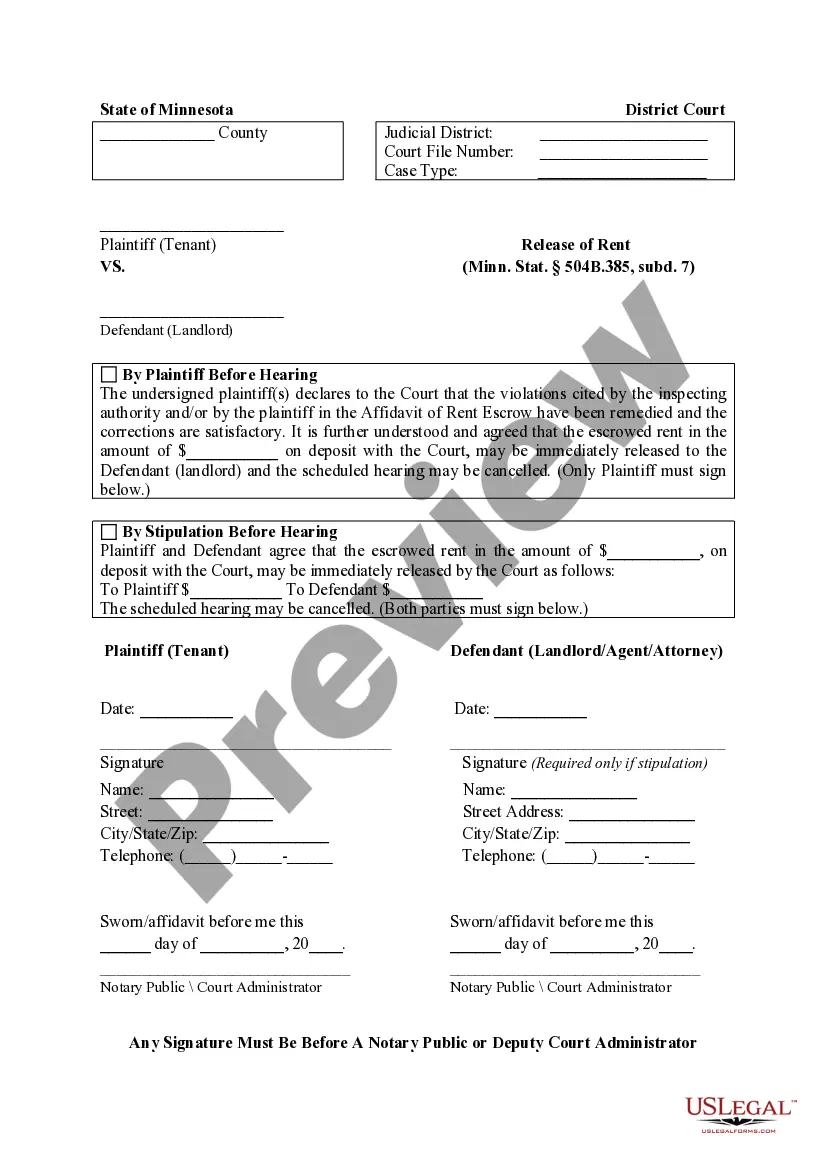

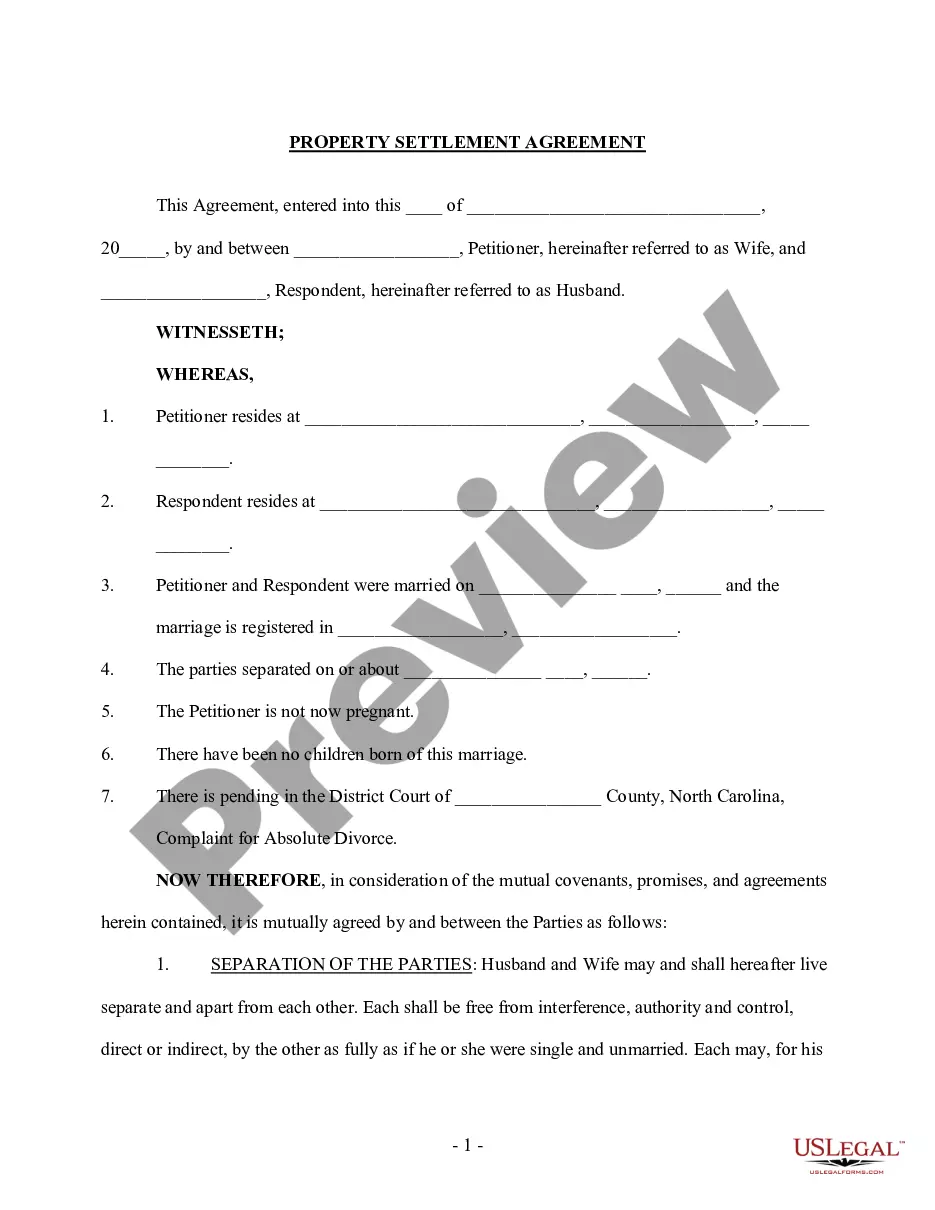

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Collin Receipt and Withdrawal from Partnership, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Consequently, if you need the current version of the Collin Receipt and Withdrawal from Partnership, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Collin Receipt and Withdrawal from Partnership:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Collin Receipt and Withdrawal from Partnership and save it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!