Harris County, located in Texas, has specific regulations and guidelines pertaining to the Receipt and Withdrawal from Partnership processes. In order to understand these procedures thoroughly, it is important to delve into their details. Receipt and Withdrawal from Partnership refer to the actions taken when a partner joins or leaves a partnership in Harris County, Texas. These processes involve the transfer of ownership rights and responsibilities, and they are subject to legal requirements set forth by the state. In Harris County, there are various types of Receipt and Withdrawal from Partnership, each with specific considerations and implications: 1. Admission of New Partner: — In this type, a new partner is brought into an existing partnership. This could occur due to various reasons, such as the need for additional capital, expertise, or expanding the overall business scope. The admission process involves legal agreements and documents, encompassing the transfer of ownership interest, profit sharing, and decision-making authority. 2. Withdrawal of Partner: — Sometimes, a partner may choose to withdraw from a partnership for personal reasons or professional considerations. This type of withdrawal necessitates careful attention to the operational impact on the partnership, including the allocation of assets, liabilities, and the partner's share of profits or losses. The exiting partner's rights and obligations need to be thoroughly addressed to ensure a smooth transition. 3. Retirement of Partner: — When a partner reaches retirement age or decides to retire from the partnership business, a formal retirement process is followed. This involves comprehensive financial and legal arrangements to determine the partner's share of the partnership's assets, liabilities, and ongoing profits, along with the buy-out or compensation plan for their ownership interest. 4. Death or Incapacity of Partner: — Unfortunately, in the event of a partner's death or incapacity, the partnership undergoes a Receipt and Withdrawal process. The deceased or incapacitated partner's estate, heirs, or legal representatives work alongside the remaining partners to effectuate the transfer of partnership ownership and rights, as well as addressing the allocation of financial assets and liabilities. It is crucial to consult with legal professionals experienced in partnership law, specifically within Harris County, to ensure compliance with all relevant regulations and to protect the interests of the partners involved. Detailed documentation and precise execution of the Receipt and Withdrawal from Partnership processes are crucial to prevent any future legal disputes or complications.

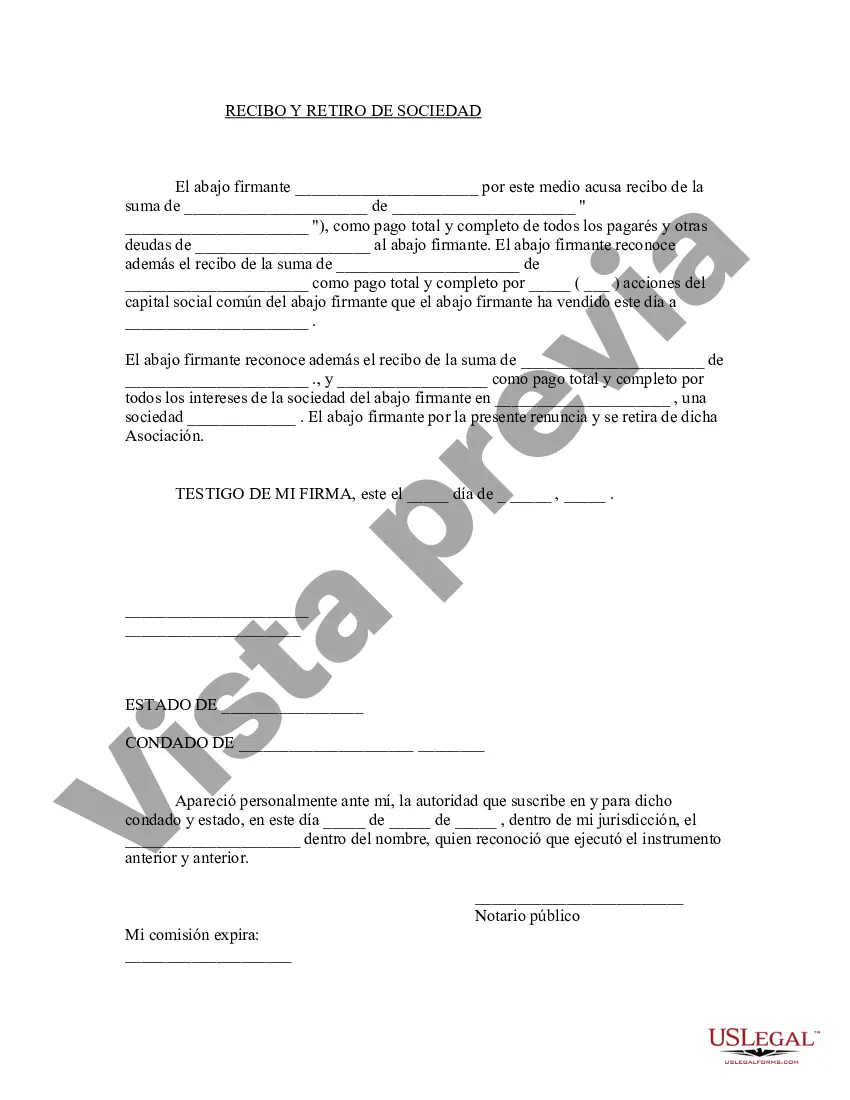

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Recepción y retiro de la sociedad - Receipt and Withdrawal from Partnership

Description

How to fill out Harris Texas Recepción Y Retiro De La Sociedad?

Whether you intend to open your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business case. All files are collected by state and area of use, so picking a copy like Harris Receipt and Withdrawal from Partnership is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to get the Harris Receipt and Withdrawal from Partnership. Follow the guide below:

- Make sure the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Harris Receipt and Withdrawal from Partnership in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!