Lima, Arizona Receipt and Withdrawal from Partnership Description: In the context of business partnerships, the process of receipt and withdrawal plays a crucial role in managing the formalities associated with the partnership arrangement. Lima, Arizona, as a jurisdiction, provides specific guidelines and requirements for partnership receipt and withdrawal. Receipt, in partnership terms, refers to the inclusion of a new partner into an existing partnership. It occurs when a new individual or entity contributes capital, assets, or expertise to the partnership, becoming a joint owner with the existing partners. Partnership receipt typically involves legal documentation and specific procedures to ensure the proper incorporation of the new partner. On the other hand, withdrawal from a partnership refers to the departure of an existing partner from the partnership entity. This departure can occur due to various reasons, such as retirement, personal circumstances, or the desire to pursue other business ventures. Proper withdrawal procedures are essential to maintain the stability and continuity of the partnership. In Lima, Arizona, the partnership receipt and withdrawal processes must adhere to the state's specific regulations. These regulations ensure transparency, protection of partnership interests, and compliance with legal requirements. It is strongly recommended that partners seeking partnership receipt or withdrawal consult legal professionals with knowledge and experience in Arizona's partnership laws. Different types of Lima, Arizona Receipt and Withdrawal from Partnership: 1. General Partnership Receipt and Withdrawal: This type of partnership involves two or more individuals who agree to carry on a business venture for profit-sharing purposes. General partnership receipt and withdrawal procedures in Lima, Arizona, follow state laws and may require various legal documents to formalize the changes. 2. Limited Partnership Receipt and Withdrawal: When a partnership includes both general partners and limited partners, the partnership structure is known as a limited partnership. Limited partners have restricted liability and minimal involvement in the partnership's management. The receipt and withdrawal of limited partners in Lima, Arizona, involves compliance with state regulations, including filing appropriate documents with the relevant authorities. 3. Limited Liability Partnership Receipt and Withdrawal: This partnership type combines the flexibility of a general partnership with limited liability protection for its partners. Partners in a limited liability partnership (LLP) are shielded from personal liability for the partnership's debts and obligations. LLP receipt and withdrawal processes in Lima, Arizona, must comply with state-specific guidelines, including the necessary documentation. In conclusion, partners involved in partnerships in Lima, Arizona, need to be aware of the proper procedures and legal requirements for receipt and withdrawal. Consulting legal professionals familiar with Arizona partnership laws is crucial to ensure compliance and protect the rights and interests of the partners involved.

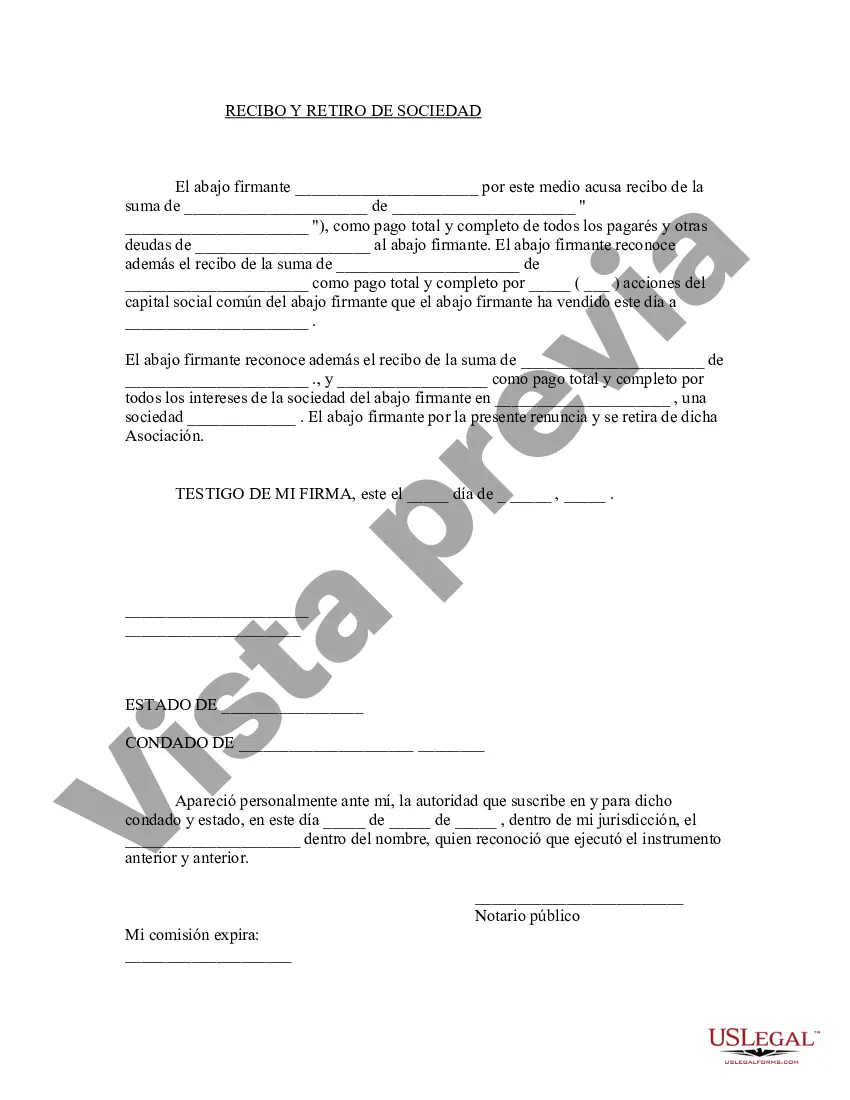

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Recepción y retiro de la sociedad - Receipt and Withdrawal from Partnership

Description

How to fill out Pima Arizona Recepción Y Retiro De La Sociedad?

Whether you intend to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business case. All files are collected by state and area of use, so picking a copy like Pima Receipt and Withdrawal from Partnership is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to obtain the Pima Receipt and Withdrawal from Partnership. Follow the guide below:

- Make certain the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Pima Receipt and Withdrawal from Partnership in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!