Title: Salt Lake Utah Receipt and Withdrawal from Partnership: A Comprehensive Guide Introduction: In Salt Lake Utah, partnership agreements often require meticulous handling of receipts and withdrawals during business operations. This description aims to provide a detailed overview of what Salt Lake Utah Receipt and Withdrawal from Partnership entail, encompassing relevant keywords and potential variations within this context. 1. Understanding Salt Lake Utah Receipt and Withdrawal from Partnership: Salt Lake Utah Receipt and Withdrawal from Partnership refers to the process of managing financial transactions and the exit of a partner from a business entity based in Salt Lake City, Utah. This procedure ensures transparency, orderly distribution of assets, and accurate accounting practices within a partnership operating in the state. 2. Key Elements of a Salt Lake Utah Receipt and Withdrawal from Partnership: a) Receipts: Receipts encompass all financial documents that authenticate the collection of funds into the partnership. These may include cash received, checks, credit card payments, wire transfers, or any other form of monetary assets recorded as income for the partnership. b) Withdrawals: Withdrawals define the process of a partner leaving the partnership, necessitating the proper distribution of assets, liabilities, and rights among the existing partners. This could result from retirement, resignation, dissolution, or any other agreement-based causes. 3. Types of Salt Lake Utah Receipt and Withdrawal from Partnership: a) Voluntary Withdrawal: Occurs when a partner willingly decides to exit the partnership, generally necessitating the approval of the remaining partners. Adhering to the partnership agreement, a procedure is followed for calculating the withdrawing partner's entitlement to the partnership's assets and any potential liabilities. b) Involuntary Withdrawal: Arises when a partner is involuntarily removed from the partnership due to reasons such as breach of partnership agreement, fraud, misconduct, or incompetence. Legal proceedings may be required in these cases to resolve conflicts and distribute assets. c) Dissolution and Liquidation: Dissolution refers to the termination of a partnership, commonly leading to the selling of assets, settlement of liabilities, and distribution of remaining funds among partners. Liquidation involves converting partnership assets into cash, ensuring equitable distribution between partners and creditors. d) Retirement or Resignation: Partners who reach retirement age or desire to retire can withdraw from the partnership, requiring well-defined agreements for settling their share of assets, liabilities, and rights. 4. Process of Salt Lake Utah Receipt and Withdrawal from Partnership: a) Legally Binding Agreement: Partnerships in Salt Lake Utah require a comprehensive written agreement that outlines the receipt and withdrawal procedures, including financial distribution mechanisms. b) Calculation of Partnership Interest: For a withdrawing partner, an evaluation of their partnership interest must be conducted, assessing contributed capital, profits, losses, and the value of the partnership's assets. c) Consultation with Professionals: It is advisable to consult legal and financial professionals experienced in partnership law to ensure adherence to state-specific regulations during the receipt and withdrawal processes. d) Documentation and Reporting: Detailed records of all financial transactions, agreements, and procedures should be maintained to ensure transparency, compliance, and accuracy. Conclusion: Salt Lake Utah Receipt and Withdrawal from Partnership encompasses various crucial aspects concerning the financial management and exit procedures within partnerships in Salt Lake City, Utah. Understanding the different types and implementing a well-defined process is vital to ensure a smooth transition and the equitable distribution of assets and liabilities. Seeking professional guidance during this phase is highly recommended navigating the legal and financial complexities associated with partnership withdrawal.

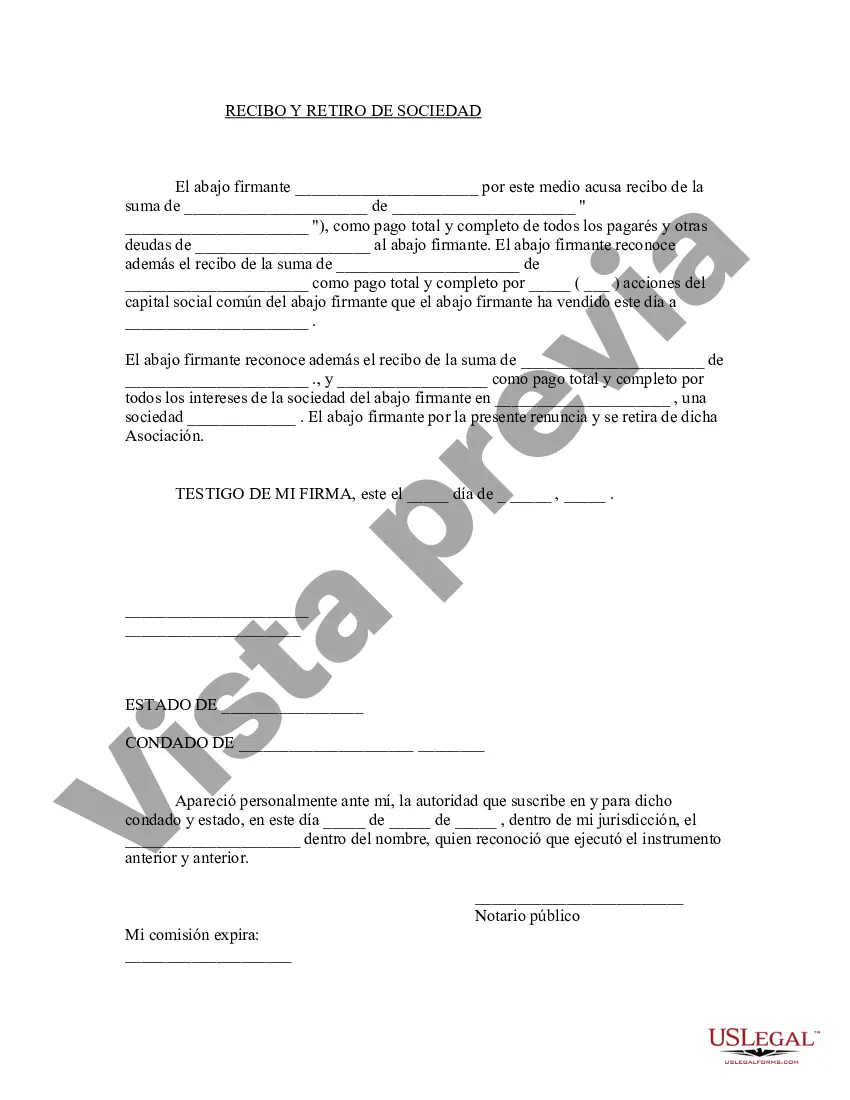

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Recepción y retiro de la sociedad - Receipt and Withdrawal from Partnership

Description

How to fill out Salt Lake Utah Recepción Y Retiro De La Sociedad?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare formal paperwork that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business purpose utilized in your region, including the Salt Lake Receipt and Withdrawal from Partnership.

Locating templates on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Salt Lake Receipt and Withdrawal from Partnership will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to get the Salt Lake Receipt and Withdrawal from Partnership:

- Make sure you have opened the right page with your local form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Salt Lake Receipt and Withdrawal from Partnership on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!