San Antonio Texas Receipt and Withdrawal from Partnership In the vibrant city of San Antonio, Texas, the process of receipt and withdrawal from a partnership is essential for business owners seeking to make changes or terminate their partnership agreements. Whether it is due to business expansion, retirement, or new opportunities, understanding the intricacies of these transactions is crucial. Receipt and withdrawal from partnership typically involve legal procedures and documentation to ensure a smooth transition and protect the rights and interests of all parties involved. San Antonio offers various types of receipt and withdrawal from partnership, catering to the specific needs and circumstances of each business owner. Let's explore some of the most common types: 1. Voluntary Withdrawal: This type occurs when a partner voluntarily chooses to leave the partnership. Reasons for voluntary withdrawal can range from personal reasons, career changes, or disagreements with other partners. Voluntary withdrawal processes often require the departing partner to notify the other partners in writing, provide a notice period, and negotiate the settlement of their partnership interest. 2. Retirement Withdrawal: When a partner intends to retire from the partnership, a retirement withdrawal process comes into play. This type of withdrawal encompasses various aspects, such as the calculation and distribution of the retiring partner's interest, transition of management responsibilities, and necessary amendments to the partnership agreement. 3. Dissolution and Liquidation: In some cases, a partnership may need to be dissolved and liquidated due to irreconcilable differences between partners or financial difficulties. Dissolution involves winding down the partnership's operations, settling outstanding obligations, distributing assets, and terminating the partnership. Liquidation entails converting assets into cash, paying off debts, and distributing remaining funds among the partners. 4. Buyout or Buy-In: Sometimes, a partner may wish to sell their ownership stake or buy a larger interest in the partnership. In these cases, a buyout or buy-in agreement is drafted to outline the terms and conditions of the transaction. This includes assessing the value of the partner's interest, negotiating a fair price, financing options, and adjustments to the partnership structure. While these are some common types of receipt and withdrawal from partnership in San Antonio, it is crucial to consult with legal professionals specializing in business law to ensure compliance with local regulations and to protect your rights. Properly navigating these processes can safeguard your interests and ensure a smooth transition for all parties involved. San Antonio, Texas provides numerous resources for business owners looking to comprehend the complexities of receipt and withdrawal from partnership, including law firms specializing in business law, business advisory services, and trade associations. Taking advantage of these resources can empower entrepreneurs to make well-informed decisions and navigate the partnership landscape successfully.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Recepción y retiro de la sociedad - Receipt and Withdrawal from Partnership

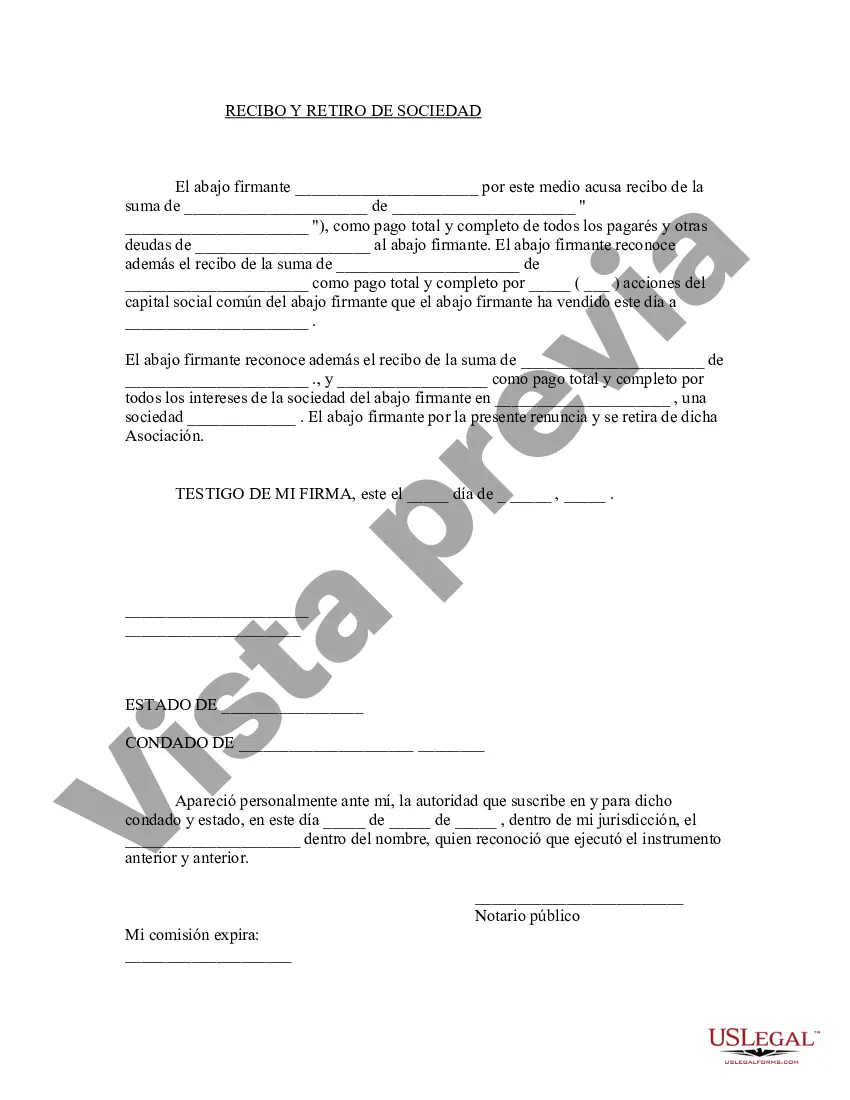

Description

How to fill out San Antonio Texas Recepción Y Retiro De La Sociedad?

If you need to find a reliable legal document provider to find the San Antonio Receipt and Withdrawal from Partnership, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can select from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support team make it easy to locate and execute different papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply select to look for or browse San Antonio Receipt and Withdrawal from Partnership, either by a keyword or by the state/county the document is created for. After locating necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the San Antonio Receipt and Withdrawal from Partnership template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be immediately ready for download once the payment is completed. Now you can execute the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less costly and more reasonably priced. Create your first company, organize your advance care planning, draft a real estate agreement, or complete the San Antonio Receipt and Withdrawal from Partnership - all from the comfort of your home.

Join US Legal Forms now!